I'm afraid that the last sentence is accurate. But there was a very good post by DiabloWags regarding the wealth tax versus the estate tax, that bears reviewing. This poster obviously has background in the area. At the risk of being repetitive, the problem is not taxation per se, but the ability to pass on wealth to future generations. Capitalists argue that a capitalist society is fair because you gain the rewards of your hard work. But, often people are rich, simply because they inherit wealth or are born into a privileged class, and that privilege prevents social mobility and other things we desire in a capitalistic society. So talking about things like estate taxes and changing tax basis would, in my opinion, have substantial benefit. Again, take a closer look at Diablo's post.Unit2Sucks said:

And just want to +1 to everything WIAF said above about taxes. Not everyone might agree with his commentary (I generally do on tax), but he knows what he's talking about as an experienced practitioner. I think people generally have an understand that there are a lot of different ways people can legally avoid creating taxable income, but they don't really understand how it works or how ill-equipped our government is to address it. Making small tweaks to the tax code and focusing on income tax will never really address the problem of wealth inequality.

Closing the wealth gap

75,905 Views |

526 Replies |

Last: 3 yr ago by DiabloWags

Some boundaries please. I made the mistake of begin overt in one charitable thing for Cal, and was rewarded with identity fraud, people emailing me to have a coach fired, and on and on. Just not going there anymore.concordtom said:wifeisafurd said:Tom, in your case it is a matter of you not being able to keep upconcordtom said:wifeisafurd said:And the numbers are total bullcrap. Tell me counselor:bearister said:

10 years later, the disparity is much worse:

Of the 1%, by the 1%, for the 1% | Vanity Fair

https://www.vanityfair.com/news/2011/05/top-one-percent-201105

"The top 1% percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn't seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late."

How is total wealth for the US determined?

How is who is in the top 1% determined? Did you have Ms. Jenner on your list?

How is the total amount of wealth of the top 1% determined?

The problem is that there are no real sources. The IRS keeps records on taxable income limited amounts of non-taxable income. It didn't even keep track on non-taxable income years ago. I don't know if the numbers are to conservative or overstate the problem, just that the numbers you quote don't really exist in any data base.

Typical Fox retort.

Just muddy it up, change the subject, don't address the point of the claim by arguing that the data is bad.

Barf !

As I said before:

"I'd be more impressed if you added to discussion by sharing thoughts or projects designed to help others."

I think it's pretty rich for you to call me evasive for answering a question of yours. You're the one that asked about our family personal marginal tax brackets and when I respond you say it's irrelevant. OK. Thanks for asking an irrelevant question, I guess.Unit2Sucks said:I think your response is a bit evasive. My point is that most wealthy people (eg 1%ers) are self-made so when we make these decade long comparisons, it creates the inaccurate impression that there is far more continuity among that class than their actually is. Comparing marginal rates is irrelevant to this conversation. For the most part if you aren't in the top federal bracket, you aren't that wealthy. If you are so wealthy that you don't pay any taxes, lol, then it's pretty obvious and the children are less likely to surpass their parents (although I still know some of those outcomes as well).dajo9 said:wifeisafurd said:dajo9 said:Unit2Sucks said:I think the point he might be making is that the composition of the people in the 1% changes over time. I bet if you check around on BI, most 1%ers are the first in their families to attain that status. Of course that's not the case everywhere but it's worth considering. You can't blame Zuckerberg for the Dubya Bush tax cuts, for example. Can you blame every first generation entrepreneur for wealth inequality when their parents often came over with just the clothes on their back and a dream?concordtom said:wifeisafurd said:And the numbers are total bullcrap. Tell me counselor:bearister said:

10 years later, the disparity is much worse:

Of the 1%, by the 1%, for the 1% | Vanity Fair

https://www.vanityfair.com/news/2011/05/top-one-percent-201105

"The top 1% percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn't seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late."

How is total wealth for the US determined?

How is who is in the top 1% determined? Did you have Ms. Jenner on your list?

How is the total amount of wealth of the top 1% determined?

The problem is that there are no real sources. The IRS keeps records on taxable income limited amounts of non-taxable income. It didn't even keep track on non-taxable income years ago. I don't know if the numbers are to conservative or overstate the problem, just that the numbers you quote don't really exist in any data base.

Typical Fox retort.

Just muddy it up, change the subject, don't address the point of the claim by arguing that the data is bad.

Barf !

I know the tactic well. It doesn't reflect well on you or your class, so just muck it up and don't answer to it.

I'd be more impressed if you added to discussion by sharing thoughts or projects designed to help others.

Go ahead, brag a little. It's allowed, for a good cause! As we've seen.

We can take an informal poll. Who here is in a higher tax bracket than their parents? Who here has a net worth larger than their parents? Anyone 10x? 100x?

I've been in a higher tax bracket than my parents every year since I entered the workforce. My net worth exceeds theirs, although not by 10x yet. If you disregard real estate, I'm 10x but not 100x.

I have a number of friends who are well over 10x their parents' net worth and some probably 100x. I read these articles about how the wealth held by the 1% has grown over time, it always makes me wonder what the authors think about people like that.

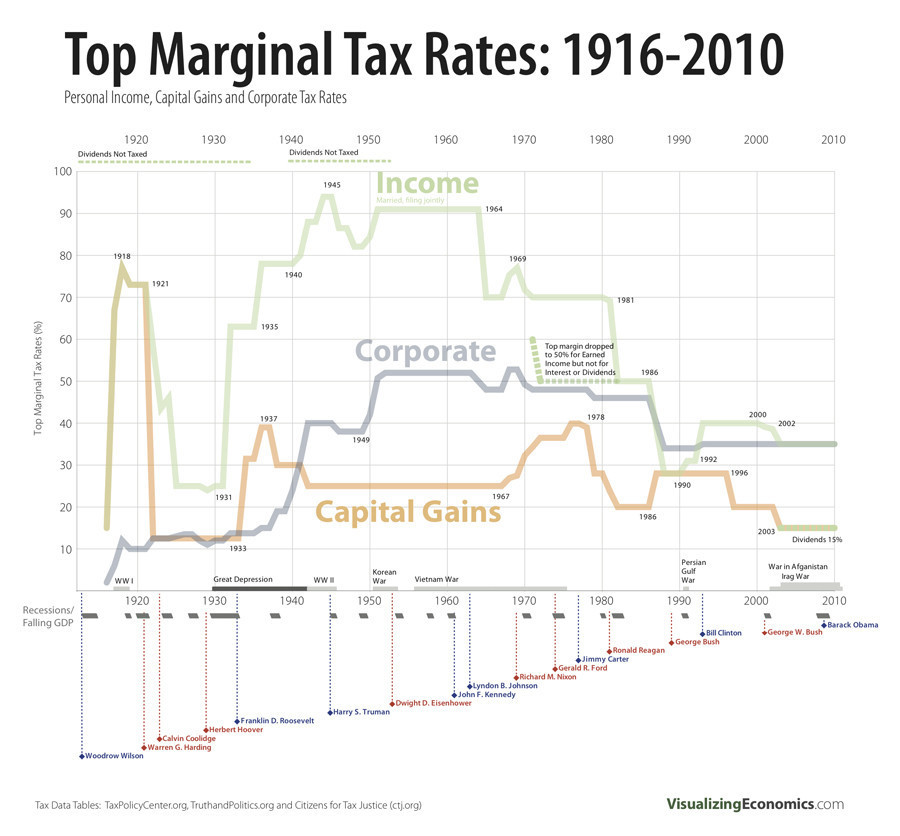

There are some problems with your argument. First, inflation skews these intergenerational numbers badly. For example, sometime around 1970, my grandfather (Stanford grad) earned around $50k. Hard data is hard to find but I think that put him near the 1%, if not in it. But his wealth was not transformational (I never saw a dime). My grandfather's income put him in a 50% federal income tax bracket at the time - higher than me. Higher than everybody today.

The big problem with what you are saying is that being in the 1% all by itself is not an issue. The issue is the current 1% is so much more wealthy than prior generation 1%'s largely because of tax policy. Today we have transformational, intergenerational wealth. Democracy threatening wealth.

Also, the question unit2 asked was what bracket people are in compared to previous generations. That is a question about marginal tax rates.

So much typing by you for nothing.

With few obvious exceptions, people aren't creating true intergenerational wealth (9 figure net worth) by making a nice salary. They're doing it through the value of equity and always have been. They pay capital gains taxes (or none at all) but they don't pay income tax. WIAF spoke to that so I won't belabor it.

I think inflation is largely irrelevant to the discussion of wealth accumulation in the past 4 decades because asset inflation has exceeded "inflation" over the period. Boomers have tons of money and haven't been harmed by inflation.

And just want to +1 to everything WIAF said above about taxes. Not everyone might agree with his commentary (I generally do on tax), but he knows what he's talking about as an experienced practitioner. I think people generally have an understand that there are a lot of different ways people can legally avoid creating taxable income, but they don't really understand how it works or how ill-equipped our government is to address it. Making small tweaks to the tax code and focusing on income tax will never really address the problem of wealth inequality.

I spent more time writing about wealth and it's corrosive effects than I did on income, but for some reason you and wiaf are hyperfocused on what I said about income. You are both also imagining things I never said. I can't help you both with that problem, except I have gone back and edited my post with "headers" to make it easier for the both of you to follow along.

More substantively, America had a problem with massive wealth inequalities before and the Greatest Generation largely resolved the problem through a combination of ~50% top corporate income tax rates, ~90% top income tax rates, strong anti-trust action, and strong financial regulation. It worked for that time - see what I wrote in my prior post comparing Howard Hughes (the wealthiest American of the era) to Jeff Yass (some unknown investor and political player of this era with equivalent wealth to Howard Hughes). Now compare that to the problem the Greatest Generation had with dynastic wealth from the Rockefellers, the Vanderbilt's, the Mellon's, the Hearst's, the Carnegie's, etc. Fortunes were still made in the mid-20th century but it was more limited. Today, we are back to the old days.

There are a lot of reasons why the old remedies likely wouldn't work today (some would help, like stronger anti-trust and financial regulation). That is why I have consistently over the years on these boards supported a wealth tax to resolve the issue of wealth inequality, despite some imaginations around here. Sure, I'd roll back Trump tax cuts for high income earners, but that is playing at the margins. We need a wealth tax. If that is a revelation for you, then you haven't been reading me clearly. I mean, I'm probably the only person on these boards who supported Elizabeth Warren for President.

You won't see me debating the particulars of tax laws with wiaf for the same reason you don't see me debating vaccine science or debating football strategy. I wouldn't debate defensive strategies with Sonny Dykes, I just knew he was ineffective and I wanted him fired. I look at wiaf as a coach that is ineffective and should be fired. If I were President, I would assemble a team of CPA's, lawyers, and financiers who wanted to fix the problem to resolve the particulars of a wealth tax. Wiaf would not be on the team.

What I know is that investing and profits and taxes are all human constructs. This isn't like vaccines where we have to play within the rules of science. We just have to have the will. Our grandparents had the will and they didn't listen to the people who told them it was impossible.

wifeisafurd said:I'm afraid that the last sentence is accurate. But there was a very good post by DiabloWags regarding the wealth tax versus the estate tax, that bears reviewing. This poster obviously has background in the area. At the risk of being repetitive, the problem is not taxation per se, but the ability to pass on wealth to future generations. Capitalists argue that a capitalist society is fair because you gain the rewards of your hard work. But, often people are rich, simply because they inherit wealth or are born into a privileged class, and that privilege prevents social mobility and other things we desire in a capitalistic society. So talking about things like estate taxes and changing tax basis would, in my opinion, have substantial benefit. Again, take a closer look at Diablo's post.Unit2Sucks said:

And just want to +1 to everything WIAF said above about taxes. Not everyone might agree with his commentary (I generally do on tax), but he knows what he's talking about as an experienced practitioner. I think people generally have an understand that there are a lot of different ways people can legally avoid creating taxable income, but they don't really understand how it works or how ill-equipped our government is to address it. Making small tweaks to the tax code and focusing on income tax will never really address the problem of wealth inequality.

I mentioned the Grantor's Annuity Trust over the weekend.

But for some reason, no one bothered to educate themselves.

The Grantor's Annuity Trust allows assets to be passed on . . . tax free.

People like Phil Knight are poster child's for using the Grantor's Annuity Trust.

How American Billionaires Like Phil Knight Pass Wealth to Heirs Tax-Free (bloomberg.com)

dajo9 said:

We need a wealth tax. If that is a revelation for you, then you haven't been reading me clearly. I mean, I'm probably the only person on these boards who supported Elizabeth Warren for President.

Like most socialists, Senator Warren is enamored with class warfare and wealth distribution. Much of her political career has been predicated on vilifying productive Americans while nurturing a sense of victimhood among her followers.

Interestingly enough, her colleagues like Bernie Sanders own 3 houses and write books making themselves millionaires; but are critical of someone making the same amount of money by starting a business, hiring people and creating jobs for others and creating income for other people while taking on the RISK of starting a business. And yet, if you look at his financial statements which he released while running for office, the money that Sanders gives to charity is far less than a good portion of the country and dramatically less than a large number of other people with his wealth. Another socialist, executive director of BLM Patrisse Cullora had to resign amid controversy surrounding revelations that she leads a lavish lifestyle, owns 4 properties, including a $1.4 million house in Malibu and a ranch in Georgia.

I wonder what Karl Marx would think of the two most visible "socialists/Marxists" in America being multi-millionaires?

Everyone that is against tRump is a Leftist.

Any suggestion of gun control equates to "the government intends to take all our guns away."

Any suggestion that something can be done to make income and wealth distribution trends more equitable is a socialist/communist.

I'm not knowledgeable in the area tax, so I certainly can't engage in balloon animal word smithing on the subject, but nonetheless, I'm thinking there has to be whole lot of livable real estate between the two extremes.

Any suggestion of gun control equates to "the government intends to take all our guns away."

Any suggestion that something can be done to make income and wealth distribution trends more equitable is a socialist/communist.

I'm not knowledgeable in the area tax, so I certainly can't engage in balloon animal word smithing on the subject, but nonetheless, I'm thinking there has to be whole lot of livable real estate between the two extremes.

Cancel my subscription to the Resurrection

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

dajo9 said:I think it's pretty rich for you to call me evasive for answering a question of yours. You're the one that asked about our family personal marginal tax brackets and when I respond you say it's irrelevant. OK. Thanks for asking an irrelevant question, I guess.Unit2Sucks said:I think your response is a bit evasive. My point is that most wealthy people (eg 1%ers) are self-made so when we make these decade long comparisons, it creates the inaccurate impression that there is far more continuity among that class than their actually is. Comparing marginal rates is irrelevant to this conversation. For the most part if you aren't in the top federal bracket, you aren't that wealthy. If you are so wealthy that you don't pay any taxes, lol, then it's pretty obvious and the children are less likely to surpass their parents (although I still know some of those outcomes as well).dajo9 said:wifeisafurd said:dajo9 said:Unit2Sucks said:I think the point he might be making is that the composition of the people in the 1% changes over time. I bet if you check around on BI, most 1%ers are the first in their families to attain that status. Of course that's not the case everywhere but it's worth considering. You can't blame Zuckerberg for the Dubya Bush tax cuts, for example. Can you blame every first generation entrepreneur for wealth inequality when their parents often came over with just the clothes on their back and a dream?concordtom said:wifeisafurd said:And the numbers are total bullcrap. Tell me counselor:bearister said:

10 years later, the disparity is much worse:

Of the 1%, by the 1%, for the 1% | Vanity Fair

https://www.vanityfair.com/news/2011/05/top-one-percent-201105

"The top 1% percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn't seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late."

How is total wealth for the US determined?

How is who is in the top 1% determined? Did you have Ms. Jenner on your list?

How is the total amount of wealth of the top 1% determined?

The problem is that there are no real sources. The IRS keeps records on taxable income limited amounts of non-taxable income. It didn't even keep track on non-taxable income years ago. I don't know if the numbers are to conservative or overstate the problem, just that the numbers you quote don't really exist in any data base.

Typical Fox retort.

Just muddy it up, change the subject, don't address the point of the claim by arguing that the data is bad.

Barf !

I know the tactic well. It doesn't reflect well on you or your class, so just muck it up and don't answer to it.

I'd be more impressed if you added to discussion by sharing thoughts or projects designed to help others.

Go ahead, brag a little. It's allowed, for a good cause! As we've seen.

We can take an informal poll. Who here is in a higher tax bracket than their parents? Who here has a net worth larger than their parents? Anyone 10x? 100x?

I've been in a higher tax bracket than my parents every year since I entered the workforce. My net worth exceeds theirs, although not by 10x yet. If you disregard real estate, I'm 10x but not 100x.

I have a number of friends who are well over 10x their parents' net worth and some probably 100x. I read these articles about how the wealth held by the 1% has grown over time, it always makes me wonder what the authors think about people like that.

There are some problems with your argument. First, inflation skews these intergenerational numbers badly. For example, sometime around 1970, my grandfather (Stanford grad) earned around $50k. Hard data is hard to find but I think that put him near the 1%, if not in it. But his wealth was not transformational (I never saw a dime). My grandfather's income put him in a 50% federal income tax bracket at the time - higher than me. Higher than everybody today.

The big problem with what you are saying is that being in the 1% all by itself is not an issue. The issue is the current 1% is so much more wealthy than prior generation 1%'s largely because of tax policy. Today we have transformational, intergenerational wealth. Democracy threatening wealth.

Also, the question unit2 asked was what bracket people are in compared to previous generations. That is a question about marginal tax rates.

So much typing by you for nothing.

With few obvious exceptions, people aren't creating true intergenerational wealth (9 figure net worth) by making a nice salary. They're doing it through the value of equity and always have been. They pay capital gains taxes (or none at all) but they don't pay income tax. WIAF spoke to that so I won't belabor it.

I think inflation is largely irrelevant to the discussion of wealth accumulation in the past 4 decades because asset inflation has exceeded "inflation" over the period. Boomers have tons of money and haven't been harmed by inflation.

And just want to +1 to everything WIAF said above about taxes. Not everyone might agree with his commentary (I generally do on tax), but he knows what he's talking about as an experienced practitioner. I think people generally have an understand that there are a lot of different ways people can legally avoid creating taxable income, but they don't really understand how it works or how ill-equipped our government is to address it. Making small tweaks to the tax code and focusing on income tax will never really address the problem of wealth inequality.

I spent more time writing about wealth and it's corrosive effects than I did on income, but for some reason you and wiaf are hyperfocused on what I said about income. You are both also imagining things I never said. I can't help you both with that problem, except I have gone back and edited my post with "headers" to make it easier for the both of you to follow along.

More substantively, America had a problem with massive wealth inequalities before and the Greatest Generation largely resolved the problem through a combination of ~50% top corporate income tax rates, ~90% top income tax rates, strong anti-trust action, and strong financial regulation. It worked for that time - see what I wrote in my prior post comparing Howard Hughes (the wealthiest American of the era) to Jeff Yass (some unknown investor and political player of this era with equivalent wealth to Howard Hughes).

I bet your grandfather paid a lower percentage of his income in tax than you did because, as WIAF mentioned, nobody really paid those rates. Look at tax revenues as a percentage of GDP over time - it wasn't higher back then. Do you think they had less wealth inequality because there was less government spending?

Or perhaps there is no relation. Reality is that the change in wealth inequality has nothing to do with changes to tax policy and everything to do with changes in the economy.

Unit2Sucks said:dajo9 said:I think it's pretty rich for you to call me evasive for answering a question of yours. You're the one that asked about our family personal marginal tax brackets and when I respond you say it's irrelevant. OK. Thanks for asking an irrelevant question, I guess.Unit2Sucks said:I think your response is a bit evasive. My point is that most wealthy people (eg 1%ers) are self-made so when we make these decade long comparisons, it creates the inaccurate impression that there is far more continuity among that class than their actually is. Comparing marginal rates is irrelevant to this conversation. For the most part if you aren't in the top federal bracket, you aren't that wealthy. If you are so wealthy that you don't pay any taxes, lol, then it's pretty obvious and the children are less likely to surpass their parents (although I still know some of those outcomes as well).dajo9 said:wifeisafurd said:dajo9 said:Unit2Sucks said:I think the point he might be making is that the composition of the people in the 1% changes over time. I bet if you check around on BI, most 1%ers are the first in their families to attain that status. Of course that's not the case everywhere but it's worth considering. You can't blame Zuckerberg for the Dubya Bush tax cuts, for example. Can you blame every first generation entrepreneur for wealth inequality when their parents often came over with just the clothes on their back and a dream?concordtom said:wifeisafurd said:And the numbers are total bullcrap. Tell me counselor:bearister said:

10 years later, the disparity is much worse:

Of the 1%, by the 1%, for the 1% | Vanity Fair

https://www.vanityfair.com/news/2011/05/top-one-percent-201105

"The top 1% percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn't seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late."

How is total wealth for the US determined?

How is who is in the top 1% determined? Did you have Ms. Jenner on your list?

How is the total amount of wealth of the top 1% determined?

The problem is that there are no real sources. The IRS keeps records on taxable income limited amounts of non-taxable income. It didn't even keep track on non-taxable income years ago. I don't know if the numbers are to conservative or overstate the problem, just that the numbers you quote don't really exist in any data base.

Typical Fox retort.

Just muddy it up, change the subject, don't address the point of the claim by arguing that the data is bad.

Barf !

I know the tactic well. It doesn't reflect well on you or your class, so just muck it up and don't answer to it.

I'd be more impressed if you added to discussion by sharing thoughts or projects designed to help others.

Go ahead, brag a little. It's allowed, for a good cause! As we've seen.

We can take an informal poll. Who here is in a higher tax bracket than their parents? Who here has a net worth larger than their parents? Anyone 10x? 100x?

I've been in a higher tax bracket than my parents every year since I entered the workforce. My net worth exceeds theirs, although not by 10x yet. If you disregard real estate, I'm 10x but not 100x.

I have a number of friends who are well over 10x their parents' net worth and some probably 100x. I read these articles about how the wealth held by the 1% has grown over time, it always makes me wonder what the authors think about people like that.

There are some problems with your argument. First, inflation skews these intergenerational numbers badly. For example, sometime around 1970, my grandfather (Stanford grad) earned around $50k. Hard data is hard to find but I think that put him near the 1%, if not in it. But his wealth was not transformational (I never saw a dime). My grandfather's income put him in a 50% federal income tax bracket at the time - higher than me. Higher than everybody today.

The big problem with what you are saying is that being in the 1% all by itself is not an issue. The issue is the current 1% is so much more wealthy than prior generation 1%'s largely because of tax policy. Today we have transformational, intergenerational wealth. Democracy threatening wealth.

Also, the question unit2 asked was what bracket people are in compared to previous generations. That is a question about marginal tax rates.

So much typing by you for nothing.

With few obvious exceptions, people aren't creating true intergenerational wealth (9 figure net worth) by making a nice salary. They're doing it through the value of equity and always have been. They pay capital gains taxes (or none at all) but they don't pay income tax. WIAF spoke to that so I won't belabor it.

I think inflation is largely irrelevant to the discussion of wealth accumulation in the past 4 decades because asset inflation has exceeded "inflation" over the period. Boomers have tons of money and haven't been harmed by inflation.

And just want to +1 to everything WIAF said above about taxes. Not everyone might agree with his commentary (I generally do on tax), but he knows what he's talking about as an experienced practitioner. I think people generally have an understand that there are a lot of different ways people can legally avoid creating taxable income, but they don't really understand how it works or how ill-equipped our government is to address it. Making small tweaks to the tax code and focusing on income tax will never really address the problem of wealth inequality.

I spent more time writing about wealth and it's corrosive effects than I did on income, but for some reason you and wiaf are hyperfocused on what I said about income. You are both also imagining things I never said. I can't help you both with that problem, except I have gone back and edited my post with "headers" to make it easier for the both of you to follow along.

More substantively, America had a problem with massive wealth inequalities before and the Greatest Generation largely resolved the problem through a combination of ~50% top corporate income tax rates, ~90% top income tax rates, strong anti-trust action, and strong financial regulation. It worked for that time - see what I wrote in my prior post comparing Howard Hughes (the wealthiest American of the era) to Jeff Yass (some unknown investor and political player of this era with equivalent wealth to Howard Hughes).

Maybe, I have no idea. Confiscatory income tax rates had the added benefit of owners not paying themselves as much as possible. Maybe if you are in a partnership, as my Grandfather was, you decide to pay staff more, since you wouldn't be able to keep the money yourself. I don't know as I wasn't around for discussions like that (and I'm not advocating for confiscatory income tax rates today).Quote:

I bet your grandfather paid a lower percentage of his income in tax than you did because, as WIAF mentioned, nobody really paid those rates.

I just disagree with that. Though there is one more change that I left out in my previous post - labor power. Which is more difficult today but I think can be matched with voting power, if people have the will for it.Quote:

Or perhaps there is no relation. Reality is that the change in wealth inequality has nothing to do with changes to tax policy and everything to do with changes in the economy.

It seems it would be a striking coincidence that the one time our government set out to reduce wealth inequality, it was achieved through completely unrelated changes in the economy. I also think it would be a tragedy to just give up without trying because experts who benefit from the current system say it is impossible.

dajo9 said:I think it's pretty rich for you to call me evasive for answering a question of yours. You're the one that asked about our family personal marginal tax brackets and when I respond you say it's irrelevant. OK. Thanks for asking an irrelevant question, I guess.Unit2Sucks said:I think your response is a bit evasive. My point is that most wealthy people (eg 1%ers) are self-made so when we make these decade long comparisons, it creates the inaccurate impression that there is far more continuity among that class than their actually is. Comparing marginal rates is irrelevant to this conversation. For the most part if you aren't in the top federal bracket, you aren't that wealthy. If you are so wealthy that you don't pay any taxes, lol, then it's pretty obvious and the children are less likely to surpass their parents (although I still know some of those outcomes as well).dajo9 said:wifeisafurd said:dajo9 said:Unit2Sucks said:I think the point he might be making is that the composition of the people in the 1% changes over time. I bet if you check around on BI, most 1%ers are the first in their families to attain that status. Of course that's not the case everywhere but it's worth considering. You can't blame Zuckerberg for the Dubya Bush tax cuts, for example. Can you blame every first generation entrepreneur for wealth inequality when their parents often came over with just the clothes on their back and a dream?concordtom said:wifeisafurd said:And the numbers are total bullcrap. Tell me counselor:bearister said:

10 years later, the disparity is much worse:

Of the 1%, by the 1%, for the 1% | Vanity Fair

https://www.vanityfair.com/news/2011/05/top-one-percent-201105

"The top 1% percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn't seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late."

How is total wealth for the US determined?

How is who is in the top 1% determined? Did you have Ms. Jenner on your list?

How is the total amount of wealth of the top 1% determined?

The problem is that there are no real sources. The IRS keeps records on taxable income limited amounts of non-taxable income. It didn't even keep track on non-taxable income years ago. I don't know if the numbers are to conservative or overstate the problem, just that the numbers you quote don't really exist in any data base.

Typical Fox retort.

Just muddy it up, change the subject, don't address the point of the claim by arguing that the data is bad.

Barf !

I know the tactic well. It doesn't reflect well on you or your class, so just muck it up and don't answer to it.

I'd be more impressed if you added to discussion by sharing thoughts or projects designed to help others.

Go ahead, brag a little. It's allowed, for a good cause! As we've seen.

We can take an informal poll. Who here is in a higher tax bracket than their parents? Who here has a net worth larger than their parents? Anyone 10x? 100x?

I've been in a higher tax bracket than my parents every year since I entered the workforce. My net worth exceeds theirs, although not by 10x yet. If you disregard real estate, I'm 10x but not 100x.

I have a number of friends who are well over 10x their parents' net worth and some probably 100x. I read these articles about how the wealth held by the 1% has grown over time, it always makes me wonder what the authors think about people like that.

There are some problems with your argument. First, inflation skews these intergenerational numbers badly. For example, sometime around 1970, my grandfather (Stanford grad) earned around $50k. Hard data is hard to find but I think that put him near the 1%, if not in it. But his wealth was not transformational (I never saw a dime). My grandfather's income put him in a 50% federal income tax bracket at the time - higher than me. Higher than everybody today.

The big problem with what you are saying is that being in the 1% all by itself is not an issue. The issue is the current 1% is so much more wealthy than prior generation 1%'s largely because of tax policy. Today we have transformational, intergenerational wealth. Democracy threatening wealth.

Also, the question unit2 asked was what bracket people are in compared to previous generations. That is a question about marginal tax rates.

So much typing by you for nothing.

With few obvious exceptions, people aren't creating true intergenerational wealth (9 figure net worth) by making a nice salary. They're doing it through the value of equity and always have been. They pay capital gains taxes (or none at all) but they don't pay income tax. WIAF spoke to that so I won't belabor it.

I think inflation is largely irrelevant to the discussion of wealth accumulation in the past 4 decades because asset inflation has exceeded "inflation" over the period. Boomers have tons of money and haven't been harmed by inflation.

And just want to +1 to everything WIAF said above about taxes. Not everyone might agree with his commentary (I generally do on tax), but he knows what he's talking about as an experienced practitioner. I think people generally have an understand that there are a lot of different ways people can legally avoid creating taxable income, but they don't really understand how it works or how ill-equipped our government is to address it. Making small tweaks to the tax code and focusing on income tax will never really address the problem of wealth inequality.

I spent more time writing about wealth and it's corrosive effects than I did on income, but for some reason you and wiaf are hyperfocused on what I said about income. You are both also imagining things I never said. I can't help you both with that problem, except I have gone back and edited my post with "headers" to make it easier for the both of you to follow along.

More substantively, America had a problem with massive wealth inequalities before and the Greatest Generation largely resolved the problem through a combination of ~50% top corporate income tax rates, ~90% top income tax rates, strong anti-trust action, and strong financial regulation. It worked for that time - see what I wrote in my prior post comparing Howard Hughes (the wealthiest American of the era) to Jeff Yass (some unknown investor and political player of this era with equivalent wealth to Howard Hughes). Now compare that to the problem the Greatest Generation had with dynastic wealth from the Rockefellers, the Vanderbilt's, the Mellon's, the Hearst's, the Carnegie's, etc. Fortunes were still made in the mid-20th century but it was more limited. Today, we are back to the old days.

There are a lot of reasons why the old remedies likely wouldn't work today (some would help, like stronger anti-trust and financial regulation). That is why I have consistently over the years on these boards supported a wealth tax to resolve the issue of wealth inequality, despite some imaginations around here. Sure, I'd roll back Trump tax cuts for high income earners, but that is playing at the margins. We need a wealth tax. If that is a revelation for you, then you haven't been reading me clearly. I mean, I'm probably the only person on these boards who supported Elizabeth Warren for President.

You won't see me debating the particulars of tax laws with wiaf for the same reason you don't see me debating vaccine science or debating football strategy. I wouldn't debate defensive strategies with Sonny Dykes, I just knew he was ineffective and I wanted him fired. I look at wiaf as a coach that is ineffective and should be fired. If I were President, I would assemble a team of CPA's, lawyers, and financiers who wanted to fix the problem to resolve the particulars of a wealth tax. Wiaf would not be on the team.

What I know is that investing and profits and taxes are all human constructs. This isn't like vaccines where we have to play within the rules of science. We just have to have the will. Our grandparents had the will and they didn't listen to the people who told them it was impossible.

You, Wiaf, Wags and others have written some wonderful, thought provoking stuff on this thread. You just detailed my c-suite BIL's position on the wealth tax that caused us to get in a heated debate during Xmas vacation up at ONE of his houses in Seattle. We both want similar results, I just think there is something fundamentallt wrong with the wealth tax details, he, like you, just say enough is enough, this is our only solution. I love my BIL so I told him I'd keep mulling it over. Still not convinced but I do appreciate you spelling out your reasoning. And I love the analogies. Love what Waif has written,. Live what wags has written. Wonderful thread.

Thanks 82. I am also more interested in results than methods. I invite you to spell out the particulars of your idea in more detail because I'm just not clear on how it would work even in general terms.82gradDLSdad said:dajo9 said:I think it's pretty rich for you to call me evasive for answering a question of yours. You're the one that asked about our family personal marginal tax brackets and when I respond you say it's irrelevant. OK. Thanks for asking an irrelevant question, I guess.Unit2Sucks said:I think your response is a bit evasive. My point is that most wealthy people (eg 1%ers) are self-made so when we make these decade long comparisons, it creates the inaccurate impression that there is far more continuity among that class than their actually is. Comparing marginal rates is irrelevant to this conversation. For the most part if you aren't in the top federal bracket, you aren't that wealthy. If you are so wealthy that you don't pay any taxes, lol, then it's pretty obvious and the children are less likely to surpass their parents (although I still know some of those outcomes as well).dajo9 said:wifeisafurd said:dajo9 said:Unit2Sucks said:I think the point he might be making is that the composition of the people in the 1% changes over time. I bet if you check around on BI, most 1%ers are the first in their families to attain that status. Of course that's not the case everywhere but it's worth considering. You can't blame Zuckerberg for the Dubya Bush tax cuts, for example. Can you blame every first generation entrepreneur for wealth inequality when their parents often came over with just the clothes on their back and a dream?concordtom said:wifeisafurd said:And the numbers are total bullcrap. Tell me counselor:bearister said:

10 years later, the disparity is much worse:

Of the 1%, by the 1%, for the 1% | Vanity Fair

https://www.vanityfair.com/news/2011/05/top-one-percent-201105

"The top 1% percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn't seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late."

How is total wealth for the US determined?

How is who is in the top 1% determined? Did you have Ms. Jenner on your list?

How is the total amount of wealth of the top 1% determined?

The problem is that there are no real sources. The IRS keeps records on taxable income limited amounts of non-taxable income. It didn't even keep track on non-taxable income years ago. I don't know if the numbers are to conservative or overstate the problem, just that the numbers you quote don't really exist in any data base.

Typical Fox retort.

Just muddy it up, change the subject, don't address the point of the claim by arguing that the data is bad.

Barf !

I know the tactic well. It doesn't reflect well on you or your class, so just muck it up and don't answer to it.

I'd be more impressed if you added to discussion by sharing thoughts or projects designed to help others.

Go ahead, brag a little. It's allowed, for a good cause! As we've seen.

We can take an informal poll. Who here is in a higher tax bracket than their parents? Who here has a net worth larger than their parents? Anyone 10x? 100x?

I've been in a higher tax bracket than my parents every year since I entered the workforce. My net worth exceeds theirs, although not by 10x yet. If you disregard real estate, I'm 10x but not 100x.

I have a number of friends who are well over 10x their parents' net worth and some probably 100x. I read these articles about how the wealth held by the 1% has grown over time, it always makes me wonder what the authors think about people like that.

There are some problems with your argument. First, inflation skews these intergenerational numbers badly. For example, sometime around 1970, my grandfather (Stanford grad) earned around $50k. Hard data is hard to find but I think that put him near the 1%, if not in it. But his wealth was not transformational (I never saw a dime). My grandfather's income put him in a 50% federal income tax bracket at the time - higher than me. Higher than everybody today.

The big problem with what you are saying is that being in the 1% all by itself is not an issue. The issue is the current 1% is so much more wealthy than prior generation 1%'s largely because of tax policy. Today we have transformational, intergenerational wealth. Democracy threatening wealth.

Also, the question unit2 asked was what bracket people are in compared to previous generations. That is a question about marginal tax rates.

So much typing by you for nothing.

With few obvious exceptions, people aren't creating true intergenerational wealth (9 figure net worth) by making a nice salary. They're doing it through the value of equity and always have been. They pay capital gains taxes (or none at all) but they don't pay income tax. WIAF spoke to that so I won't belabor it.

I think inflation is largely irrelevant to the discussion of wealth accumulation in the past 4 decades because asset inflation has exceeded "inflation" over the period. Boomers have tons of money and haven't been harmed by inflation.

And just want to +1 to everything WIAF said above about taxes. Not everyone might agree with his commentary (I generally do on tax), but he knows what he's talking about as an experienced practitioner. I think people generally have an understand that there are a lot of different ways people can legally avoid creating taxable income, but they don't really understand how it works or how ill-equipped our government is to address it. Making small tweaks to the tax code and focusing on income tax will never really address the problem of wealth inequality.

I spent more time writing about wealth and it's corrosive effects than I did on income, but for some reason you and wiaf are hyperfocused on what I said about income. You are both also imagining things I never said. I can't help you both with that problem, except I have gone back and edited my post with "headers" to make it easier for the both of you to follow along.

More substantively, America had a problem with massive wealth inequalities before and the Greatest Generation largely resolved the problem through a combination of ~50% top corporate income tax rates, ~90% top income tax rates, strong anti-trust action, and strong financial regulation. It worked for that time - see what I wrote in my prior post comparing Howard Hughes (the wealthiest American of the era) to Jeff Yass (some unknown investor and political player of this era with equivalent wealth to Howard Hughes). Now compare that to the problem the Greatest Generation had with dynastic wealth from the Rockefellers, the Vanderbilt's, the Mellon's, the Hearst's, the Carnegie's, etc. Fortunes were still made in the mid-20th century but it was more limited. Today, we are back to the old days.

There are a lot of reasons why the old remedies likely wouldn't work today (some would help, like stronger anti-trust and financial regulation). That is why I have consistently over the years on these boards supported a wealth tax to resolve the issue of wealth inequality, despite some imaginations around here. Sure, I'd roll back Trump tax cuts for high income earners, but that is playing at the margins. We need a wealth tax. If that is a revelation for you, then you haven't been reading me clearly. I mean, I'm probably the only person on these boards who supported Elizabeth Warren for President.

You won't see me debating the particulars of tax laws with wiaf for the same reason you don't see me debating vaccine science or debating football strategy. I wouldn't debate defensive strategies with Sonny Dykes, I just knew he was ineffective and I wanted him fired. I look at wiaf as a coach that is ineffective and should be fired. If I were President, I would assemble a team of CPA's, lawyers, and financiers who wanted to fix the problem to resolve the particulars of a wealth tax. Wiaf would not be on the team.

What I know is that investing and profits and taxes are all human constructs. This isn't like vaccines where we have to play within the rules of science. We just have to have the will. Our grandparents had the will and they didn't listen to the people who told them it was impossible.

You, Wiaf, Wags and others have written some wonderful, thought provoking stuff on this thread. You just detailed my c-suite BIL's position on the wealth tax that caused us to get in a heated debate during Xmas vacation up at ONE of his houses in Seattle. We both want similar results, I just think there is something fundamentallt wrong with the wealth tax details, he, like you, just say enough is enough, this is our only solution. I love my BIL so I told him I'd keep mulling it over. Still not convinced but I do appreciate you spelling out your reasoning. And I love the analogies. Love what Waif has written,. Live what wags has written. Wonderful thread.

bearister said:

Everyone that is against tRump is a Leftist.

Youre terribly mistaken.

I'm not a Leftist . . . and I cant wait for the Orange Crap Stain to pass away.

When he does, I will catch a flight to the East Coast where I can piss on his grave.

After that, I'll spend $20,000 on a wonderful "Celebration of Death" party.

dajo9 said:Thanks 82. I am also more interested in results than methods. I invite you to spell out the particulars of your idea in more detail because I'm just not clear on how it would work even in general terms.82gradDLSdad said:dajo9 said:I think it's pretty rich for you to call me evasive for answering a question of yours. You're the one that asked about our family personal marginal tax brackets and when I respond you say it's irrelevant. OK. Thanks for asking an irrelevant question, I guess.Unit2Sucks said:I think your response is a bit evasive. My point is that most wealthy people (eg 1%ers) are self-made so when we make these decade long comparisons, it creates the inaccurate impression that there is far more continuity among that class than their actually is. Comparing marginal rates is irrelevant to this conversation. For the most part if you aren't in the top federal bracket, you aren't that wealthy. If you are so wealthy that you don't pay any taxes, lol, then it's pretty obvious and the children are less likely to surpass their parents (although I still know some of those outcomes as well).dajo9 said:wifeisafurd said:dajo9 said:Unit2Sucks said:I think the point he might be making is that the composition of the people in the 1% changes over time. I bet if you check around on BI, most 1%ers are the first in their families to attain that status. Of course that's not the case everywhere but it's worth considering. You can't blame Zuckerberg for the Dubya Bush tax cuts, for example. Can you blame every first generation entrepreneur for wealth inequality when their parents often came over with just the clothes on their back and a dream?concordtom said:wifeisafurd said:And the numbers are total bullcrap. Tell me counselor:bearister said:

10 years later, the disparity is much worse:

Of the 1%, by the 1%, for the 1% | Vanity Fair

https://www.vanityfair.com/news/2011/05/top-one-percent-201105

"The top 1% percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn't seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late."

How is total wealth for the US determined?

How is who is in the top 1% determined? Did you have Ms. Jenner on your list?

How is the total amount of wealth of the top 1% determined?

The problem is that there are no real sources. The IRS keeps records on taxable income limited amounts of non-taxable income. It didn't even keep track on non-taxable income years ago. I don't know if the numbers are to conservative or overstate the problem, just that the numbers you quote don't really exist in any data base.

Typical Fox retort.

Just muddy it up, change the subject, don't address the point of the claim by arguing that the data is bad.

Barf !

I know the tactic well. It doesn't reflect well on you or your class, so just muck it up and don't answer to it.

I'd be more impressed if you added to discussion by sharing thoughts or projects designed to help others.

Go ahead, brag a little. It's allowed, for a good cause! As we've seen.

We can take an informal poll. Who here is in a higher tax bracket than their parents? Who here has a net worth larger than their parents? Anyone 10x? 100x?

I've been in a higher tax bracket than my parents every year since I entered the workforce. My net worth exceeds theirs, although not by 10x yet. If you disregard real estate, I'm 10x but not 100x.

I have a number of friends who are well over 10x their parents' net worth and some probably 100x. I read these articles about how the wealth held by the 1% has grown over time, it always makes me wonder what the authors think about people like that.

There are some problems with your argument. First, inflation skews these intergenerational numbers badly. For example, sometime around 1970, my grandfather (Stanford grad) earned around $50k. Hard data is hard to find but I think that put him near the 1%, if not in it. But his wealth was not transformational (I never saw a dime). My grandfather's income put him in a 50% federal income tax bracket at the time - higher than me. Higher than everybody today.

The big problem with what you are saying is that being in the 1% all by itself is not an issue. The issue is the current 1% is so much more wealthy than prior generation 1%'s largely because of tax policy. Today we have transformational, intergenerational wealth. Democracy threatening wealth.

Also, the question unit2 asked was what bracket people are in compared to previous generations. That is a question about marginal tax rates.

So much typing by you for nothing.

With few obvious exceptions, people aren't creating true intergenerational wealth (9 figure net worth) by making a nice salary. They're doing it through the value of equity and always have been. They pay capital gains taxes (or none at all) but they don't pay income tax. WIAF spoke to that so I won't belabor it.

I think inflation is largely irrelevant to the discussion of wealth accumulation in the past 4 decades because asset inflation has exceeded "inflation" over the period. Boomers have tons of money and haven't been harmed by inflation.

And just want to +1 to everything WIAF said above about taxes. Not everyone might agree with his commentary (I generally do on tax), but he knows what he's talking about as an experienced practitioner. I think people generally have an understand that there are a lot of different ways people can legally avoid creating taxable income, but they don't really understand how it works or how ill-equipped our government is to address it. Making small tweaks to the tax code and focusing on income tax will never really address the problem of wealth inequality.

I spent more time writing about wealth and it's corrosive effects than I did on income, but for some reason you and wiaf are hyperfocused on what I said about income. You are both also imagining things I never said. I can't help you both with that problem, except I have gone back and edited my post with "headers" to make it easier for the both of you to follow along.

More substantively, America had a problem with massive wealth inequalities before and the Greatest Generation largely resolved the problem through a combination of ~50% top corporate income tax rates, ~90% top income tax rates, strong anti-trust action, and strong financial regulation. It worked for that time - see what I wrote in my prior post comparing Howard Hughes (the wealthiest American of the era) to Jeff Yass (some unknown investor and political player of this era with equivalent wealth to Howard Hughes). Now compare that to the problem the Greatest Generation had with dynastic wealth from the Rockefellers, the Vanderbilt's, the Mellon's, the Hearst's, the Carnegie's, etc. Fortunes were still made in the mid-20th century but it was more limited. Today, we are back to the old days.

There are a lot of reasons why the old remedies likely wouldn't work today (some would help, like stronger anti-trust and financial regulation). That is why I have consistently over the years on these boards supported a wealth tax to resolve the issue of wealth inequality, despite some imaginations around here. Sure, I'd roll back Trump tax cuts for high income earners, but that is playing at the margins. We need a wealth tax. If that is a revelation for you, then you haven't been reading me clearly. I mean, I'm probably the only person on these boards who supported Elizabeth Warren for President.

You won't see me debating the particulars of tax laws with wiaf for the same reason you don't see me debating vaccine science or debating football strategy. I wouldn't debate defensive strategies with Sonny Dykes, I just knew he was ineffective and I wanted him fired. I look at wiaf as a coach that is ineffective and should be fired. If I were President, I would assemble a team of CPA's, lawyers, and financiers who wanted to fix the problem to resolve the particulars of a wealth tax. Wiaf would not be on the team.

What I know is that investing and profits and taxes are all human constructs. This isn't like vaccines where we have to play within the rules of science. We just have to have the will. Our grandparents had the will and they didn't listen to the people who told them it was impossible.

You, Wiaf, Wags and others have written some wonderful, thought provoking stuff on this thread. You just detailed my c-suite BIL's position on the wealth tax that caused us to get in a heated debate during Xmas vacation up at ONE of his houses in Seattle. We both want similar results, I just think there is something fundamentallt wrong with the wealth tax details, he, like you, just say enough is enough, this is our only solution. I love my BIL so I told him I'd keep mulling it over. Still not convinced but I do appreciate you spelling out your reasoning. And I love the analogies. Love what Waif has written,. Live what wags has written. Wonderful thread.

I don't have many details on wealth inequality. I do think I'm ready for government to step in with a federal compensation scale that would more equitably divy up corporate profits. I was and am still appalled at how much our upper management took home at AT&T while simultaneously off shoring jobs, capping employee pay and saddling the company with debt that they are still trying to undo. Basically they funneled all the built in profit that the phone company enjoyed to the very poor performing top. Randall Stephenson was making $30,000,000 per year at the end. Absolutely no reason to pay any lifer phone company person that much money. I'm sure he's not alone in the CEO over compensation camp. Like I said, this doesn't address wealth inequality but I really do we think we can help with average workers sharing in their corporations profits.

82gradDLSdad said:

You, Wiaf, Wags and others have written some wonderful, thought provoking stuff on this thread. You just detailed my c-suite BIL's position on the wealth tax that caused us to get in a heated debate during Xmas vacation up at ONE of his houses in Seattle. We both want similar results, I just think there is something fundamentallt wrong with the wealth tax details, he, like you, just say enough is enough, this is our only solution. I love my BIL so I told him I'd keep mulling it over. Still not convinced but I do appreciate you spelling out your reasoning. And I love the analogies. Love what Waif has written,. Live what wags has written. Wonderful thread.

As I mentioned at the beginning of last weekend, calculating what wealth is, can be very complicated.

It's far easier said, than done.

So would trying to implement a wealth tax policy, once you specifically identify what wealth is. And dare I mention, that right now the IRS is terribly understaffed and last year was ridiculously late in processing income tax returns, let alone stimulus checks. You'd have to dramatically increase the size of the IRS in order to execute such a policy change.

I would be more of a champion of getting rid of the Grantor's Annuity Trusts that people like Phil Knight and the mega-rich use as vehicles to avoid paying income taxes.

I'm 62.

I've paid my fair share of taxes and there are only 3 left in my family.

When I pass away, my wealth will be distributed to wildlife/environmental concerns.

I dont trust the Govt with redistributing what I worked so hard for all these years.

The last time I checked, our Constitution still uses the word liberty.

wifeisafurd said:Some boundaries please. I made the mistake of begin overt in one charitable thing for Cal, and was rewarded with identity fraud, people emailing me to have a coach fired, and on and on. Just not going there anymore.concordtom said:wifeisafurd said:Tom, in your case it is a matter of you not being able to keep upconcordtom said:wifeisafurd said:And the numbers are total bullcrap. Tell me counselor:bearister said:

10 years later, the disparity is much worse:

Of the 1%, by the 1%, for the 1% | Vanity Fair

https://www.vanityfair.com/news/2011/05/top-one-percent-201105

"The top 1% percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn't seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late."

How is total wealth for the US determined?

How is who is in the top 1% determined? Did you have Ms. Jenner on your list?

How is the total amount of wealth of the top 1% determined?

The problem is that there are no real sources. The IRS keeps records on taxable income limited amounts of non-taxable income. It didn't even keep track on non-taxable income years ago. I don't know if the numbers are to conservative or overstate the problem, just that the numbers you quote don't really exist in any data base.

Typical Fox retort.

Just muddy it up, change the subject, don't address the point of the claim by arguing that the data is bad.

Barf !

As I said before:

"I'd be more impressed if you added to discussion by sharing thoughts or projects designed to help others."

I never contacted you, wrote your name or looked you up.

You are simply wife to me, the guy from near Dana point who has commercial real estate interests for lease. All things you've offered up here.

I respect your boundaries and wasn't going there.

My post was trying to draw out of you concern for others less fortunate, since we are discussing wealth disparity.

Wife, I come from a big family with different sides.

My father and step father both achieved great wealth. My stepfather's family has a small philanthropic foundation. My father, on the other hand, has never given much of a damn about others.

I've tried to reconcile the attitudinal differences.

I understand what you're saying about privacy. I'm sorry it turned that way for you. I respect that you gave back to Cal. I'm wanting to hear about other thoughts you have about the communities you deal with.

The Safeway at willow pass road and port Chicago Hwy is full of homeless people at night. This could be a plot of land you own. Where do these people come from? How did they get there? What do we do to keep that from becoming the norm in not just Oakland, San Francisco, and now concord but soon Orinda and Dana Point, too?

It's a macro issue we are talking about here - income and wealth inequality. It's not good enough to be like my father and sit back in self satisfaction of, "I lived a good life because I got mine! Through my own brilliance and hard work, I got mine!"

There is a fallacy somewhere in there. It is rooted in the Horacio Alger mythology - that success is available to anyone and everyone, so long as they merit it - or is that more akin to Ayn Rand?

Obama spoke to it when he said, "YOU did not build that company."

But now, I'm digressing.

I have no idea where you're at with this topic. But I'm reminded of the quote, "it's not how far you went, it's how many you brought with you."

There. Enough for you to psychologically dissect me, instead.

Cheers.

DiabloWags said:dajo9 said:

We need a wealth tax. If that is a revelation for you, then you haven't been reading me clearly. I mean, I'm probably the only person on these boards who supported Elizabeth Warren for President.

Like most socialists, Senator Warren is enamored with class warfare and wealth distribution. Much of her political career has been predicated on vilifying productive Americans while nurturing a sense of victimhood among her followers.

Interestingly enough, her colleagues like Bernie Sanders own 3 houses and write books making themselves millionaires; but are critical of someone making the same amount of money by starting a business, hiring people and creating jobs for others and creating income for other people while taking on the RISK of starting a business. And yet, if you look at his financial statements which he released while running for office, the money that Sanders gives to charity is far less than a good portion of the country and dramatically less than a large number of other people with his wealth. Another socialist, executive director of BLM Patrisse Cullora had to resign amid controversy surrounding revelations that she leads a lavish lifestyle, owns 4 properties, including a $1.4 million house in Malibu and a ranch in Georgia.

I wonder what Karl Marx would think of the two most visible "socialists/Marxists" in America being multi-millionaires?

I've posted this many times, don't recall anyone responding.

Watch, if nothing else, his talk from minute 7 to 20.

Then let me know what you think about the direction of American society.

Skinny, we've created a flat tax system, and it allows wealth disparity to increase. He proposes one possible solution, which was picked up by Warren.

But I suppose first we should decide on whether we should care about a widening wealth gap. What go you think? I am was always taught that society functions best when there is a strong middle class, poorly when wealth is in the hands of few, as my Latin American studies taught. What say you?

concordtom said:

Obama spoke to it when he said, "YOU did not build that company."

Just to provide some context, Barack Obama's quote (above) was largely taken out of context by his critics. And the reason why is because he wasnt reflecting on building a COMPANY.

His actual quote was "Somebody invested in roads and bridges. If you've got a business, you didnt build that."

President Obama was clearly speaking to an American system having built roads and bridges.

Not a company.

concordtom said:

I've posted this many times, don't recall anyone responding.

Watch, if nothing else, his talk from minute 7 to 20.

Then let me know what you think about the direction of American society.

Tom, what Professor Zucman is explaining is nothing new.

The wealthy dont receive much income in the way of ordinary income.

They receive their money via long term capital gains, which are federally taxed at 20%.

And if you live in California, you can add another 13.3% to that if your gains were over $1.0 million.

This has been mentioned ad nauseam.

Interestingly enough, his chart of income inequality for the Top 1% vs Bottom 50% appears to intersect in 1994 (and I would argue) it coincides with the beginning of the computer and the birth of the Digital Age.

I dont think that there is any surprise that uneducated "laborers" who largely make up the Bottom 50%, have not been able to participate in the strong capital gains that the Top 1% have enjoyed.

I would also argue that the current playbook of the FED also plays in favor of the rich.

Anytime there is the threat of an economic contraction, the FED injects liquidity and sends rates to zero.

This monetary response obviously benefits the wealthier classes given their ability to deploy cash into the markets.

This is why Congress sent out actual "stimulus" checks to individuals during the Pandemic.

They learned their lesson from 2008-2009 where no direct stimulus to individuals occurred.

The $475 Billion TARP only dealt with purchasing toxic assets and equity from financial institutions.

But to this day, socialists like Bernie Sanders still use this as their battle cry.

What I keep wondering is why things that we say like dealing with generational wealth being passed on doesn't get any traction either here or anywhere else. Biden gave it some lip service, but it wasn't what went to Congress. Bearister talked about some middle field, well here it is. Just not allowing a step up basis would be huge. A Democratic Congress could impose meaningful estate taxes and eliminate devises to avoid the estate tax tomorrow and we would have a President that presumably sign the legislation. And there would be no legal challenges or the rest of the structural issues we have with the wealth tax. That they don't tells me the Dems don't want to offend their large donors. I pick on the Dems only because they have the power right now to do this. It seems all everyone wants to discuss is a wealth tax, which is not even on the political radar in terms of being passed. It probably also is illegal, and so fundamentally flawed in terms of practicality, that essentially no one in the world has a wealth tax.82gradDLSdad said:dajo9 said:I think it's pretty rich for you to call me evasive for answering a question of yours. You're the one that asked about our family personal marginal tax brackets and when I respond you say it's irrelevant. OK. Thanks for asking an irrelevant question, I guess.Unit2Sucks said:I think your response is a bit evasive. My point is that most wealthy people (eg 1%ers) are self-made so when we make these decade long comparisons, it creates the inaccurate impression that there is far more continuity among that class than their actually is. Comparing marginal rates is irrelevant to this conversation. For the most part if you aren't in the top federal bracket, you aren't that wealthy. If you are so wealthy that you don't pay any taxes, lol, then it's pretty obvious and the children are less likely to surpass their parents (although I still know some of those outcomes as well).dajo9 said:wifeisafurd said:dajo9 said:Unit2Sucks said:I think the point he might be making is that the composition of the people in the 1% changes over time. I bet if you check around on BI, most 1%ers are the first in their families to attain that status. Of course that's not the case everywhere but it's worth considering. You can't blame Zuckerberg for the Dubya Bush tax cuts, for example. Can you blame every first generation entrepreneur for wealth inequality when their parents often came over with just the clothes on their back and a dream?concordtom said:wifeisafurd said:And the numbers are total bullcrap. Tell me counselor:bearister said:

10 years later, the disparity is much worse:

Of the 1%, by the 1%, for the 1% | Vanity Fair

https://www.vanityfair.com/news/2011/05/top-one-percent-201105

"The top 1% percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn't seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late."

How is total wealth for the US determined?

How is who is in the top 1% determined? Did you have Ms. Jenner on your list?

How is the total amount of wealth of the top 1% determined?

The problem is that there are no real sources. The IRS keeps records on taxable income limited amounts of non-taxable income. It didn't even keep track on non-taxable income years ago. I don't know if the numbers are to conservative or overstate the problem, just that the numbers you quote don't really exist in any data base.

Typical Fox retort.

Just muddy it up, change the subject, don't address the point of the claim by arguing that the data is bad.

Barf !

I know the tactic well. It doesn't reflect well on you or your class, so just muck it up and don't answer to it.

I'd be more impressed if you added to discussion by sharing thoughts or projects designed to help others.

Go ahead, brag a little. It's allowed, for a good cause! As we've seen.

We can take an informal poll. Who here is in a higher tax bracket than their parents? Who here has a net worth larger than their parents? Anyone 10x? 100x?

I've been in a higher tax bracket than my parents every year since I entered the workforce. My net worth exceeds theirs, although not by 10x yet. If you disregard real estate, I'm 10x but not 100x.

I have a number of friends who are well over 10x their parents' net worth and some probably 100x. I read these articles about how the wealth held by the 1% has grown over time, it always makes me wonder what the authors think about people like that.

There are some problems with your argument. First, inflation skews these intergenerational numbers badly. For example, sometime around 1970, my grandfather (Stanford grad) earned around $50k. Hard data is hard to find but I think that put him near the 1%, if not in it. But his wealth was not transformational (I never saw a dime). My grandfather's income put him in a 50% federal income tax bracket at the time - higher than me. Higher than everybody today.

The big problem with what you are saying is that being in the 1% all by itself is not an issue. The issue is the current 1% is so much more wealthy than prior generation 1%'s largely because of tax policy. Today we have transformational, intergenerational wealth. Democracy threatening wealth.

Also, the question unit2 asked was what bracket people are in compared to previous generations. That is a question about marginal tax rates.

So much typing by you for nothing.

With few obvious exceptions, people aren't creating true intergenerational wealth (9 figure net worth) by making a nice salary. They're doing it through the value of equity and always have been. They pay capital gains taxes (or none at all) but they don't pay income tax. WIAF spoke to that so I won't belabor it.

I think inflation is largely irrelevant to the discussion of wealth accumulation in the past 4 decades because asset inflation has exceeded "inflation" over the period. Boomers have tons of money and haven't been harmed by inflation.

And just want to +1 to everything WIAF said above about taxes. Not everyone might agree with his commentary (I generally do on tax), but he knows what he's talking about as an experienced practitioner. I think people generally have an understand that there are a lot of different ways people can legally avoid creating taxable income, but they don't really understand how it works or how ill-equipped our government is to address it. Making small tweaks to the tax code and focusing on income tax will never really address the problem of wealth inequality.

I spent more time writing about wealth and it's corrosive effects than I did on income, but for some reason you and wiaf are hyperfocused on what I said about income. You are both also imagining things I never said. I can't help you both with that problem, except I have gone back and edited my post with "headers" to make it easier for the both of you to follow along.

More substantively, America had a problem with massive wealth inequalities before and the Greatest Generation largely resolved the problem through a combination of ~50% top corporate income tax rates, ~90% top income tax rates, strong anti-trust action, and strong financial regulation. It worked for that time - see what I wrote in my prior post comparing Howard Hughes (the wealthiest American of the era) to Jeff Yass (some unknown investor and political player of this era with equivalent wealth to Howard Hughes). Now compare that to the problem the Greatest Generation had with dynastic wealth from the Rockefellers, the Vanderbilt's, the Mellon's, the Hearst's, the Carnegie's, etc. Fortunes were still made in the mid-20th century but it was more limited. Today, we are back to the old days.

There are a lot of reasons why the old remedies likely wouldn't work today (some would help, like stronger anti-trust and financial regulation). That is why I have consistently over the years on these boards supported a wealth tax to resolve the issue of wealth inequality, despite some imaginations around here. Sure, I'd roll back Trump tax cuts for high income earners, but that is playing at the margins. We need a wealth tax. If that is a revelation for you, then you haven't been reading me clearly. I mean, I'm probably the only person on these boards who supported Elizabeth Warren for President.

You won't see me debating the particulars of tax laws with wiaf for the same reason you don't see me debating vaccine science or debating football strategy. I wouldn't debate defensive strategies with Sonny Dykes, I just knew he was ineffective and I wanted him fired. I look at wiaf as a coach that is ineffective and should be fired. If I were President, I would assemble a team of CPA's, lawyers, and financiers who wanted to fix the problem to resolve the particulars of a wealth tax. Wiaf would not be on the team.

What I know is that investing and profits and taxes are all human constructs. This isn't like vaccines where we have to play within the rules of science. We just have to have the will. Our grandparents had the will and they didn't listen to the people who told them it was impossible.

You, Wiaf, Wags and others have written some wonderful, thought provoking stuff on this thread. You just detailed my c-suite BIL's position on the wealth tax that caused us to get in a heated debate during Xmas vacation up at ONE of his houses in Seattle. We both want similar results, I just think there is something fundamentallt wrong with the wealth tax details, he, like you, just say enough is enough, this is our only solution. I love my BIL so I told him I'd keep mulling it over. Still not convinced but I do appreciate you spelling out your reasoning. And I love the analogies. Love what Waif has written,. Live what wags has written. Wonderful thread.

wifeisafurd said: