Agreed that some miss the concept of risk / reward. Some malcontents begrudge others getting return for risking the loss of capital and taking the time to get educated to do research and analysis.DiabloWags said:I would tend to agree with this.calbear93 said:I would say that anyone over 40 who has not accumulated something close to $1m in assets during an all asset bubble driven by a zero interest rate environment has not really been trying. Of course, $1m won't buy you much of a retirement, especially if some of the assets are tied to illiquid assets like home equity.Eastern Oregon Bear said:There's probably more than 62.4 millionaires posting on Bear Insider.bear2034 said:

More than your average millionaire, amazingly. There are about 62.4 millionaires in the world, if you divide that into 21 million bitcoins, that's only 0.33 bitcoin per millionaire.

90/10 split. Bitcoin (including bitcoin ETF) / Tesla. Concentration, not diversification.

But then again, you still have to have an appetite for risk and not everyone is "wired" that way.

Is it time to go all in on Bitcoin?

28,328 Views |

264 Replies |

Last: 5 mo ago by PAC-10-BEAR

Don't disagree. It is a speculative investment and is treated like a speculative and risky growth stock dependent on interest rate. People putting money in ETFs may create some appearance of safety like subprime mortgage securitization and subsequent derivatives did before the great recession, but the ETFs have no more safety than investing in straight crypto other than being able to invest in partial interest. If you cannot even invest in one bitcoin, maybe it's not the right investment.dajo9 said:calbear93 said:Bitcoin and Ethereum seem like the only legitimate crypto assets.bear2034 said:calbear93 said:You do realize that the volatility of crypto (including, even if you are right, spike in price) makes it that unlikely that it will ever be adopted as currency for most commercial transactions.bear2034 said:The future is endless pic.twitter.com/hXXvuV8qkV

— Big Tesla (@hikingskiing) February 24, 2024

More than your average millionaire, amazingly. There are about 62.4 millionaires in the world, if you divide that into 21 million bitcoins, that's only 0.33 bitcoin per millionaire.

90/10 split. Bitcoin (including bitcoin ETF) / Tesla. Concentration, not diversification.

If you truly believe in the viability of crypto, why not invest in companies that will get growth no matter which crypto wins and no matter the volatility, such as Coinbase and Nvidia (you know, the computing power required to mine bitcoin)? If I were a believer in crypto, that would be my play. For me, I have been a believer of Nvidia and their market leading position for chips needed to handle the demands of AI processing and forward thinking management for a long time. Even during the internet bubble era, they were the market leaders for video graphics. The management always anticipates the next big demand in computing power. I personally would not invest in something solely crypto related like Coinbase, but I can see how they can be a winner and make for a safer investment that can be tracked for valuation if you believed in the crypto market.

Bitcoin's volatility may scare off some but it's upside is enormous which is why we are seeing large inflows into the ETF's. It's volatility will diminish over time as more retail investors, institutions, and nation states adopt the bitcoin standard. I don't invest in other cryptocurrencies because bitcoin is a better hold of value in the long term due to its scarcity. I don't invest in bitcoin proxy stocks because I'd rather hold the actual asset in my possession.

Crypto EFTs will spike demand for bitcoins for a bit but the funds are making those available only because they can get a cut of the easy management fees. I don't know if Larry Fink actually owns any crypto in his own personal account.

I see crypto as more a place to park funds in the midst of high instability similar to havens like gold. No intrinsic value. I also don't really view it as a legitimate digital currency when there is so much volatility. Government owned digital currency will be the only stable source in the future. Also, I believe cybersecurity risk remains a barrier to government adoption of digital currency but not an expert on that.

Doesn't mean crypto won't go up or outperform. Just not something I know how to value or justify the valuation. Similar to how I had no FOMO when GameStop or AMC stocks were skyrocketing. I had no advantage through analysis or experience, so happy to not participate and OK to miss out.

I disagree about crypto as a place to store funds amid instability. Crypto did terribly during the recent years of instability. Also, it was the opposite of an inflation hedge. It acts like a high beta stock but, as you point out, no fundamentals from which to value.

I guess my point is that the only basis for investing in something that has no intrinsic value is to argue that the scarcity allows it to be a place to park assets during instability. That's been the basis for investing in gold. If you don't even have that, what's the point?

A government would issue a digital currency backed by the government, issued by the central bank, and in the country's currency.bear2034 said:calbear93 said:Bitcoin and Ethereum seem like the only legitimate crypto assets.bear2034 said:calbear93 said:You do realize that the volatility of crypto (including, even if you are right, spike in price) makes it that unlikely that it will ever be adopted as currency for most commercial transactions.bear2034 said:The future is endless pic.twitter.com/hXXvuV8qkV

— Big Tesla (@hikingskiing) February 24, 2024

More than your average millionaire, amazingly. There are about 62.4 millionaires in the world, if you divide that into 21 million bitcoins, that's only 0.33 bitcoin per millionaire.

90/10 split. Bitcoin (including bitcoin ETF) / Tesla. Concentration, not diversification.

If you truly believe in the viability of crypto, why not invest in companies that will get growth no matter which crypto wins and no matter the volatility, such as Coinbase and Nvidia (you know, the computing power required to mine bitcoin)? If I were a believer in crypto, that would be my play. For me, I have been a believer of Nvidia and their market leading position for chips needed to handle the demands of AI processing and forward thinking management for a long time. Even during the internet bubble era, they were the market leaders for video graphics. The management always anticipates the next big demand in computing power. I personally would not invest in something solely crypto related like Coinbase, but I can see how they can be a winner and make for a safer investment that can be tracked for valuation if you believed in the crypto market.

Bitcoin's volatility may scare off some but it's upside is enormous which is why we are seeing large inflows into the ETF's. It's volatility will diminish over time as more retail investors, institutions, and nation states adopt the bitcoin standard. I don't invest in other cryptocurrencies because bitcoin is a better hold of value in the long term due to its scarcity. I don't invest in bitcoin proxy stocks because I'd rather hold the actual asset in my possession.

Crypto EFTs will spike demand for bitcoins for a bit but the funds are making those available only because they can get a cut of the easy management fees. I don't know if Larry Fink actually owns any crypto in his own personal account.

I see crypto as more a place to park funds in the midst of high instability similar to havens like gold. No intrinsic value. I also don't really view it as a legitimate digital currency when there is so much volatility. Government owned digital currency will be the only stable source in the future. Also, I believe cybersecurity risk remains a barrier to government adoption of digital currency but not an expert on that.

Doesn't mean crypto won't go up or outperform. Just not something I know how to value or justify the valuation. Similar to how I had no FOMO when GameStop or AMC stocks were skyrocketing. I had no advantage through analysis or experience, so happy to not participate and OK to miss out.

As far stable fiat government currencies for the future, which one are you referring to, USD, Yuan, Euro? Bitcoin has only been around for 15 years compared to the dollar but over time, I'm sure it will become less volatile.

As far as stability, how can you say that bitcoin will go past million and then also argue for stability?

I admit complete ignorance about the intrinsic "value" of Bitcoin, but why is Bitcoin any more valuable than NFTs -- or Hunter Biden paintings for that matter -- all of which have a "limited supply"?

Because Fidelity has introduced funds that add bitcoin to the typical 60-40 portfolio.

OsoDorado said:

I admit complete ignorance about the intrinsic "value" of Bitcoin, but why is Bitcoin any more valuable than NFTs -- or Hunter Biden paintings for that matter -- all of which have a "limited supply"?

Why are diamonds more valuable than sapphires? Diamonds are king. Bitcoin is king.

calbear93 said:Agreed that some miss the concept of risk / reward. Some malcontents begrudge others getting return for risking the loss of capital and taking the time to get educated to do research and analysis.DiabloWags said:I would tend to agree with this.calbear93 said:

I would say that anyone over 40 who has not accumulated something close to $1m in assets during an all asset bubble driven by a zero interest rate environment has not really been trying. Of course, $1m won't buy you much of a retirement, especially if some of the assets are tied to illiquid assets like home equity.

But then again, you still have to have an appetite for risk and not everyone is "wired" that way.

Yes, i would say that the Bernie Sanders and Elizabeth Warrens are poster child's for this.

The word RISK is not in their vocabulary.

It doesn't fit their political agenda.

"Cults don't end well. They really don't."

Zippergate said:

Because Fidelity has introduced funds that add bitcoin to the typical 60-40 portfolio.

Fidelity offering Bitcoin as another asset class in a 401k to its customers has nothing to do with Oso Dorado's question regarding "supply" and "value".

.

"Cults don't end well. They really don't."

calbear93 said:

Don't disagree. It is a speculative investment and is treated like a speculative and risky growth stock dependent on interest rate. People putting money in ETFs may create some appearance of safety like subprime mortgage securitization and subsequent derivatives did before the great recession, but the ETFs have no more safety than investing in straight crypto other than being able to invest in partial interest. If you cannot even invest in one bitcoin, maybe it's not the right investment.

I guess my point is that the only basis for investing in something that has no intrinsic value is to argue that the scarcity allows it to be a place to park assets during instability. That's been the basis for investing in gold. If you don't even have that, what's the point?

Stop it.

You're making too much sense.

"Cults don't end well. They really don't."

My point was those other assets you listed do not get 401k money. Fund flows rule. I hate bitcoin but the ETF approvals changed everything. It's an asset class in itself and money managers who don't own it are underperforming and experiencing FOMO.

As for what bitcoin is worth, here's an interesting thread.

Anyone notice Gold hit a new all-time high of $2100 today?

"Gold is money everything else is credit". --J.P. Morgan

As for what bitcoin is worth, here's an interesting thread.

What's the fair value of Bitcoin?

— Alf (@MacroAlf) February 29, 2024

Here is a valuation framework for crypto as a macro asset class.

1/

Anyone notice Gold hit a new all-time high of $2100 today?

"Gold is money everything else is credit". --J.P. Morgan

Zippergate said:

Anyone notice Gold hit a new all-time high of $2100 today?

"Gold is money everything else is credit". --J.P. Morgan

(I never listed any assets.... paintings and NFT. That was Oso Dorado)

Looking at the GOLD chart, it looks as though a lot of funds must have seen their systems trigger into buy mode when it got above yesterday's high and most likely even more buying once it traded above the downtrend line around $2,065. Gold has been in a "wedge" since Jan. 1st and there's been decent buying interest in the anticipation of lower rates. - - - I can imagine a ton of short-covering came into play today as well. The catalyst may have been falling yields as a handful of Fed Governor's were "yapping" today about monetary policy.

I used to be in the gold pit on the COMEX in 1986.

"Cults don't end well. They really don't."

Oops, my bad. Good commentary on the market. Risk ON despite only a slight move in the FF futures curve. Gold futures pit? How cool is that.

Zippergate said:

Oops, my bad. Good commentary on the market. Risk ON despite only a slight move in the FF futures curve. Gold futures pit? How cool is that.

I was trading for the legendary Paul Tudor Jones.

He was managing $30 million at the time and had $150 million heading into the '87 Crash.

Doubled it, by not only shorting the S&P but getting long a TON of 10 Year Treasury Bonds that wound up going LIMIT UP every day for several days in a row in the flight to safety.

I had wanted to go to the NYMEX and trade oil but Paul already had someone in that ring.

Paul Tudor Jones - Wikipedia

At the time, Gold was incredibly dead. Traded in a $10 range between $340 - $350 for much of the year.

In the Summer of '86 it broke out above $371 when a handful of Swiss Banks recommended an increased allocation to the metal. It surged up to $425 and we went from doing a measly 20,000 contracts a day to 100,000 a day. It was amazing and gave me a glimpse of what it was like during the old days when the Hunt Bros were trying to corner the silver market. All of a sudden, there were a bunch of guys standing in the trading ring with badges that I had never seen before.

Guys who had made millions during that previous run.

Guys who had made millions during that previous run.By March of '87 I was back to trading the NYA Stock Index Futures on the NYFE for myself.

It proved to be a good move for the next 5 years. I had scrounged up (and borrowed) enough for the capital requirement ($20,000) and in the next 9 months I made $200,000.

Not bad for my first year trading my own account at age 27.

But the NYMEX was really where the action and volume was at. Seats traded from $30,000 to $70,000 in '86 and when crude oil collapsed from $30 to $10 everyone and their brother needed to "hedge" their (commercial) physical positions and the seat prices exploded to $125,000 and then $500,000. - - - By then, the cost of a leasing a seat for 6-months was obscene and literally unobtainable.

Seems like a lifetime ago.

"Cults don't end well. They really don't."

There are only a few investors on this board and one of them was an Elizabeth Warren supporterDiabloWags said:calbear93 said:Agreed that some miss the concept of risk / reward. Some malcontents begrudge others getting return for risking the loss of capital and taking the time to get educated to do research and analysis.DiabloWags said:I would tend to agree with this.calbear93 said:

I would say that anyone over 40 who has not accumulated something close to $1m in assets during an all asset bubble driven by a zero interest rate environment has not really been trying. Of course, $1m won't buy you much of a retirement, especially if some of the assets are tied to illiquid assets like home equity.

But then again, you still have to have an appetite for risk and not everyone is "wired" that way.

Yes, i would say that the Bernie Sanders and Elizabeth Warrens are poster child's for this.

The word RISK is not in their vocabulary.

It doesn't fit their political agenda.

DiabloWags said:Zippergate said:

Oops, my bad. Good commentary on the market. Risk ON despite only a slight move in the FF futures curve. Gold futures pit? How cool is that.

I was trading for the legendary Paul Tudor Jones.

He was managing $30 million at the time and had $150 million heading into the '87 Crash.

Doubled it, by not only shorting the S&P but getting long a TON of 10 Year Treasury Bonds that wound up going LIMIT UP every day for several days in a row in the flight to safety.

I had wanted to go to the NYMEX and trade oil but Paul already had someone in that ring.

Paul Tudor Jones - Wikipedia

At the time, Gold was incredibly dead. Traded in a $10 range between $340 - $350 for much of the year.

In the Summer of '86 it broke out above $371 when a handful of Swiss Banks recommended an increased allocation to the metal. It surged up to $425 and we went from doing a measly 20,000 contracts a day to 100,000 a day.

Fascinating. Did you have to follow Paul Tudor Jones' stop loss strategy, and how has your stop loss strategy evolved over time (if it's changed at all) ....

OsoDorado said:

Fascinating. Did you have to follow Paul Tudor Jones' stop loss strategy, and how has your stop loss strategy evolved over time (if it's changed at all) ....

I'm not really aware of the stop loss strategy that you speak of.

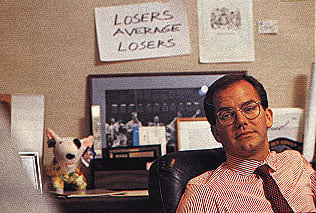

This is the only "strategy" that I was aware of . . .

"Cults don't end well. They really don't."

DiabloWags said:OsoDorado said:

Fascinating. Did you have to follow Paul Tudor Jones' stop loss strategy, and how has your stop loss strategy evolved over time (if it's changed at all) ....

I'm not really aware of the stop loss strategy that you speak of.

This is the only "strategy" that I was aware of . . .

Since I have never traded for anybody before, I was wondering if Paul Tudor Jones made you follow any specific buy/sell discipline.

For example, were there any minimum market conditions that needed to be satisfied before you could take a position? Were there specific guidelines as to how much you could/should risk on positions?

Also, how has your own personal risk discipline evolved over time?

I was his floor broker on the Comex and also was able to trade for the account of Tudor Investment Corporation where we had a 50/50 deal. There were no stop loss rules or risk management parameters.

Over time, my own personal style has transitioned away from short-term trading to being more of an investor ... focused on the medical diagnostics space and taking on the Stanley Druckenmiller approach with concentrated bets.

I would highly suggest that anyone interested in the investing game read every Druckenmiller interview that they can get their hands on. He not only ran his own hedge fund (Duquesne Capital) but also ran the Quantum Fund from 1988 - 2000 for George Soros and his perspective is pure gold.

His most recent interview with (interestingly enough) PTJ, at Paul's annual Robin Hood Foundation Gala in December:

Over time, my own personal style has transitioned away from short-term trading to being more of an investor ... focused on the medical diagnostics space and taking on the Stanley Druckenmiller approach with concentrated bets.

I would highly suggest that anyone interested in the investing game read every Druckenmiller interview that they can get their hands on. He not only ran his own hedge fund (Duquesne Capital) but also ran the Quantum Fund from 1988 - 2000 for George Soros and his perspective is pure gold.

His most recent interview with (interestingly enough) PTJ, at Paul's annual Robin Hood Foundation Gala in December:

"Cults don't end well. They really don't."

Wow! That is an incredible amount of trust with respect to risk (even if it was implicit in the 50/50 arrangement).DiabloWags said:

I was his floor broker on the Comex and also was able to trade for the account of Tudor Investment Corporation where we had a 50/50 deal. There were no stop loss rules or risk management parameters.

Over time, my own personal style has transitioned away from short-term trading to being more of an investor ... focused on the medical diagnostics space and taking on the Stanley Druckenmiller approach with concentrated bets.

I would highly suggest that anyone interested in the investing game read every Druckenmiller interview that they can get their hands on. He not only ran his own hedge fund (Duquesne Capital) but also ran the Quantum Fund from 1988 - 2000 for George Soros and his perspective is pure gold.

The whole experience must have been amazing.

Appreciate your focus on Druckenmiller's concentrated bets ....

calbear93 said:A government would issue a digital currency backed by the government, issued by the central bank, and in the country's currency.bear2034 said:calbear93 said:Bitcoin and Ethereum seem like the only legitimate crypto assets.bear2034 said:calbear93 said:You do realize that the volatility of crypto (including, even if you are right, spike in price) makes it that unlikely that it will ever be adopted as currency for most commercial transactions.bear2034 said:The future is endless pic.twitter.com/hXXvuV8qkV

— Big Tesla (@hikingskiing) February 24, 2024

More than your average millionaire, amazingly. There are about 62.4 millionaires in the world, if you divide that into 21 million bitcoins, that's only 0.33 bitcoin per millionaire.

90/10 split. Bitcoin (including bitcoin ETF) / Tesla. Concentration, not diversification.

If you truly believe in the viability of crypto, why not invest in companies that will get growth no matter which crypto wins and no matter the volatility, such as Coinbase and Nvidia (you know, the computing power required to mine bitcoin)? If I were a believer in crypto, that would be my play. For me, I have been a believer of Nvidia and their market leading position for chips needed to handle the demands of AI processing and forward thinking management for a long time. Even during the internet bubble era, they were the market leaders for video graphics. The management always anticipates the next big demand in computing power. I personally would not invest in something solely crypto related like Coinbase, but I can see how they can be a winner and make for a safer investment that can be tracked for valuation if you believed in the crypto market.

Bitcoin's volatility may scare off some but it's upside is enormous which is why we are seeing large inflows into the ETF's. It's volatility will diminish over time as more retail investors, institutions, and nation states adopt the bitcoin standard. I don't invest in other cryptocurrencies because bitcoin is a better hold of value in the long term due to its scarcity. I don't invest in bitcoin proxy stocks because I'd rather hold the actual asset in my possession.

Crypto EFTs will spike demand for bitcoins for a bit but the funds are making those available only because they can get a cut of the easy management fees. I don't know if Larry Fink actually owns any crypto in his own personal account.

I see crypto as more a place to park funds in the midst of high instability similar to havens like gold. No intrinsic value. I also don't really view it as a legitimate digital currency when there is so much volatility. Government owned digital currency will be the only stable source in the future. Also, I believe cybersecurity risk remains a barrier to government adoption of digital currency but not an expert on that.

Doesn't mean crypto won't go up or outperform. Just not something I know how to value or justify the valuation. Similar to how I had no FOMO when GameStop or AMC stocks were skyrocketing. I had no advantage through analysis or experience, so happy to not participate and OK to miss out.

As far stable fiat government currencies for the future, which one are you referring to, USD, Yuan, Euro? Bitcoin has only been around for 15 years compared to the dollar but over time, I'm sure it will become less volatile.

As far as stability, how can you say that bitcoin will go past million and then also argue for stability?

One bitcoin still equals one bitcoin. Printing U.S. dollars is rapidly devaluating the U.S. dollar against bitcoin.

dajo9 said:There are only a few investors on this board and one of them was an Elizabeth Warren supporterDiabloWags said:calbear93 said:Agreed that some miss the concept of risk / reward. Some malcontents begrudge others getting return for risking the loss of capital and taking the time to get educated to do research and analysis.DiabloWags said:I would tend to agree with this.calbear93 said:

I would say that anyone over 40 who has not accumulated something close to $1m in assets during an all asset bubble driven by a zero interest rate environment has not really been trying. Of course, $1m won't buy you much of a retirement, especially if some of the assets are tied to illiquid assets like home equity.

But then again, you still have to have an appetite for risk and not everyone is "wired" that way.

Yes, i would say that the Bernie Sanders and Elizabeth Warrens are poster child's for this.

The word RISK is not in their vocabulary.

It doesn't fit their political agenda.

If I recall correctly, most of the lefties here were originally Bernie bros before Biden won them over.

Nah, Yogi and his 5,000 aliases aren't lefties. There were a couple of other mild Bernie supporters but that's hardly most of the lefties.bear2034 said:dajo9 said:There are only a few investors on this board and one of them was an Elizabeth Warren supporterDiabloWags said:Thcalbear93 said:Agreed that some miss the concept of risk / reward. Some malcontents begrudge others getting return for risking the loss of capital and taking the time to get educated to do research and analysis.DiabloWags said:I would tend to agree with this.calbear93 said:

I would say that anyone over 40 who has not accumulated something close to $1m in assets during an all asset bubble driven by a zero interest rate environment has not really been trying. Of course, $1m won't buy you much of a retirement, especially if some of the assets are tied to illiquid assets like home equity.

But then again, you still have to have an appetite for risk and not everyone is "wired" that way.

Yes, i would say that the Bernie Sanders and Elizabeth Warrens are poster child's for this.

The word RISK is not in their vocabulary.

It doesn't fit their political agenda.

If I recall correctly, most of the lefties here were originally Bernie bros before Biden won them over.

Eastern Oregon Bear said:Yeah, but millionaires can afford the bitcoin mining server farms and create bitcoins out of nothing but their equipment and electric bills.bear2034 said:

Not all millionaires will be able to buy a single bitcoin. There isn't enough to go around. Bitcoin ETFs make bitcoin easily accessible and in smaller denominations. You can thank me later.

Horrible take

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

Just my 2 satoshis.

You obviously don't understand that Off Topic is the world headquarters of ill informed hot takes.edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

Why should I save in bitcoin?

Tried to answer this for you back in 2017. If you're still asking this question after you've had 7 years to maybe do some basic research on your own, I don't believe you're asking this in good faith.dajo9 said:edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

Why should I save in bitcoin?

https://bearinsider.com/forums/2/topics/74219/replies/1420628

If I'm wrong and you ARE asking this in good faith, I am more than happy to have that conversation. But I'm not going down this road again just so you can "dunk" on me with ill-informed bitcoin takes.

edwinbear said:Tried to answer this for you back in 2017. If you're still asking this question after you've had 7 years to maybe do some basic research on your own, I don't believe you're asking this in good faith.dajo9 said:edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

Why should I save in bitcoin?

https://bearinsider.com/forums/2/topics/74219/replies/1420628

If I'm wrong and you ARE asking this in good faith, I am more than happy to have that conversation. But I'm not going down this road again just so you can "dunk" on me with ill-informed bitcoin takes.

My takeaway from that is you are saying we should save in bitcoin because we will be transacting in bitcoin. It's been 7 years and bitcoin transactions are still extremely rare.

Is there another reason I should save in bitcoin or are you making the same prediction from 7 years ago that still hasn't come to pass?

That should not have been the takeaway, and if that's how it came across that was unintended. But to try and answer this question as succinctly as possible, one should save in bitcoin for the same reasons that people save in real estate or gold. The properties that historically made real estate/gold attractive places to store wealth are just better with bitcoin.dajo9 said:edwinbear said:Tried to answer this for you back in 2017. If you're still asking this question after you've had 7 years to maybe do some basic research on your own, I don't believe you're asking this in good faith.dajo9 said:edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

Why should I save in bitcoin?

https://bearinsider.com/forums/2/topics/74219/replies/1420628

If I'm wrong and you ARE asking this in good faith, I am more than happy to have that conversation. But I'm not going down this road again just so you can "dunk" on me with ill-informed bitcoin takes.

My takeaway from that is you are saying we should save in bitcoin because we will be transacting in bitcoin. It's been 7 years and bitcoin transactions are still extremely rare.

Is there another reason I should save in bitcoin or are you making the same prediction from 7 years ago that still hasn't come to pass?

I get it though, I'm just some random guy on the internet, so my own personal decade-long interest/study in bitcoin probably holds no weight with you.

I have to imagine you see Fidelity as more legitimate though.

https://institutional.fidelity.com/app/proxy/content?literatureURL=/9903921.PDF

They have a great explanation of why bitcoin matters in one of their reports, if you are genuine in wanting to learn.

A Fidelity report from 2022 detailing why bitcoin is unique and separate from other "crypto" assets and shouldn't be conflated.

This is a public link to my Evernote where I saved it where you can download the PDF:

https://www.evernote.com/shard/s674/sh/02978564-c501-0439-9dd7-1c65aaff9302/4iMSp9S4NYlNjGq6p8LdxMqANDQE8zbdUGJzbujF9P8q0eSFSdVVjhuJbg

This is a public link to my Evernote where I saved it where you can download the PDF:

https://www.evernote.com/shard/s674/sh/02978564-c501-0439-9dd7-1c65aaff9302/4iMSp9S4NYlNjGq6p8LdxMqANDQE8zbdUGJzbujF9P8q0eSFSdVVjhuJbg

Eastern Oregon Bear said:You obviously don't understand that Off Topic is the world headquarters of ill informed hot takes.edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

I nominate this as UNDERSTATEMENT POST OF THE YEAR.

"Cults don't end well. They really don't."

Thank you for sharing the Fidelity explainer - I read it with an open mind. Unfortunately, I have read similar things in the past and bitcoin still comes up short in my view. You may have a different opinion on bitcoin's utility and that is fine. But here are my concerns:edwinbear said:That should not have been the takeaway, and if that's how it came across that was unintended. But to try and answer this question as succinctly as possible, one should save in bitcoin for the same reasons that people save in real estate or gold. The properties that historically made real estate/gold attractive places to store wealth are just better with bitcoin.dajo9 said:edwinbear said:Tried to answer this for you back in 2017. If you're still asking this question after you've had 7 years to maybe do some basic research on your own, I don't believe you're asking this in good faith.dajo9 said:edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

Why should I save in bitcoin?

https://bearinsider.com/forums/2/topics/74219/replies/1420628

If I'm wrong and you ARE asking this in good faith, I am more than happy to have that conversation. But I'm not going down this road again just so you can "dunk" on me with ill-informed bitcoin takes.

My takeaway from that is you are saying we should save in bitcoin because we will be transacting in bitcoin. It's been 7 years and bitcoin transactions are still extremely rare.

Is there another reason I should save in bitcoin or are you making the same prediction from 7 years ago that still hasn't come to pass?

I get it though, I'm just some random guy on the internet, so my own personal decade-long interest/study in bitcoin probably holds no weight with you.

I have to imagine you see Fidelity as more legitimate though.

https://institutional.fidelity.com/app/proxy/content?literatureURL=/9903921.PDF

They have a great explanation of why bitcoin matters in one of their reports, if you are genuine in wanting to learn.

- I invest in real estate. I use it to generate cash. I do not invest in gold. It does not generate cash. I am not looking for a store of wealth. I am looking to generate wealth. The economy is hopefully growing and if I stand pat, I'm going to fall behind. Through its existence, bitcoin has been a terrible store of wealth as it is highly volatile.

- As a currency, bitcoin is inferior because it's supply is limited. That will ultimately lead to destructive deflation if the economy wants to grow faster than bitcoin supply. Expansive supply is a feature of fiat currencies, not a bug. Flexibility is key because deflationary crashes are the worst form of economic disruption.

- As a means of transaction, bitcoin is inferior because the banks / governments that process USD transactions help make me more confident that the process is legitimate and I'm not dealing with a bad actor. The small fee and amount of time is a small price to pay. I do not want to be involved in a currency that most benefits tax cheats, gangsters, and thieves. If I were in an oppressive country I might feel differently. In that case, the problem isn't the currency - it is the oppressive government.

I don't understand your use of investing vs. saving.edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

I view savings as a means of protecting the principal with potential interest to offset inflation. It is a contractual promise to repay the principal plus the agreed upon interest.

Investment is the risking of capital for potential gain in value.

You write about "saving" in gold and real estate. No one "saves" in gold and real estate. They invest in gold or real estate. It still requires someone who values the asset at a certain price. There is no agreement that you will get the return in principal, and there is no guarantee of liquidity. I think you mistake investment in safety assets that are viewed as inflation or recession hedge as savings. They are not. They are just another class of investments.

You can imagine that someone will use bitcoin as a means of currency. It does not mean that it is savings. It just means that there is a short cut to use it in a barter transaction, just like someone may take your gold bars to sell a car or trade your Rolex watch for some other asset.

I think being a cash flow investor is great. If real estate is your preferred method of generating that cash flow, there's nothing wrong with that. The following is how I'd address your concerns, however.dajo9 said:Thank you for sharing the Fidelity explainer - I read it with an open mind. Unfortunately, I have read similar things in the past and bitcoin still comes up short in my view. You may have a different opinion on bitcoin's utility and that is fine. But here are my concerns:edwinbear said:That should not have been the takeaway, and if that's how it came across that was unintended. But to try and answer this question as succinctly as possible, one should save in bitcoin for the same reasons that people save in real estate or gold. The properties that historically made real estate/gold attractive places to store wealth are just better with bitcoin.dajo9 said:edwinbear said:Tried to answer this for you back in 2017. If you're still asking this question after you've had 7 years to maybe do some basic research on your own, I don't believe you're asking this in good faith.dajo9 said:edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

Why should I save in bitcoin?

https://bearinsider.com/forums/2/topics/74219/replies/1420628

If I'm wrong and you ARE asking this in good faith, I am more than happy to have that conversation. But I'm not going down this road again just so you can "dunk" on me with ill-informed bitcoin takes.

My takeaway from that is you are saying we should save in bitcoin because we will be transacting in bitcoin. It's been 7 years and bitcoin transactions are still extremely rare.

Is there another reason I should save in bitcoin or are you making the same prediction from 7 years ago that still hasn't come to pass?

I get it though, I'm just some random guy on the internet, so my own personal decade-long interest/study in bitcoin probably holds no weight with you.

I have to imagine you see Fidelity as more legitimate though.

https://institutional.fidelity.com/app/proxy/content?literatureURL=/9903921.PDF

They have a great explanation of why bitcoin matters in one of their reports, if you are genuine in wanting to learn.

- I invest in real estate. I use it to generate cash. I do not invest in gold. It does not generate cash. I am not looking for a store of wealth. I am looking to generate wealth. The economy is hopefully growing and if I stand pat, I'm going to fall behind. Through its existence, bitcoin has been a terrible store of wealth as it is highly volatile.

- As a currency, bitcoin is inferior because it's supply is limited. That will ultimately lead to destructive deflation if the economy wants to grow faster than bitcoin supply. Expansive supply is a feature of fiat currencies, not a bug. Flexibility is key because deflationary crashes are the worst form of economic disruption.

- As a means of transaction, bitcoin is inferior because the banks / governments that process USD transactions help make me more confident that the process is legitimate and I'm not dealing with a bad actor. The small fee and amount of time is a small price to pay. I do not want to be involved in a currency that most benefits tax cheats, gangsters, and thieves. If I were in an oppressive country I might feel differently. In that case, the problem isn't the currency - it is the oppressive government.

Real Estate: I think the inability the preserve purchasing power through saving dollars compels people to seek out alternatives for safeguarding their wealth. Real estate has become a favored option, which financialized it as an asset class valued well beyond its utility value. If housing is a basic human need, is this a good or bad thing? That's a separate debate, but I do see it as problematic that people are pushed towards owning multiple properties (and/or stocks, etc.) simply because they lack viable means to save in currency. In other words, our money is broken. We should be able to save in money itself and not be forced into becoming investors on top of our 9 to 5 just to try and maintain its purchasing power. I think bitcoin does present itself as a direct savings mechanism, and offers a potential solution to this issue. Other reasons I believe bitcoin is superior to real estate include:

- Finite vs. Scalable Scarcity: Bitcoin's fixed supply contrasts sharply with real estate, which can become less scarce as demand increases, thanks to new developments and rezoning efforts.

- No Maintenance or Hidden Costs: Bitcoin stands out for its lack of ongoing expensesno maintenance, no tenants, and no fluctuating property taxes. It's not just low-maintenance; it's maintenance-free.

- Asset Security: Unlike real estate, which can be physically seized, Bitcoin offers a level of security against confiscation.

- Lower Risk Factors: Real estate investment carries multiple risks, including leverage, tenant reliability, government policy changes, environmental factors, and reliance on insurance payouts. Bitcoin sidesteps these concerns.

- Unmatched Portability and Liquidity: Real estate is immovable and often difficult to sell quickly. In contrast, Bitcoin can be easily moved and sold globally 24/7, offering superior liquidity and portability.

Inflation/Deflation: The debate around inflation and deflation transcends our shared economics education at Cal, where the prevailing wisdom suggests that some inflation is beneficial and deflationary currencies are problematic. However, this perspective is more theoretical than factual. Despite being educated in these principles, I've grown to question them, particularly noting the absence of Austrian economics in our curriculum, which was dominated by Keynesian theories. This omission raises questions about the breadth of economic theories presented to us, especially since Austrian economics offers a viewpoint where inflation isn't deemed necessary, and deflation can be positive. If I put on a tinfoil hat, I might speculate that the mainstream focus on the necessity of inflation serves to justify governmental monetary expansion and currency debasement. While we may hold differing views on the necessity of inflation, I recommend a book that challenged my own understanding and could provide you with an intriguing perspective if you have the free time:

https://www.amazon.com/Price-Tomorrow-Deflation-Abundant-Future/dp/1999257405

Transactions: Totally disagree here. Trusting in Bitcoin really just means you're putting your faith in math, and honestly, I'd take that any day over trusting Uncle Sam. Going through banks and governments for transactions feels like an endless obstacle course. They're all about collecting your info, putting up barriers, and moving at a snail's pace. Bitcoin, though? It's direct, no middleman to hike up fees or slap down restrictions. Plus, it's totally neutral it's there if you want it, no biggie if you don't.

And calling Bitcoin a playground for the shady types? That's way off base. With its open ledger, only an idiot would pick it for anything dodgy. There are reasons why many criminals who used bitcoin believing it was anonymous and not just pseudonymous have been caught. It's like saying knives are evil because they can be used in stabbings, or cars are a menace because they can be getaway vehicles. Come on, that's not the point of these things.

Since 2017, we've seen some wild moves, like the US cancelling Russia's treasury assets and Canada locking down bank accounts over trucker rally protest support. It really makes you wonder how safe any country's assets are if they're not on the US's good side, or what it means for anyone backing peaceful protests that the government doesn't like. When the government holds the reins on currency from creating it to setting its value and deciding who can use it there's no separating it from its political strings. You mentioned if you lived in an oppressive country you might feel differently. Most of the world lives in an oppressive country. If you're from the financially privileged western world, it's harder to see bitcoin's use case. But those in countries regularly experiencing hyperinflation and/or oppressive regimes see it clearly.

If we're not lining up on this basic idea about money, I get why we're at odds. It seems you're cool with governments calling the shots on money, while I'm over here saying it should stay out of their grasp, kind of like keeping church and state apart. Except this is the separation of money an state. I'm all in on the idea that money should be government-neutral, and for me (and plenty of others), Bitcoin seems like our best shot at making that happen.

calbear93 said:I don't understand your use of investing vs. saving.edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

I view savings as a means of protecting the principal with potential interest to offset inflation. It is a contractual promise to repay the principal plus the agreed upon interest.

Investment is the risking of capital for potential gain in value.

You write about "saving" in gold and real estate. No one "saves" in gold and real estate. They invest in gold or real estate. It still requires someone who values the asset at a certain price. There is no agreement that you will get the return in principal, and there is no guarantee of liquidity. I think you mistake investment in safety assets that are viewed as inflation or recession hedge as savings. They are not. They are just another class of investments.

You can imagine that someone will use bitcoin as a means of currency. It does not mean that it is savings. It just means that there is a short cut to use it in a barter transaction, just like someone may take your gold bars to sell a car or trade your Rolex watch for some other asset.

When I say see Bitcoin as saving and not investing, what I mean is having the perspective that you can hold wealth in bitcoin "forever" vs investing in Bitcoin as a trade to get more dollars at some point in the future. But you make a good point about how saving and investing are different, mainly focusing on keeping your initial money safe versus aiming to make more money. But thinking of saving just as putting your cash in a bank to earn a little interest feels a bit outdated with all the new tech and financial options we have now.

Have interest rates been keeping up with inflation? Not long ago, we saw CPI hit double digits, though the accuracy of CPI as a measure is another discussion. Remember, inflation accumulates; prices don't drop when CPI dips, they just continue rising albeit more slowly. Over the past five years, have the real returns of those treasuries been positive, especially after considering taxes?

When we talk about putting money into things like gold, real estate, or even Bitcoin, it's not just the old-school type of saving. It's more about finding a safe spot for your money where it won't lose value over time because of inflation or other economic troubles. Sure, there's no promise you'll get your money back like with a bank savings account, but history shows these assets usually do a good job of keeping their value.

Bitcoin is a cool example here. It's not just digital cash; it's becoming like digital gold. It's rare, you can split it up, take it anywhere, and no single group controls it. All this makes Bitcoin a modern way to keep your wealth safe, with the hope it might even grow in value.

Think of it like keeping gold bars or a fancy Rolex. Yes, they're investments, but they also protect your money from losing value when times get tough. And while it's true that selling Bitcoin or gold quickly wasn't always easy, that's changing fast. Bitcoin, especially, is getting easier to trade for regular money or to spend directly.

So, while Bitcoin and similar things aren't "savings" in the traditional bank account sense, they're part of a new way to save. They let you hold onto your wealth in a world that's going digital. The line between saving and investing is getting fuzzier, especially as digital assets like Bitcoin start to play a bigger role in our economy.

Featured Stories

See All

Great Reviews From Cal's Premier Day Visits

by Jim McGill

Bears Storm Back To Beat Miami, 86-85

by Cal Athletics

Big Visitors on Tap For Cal's Premier Day Saturday

by Jim McGill

Post Portal Transfer Additions and Departures - (Offensive Line)

by Bear Insider

Cal Knocks Off Notre Dame

by Cal Athletics