Keep your so-called facts to yourself! Who are we expected to believe, educated professionals or the "best people?"Unit2Sucks said:

Could even drop to 2.8% or lower once the data is in. SAD!

Is a 4.1% quarterly increase in GNP good?

40,969 Views |

203 Replies |

Last: 6 yr ago by oski003

More evidence the tax cuts were what we all thought they were (except for WIAF). The congressional research office recently released a study on the impact of the tax cuts on the economy. According to the CRS it cost the federal government $170B in revenue with little impact on the broader economy. But hey, workers received $28 in additional bonuses from it! Some links to articles.

From the summary:

From the summary:

Quote:

In 2018, gross domestic product (GDP) grew at 2.9%, about the Congressional Budget Office's (CBO's) projected rate published in 2017 before the tax cut. On the whole, the growth effects tend to show a relatively small (if any) first-year effect on the economy. Although growth rates cannot indicate the tax cut's effects on GDP, they tend to rule out very large effects particularly in the short run. Although investment grew significantly, the growth patterns for different types of assets do not appear to be consistent with the direction and size of the supply-side incentive effects one would expect from the tax changes. This potential outcome may raise questions about how much longer-run growth will result from the tax revision.

CBO, in its first baseline update post enactment, initially estimated that the Act would reduce individual income taxes by $65 billion, corporate income taxes by $94 billion, and other taxes by $3 billion, for a total reduction of $163 billion in FY2018. Corporate revenues were about $40 billion less than projected whereas individual revenues were higher, with an overall revenue reduction of about $9 billion. From 2017 to 2018, the estimated average corporate tax rate fell from 23.4% to 12.1% and individual income taxes as a percentage of personal income fell slightly from 9.6% to 9.2%.

Real wages grew more slowly than GDP: at 2.0% (adjusted by the GDP deflator) compared with 2.9% for overall real GDP. Such slower growth has occurred in the past. The real wage rate for production and non supervisory workers grew by 1.2%. Although significant amounts of dividends were repatriated in 2018 compared with previous years, the data do not appear to show a significant increase in investment flows from abroad. While evidence does indicate significant repurchases of shares, either from tax cuts or repatriated revenues, relatively little was directed to paying worker bonuses, which had been announced by some firms.

Is a $1T deficit good?

Wife, it's seriously frustrating to hear the crowd that just says "my 401k is up".

What are those voices going to say when interest rates return to historical norms and the percentage of our budget required to pay INTEREST ONLY on the $22T (and growing) occurs? It seems to me like it's a no-escape scenario.

But you like your current wealth number, right?

Pop.

Wife, it's seriously frustrating to hear the crowd that just says "my 401k is up".

What are those voices going to say when interest rates return to historical norms and the percentage of our budget required to pay INTEREST ONLY on the $22T (and growing) occurs? It seems to me like it's a no-escape scenario.

But you like your current wealth number, right?

Pop.

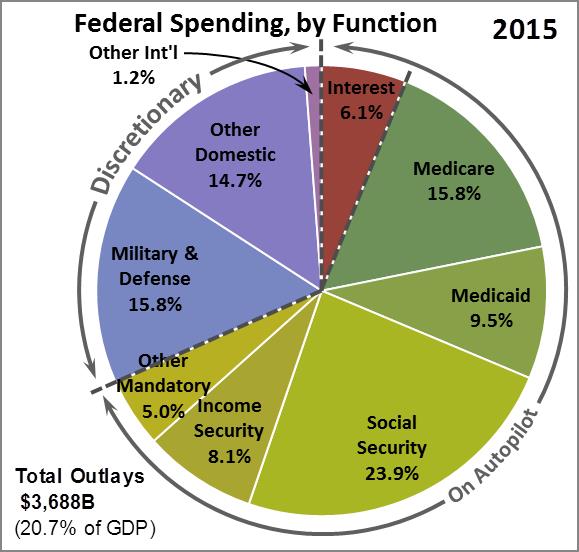

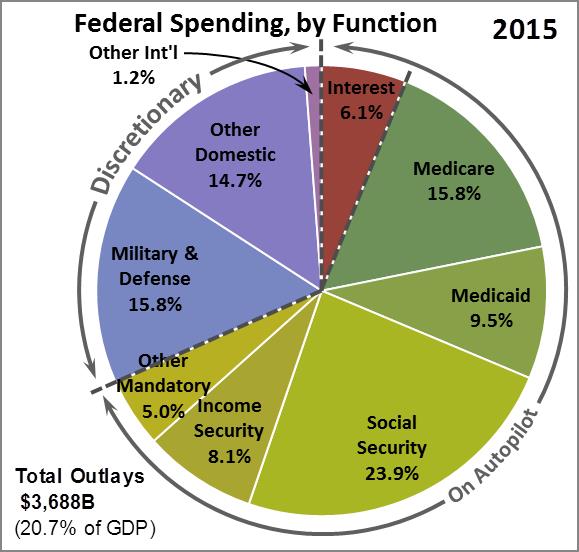

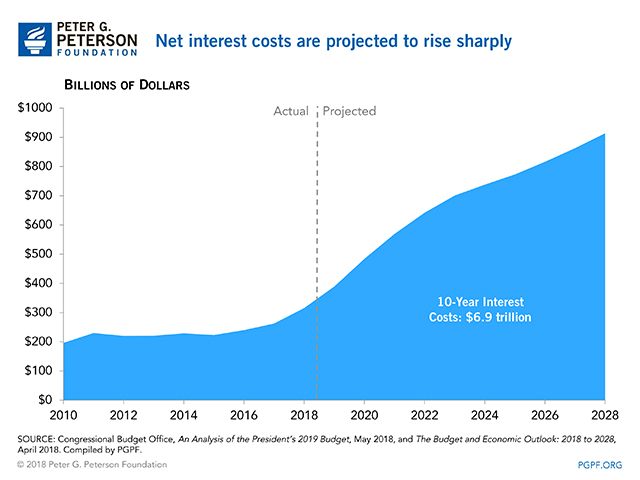

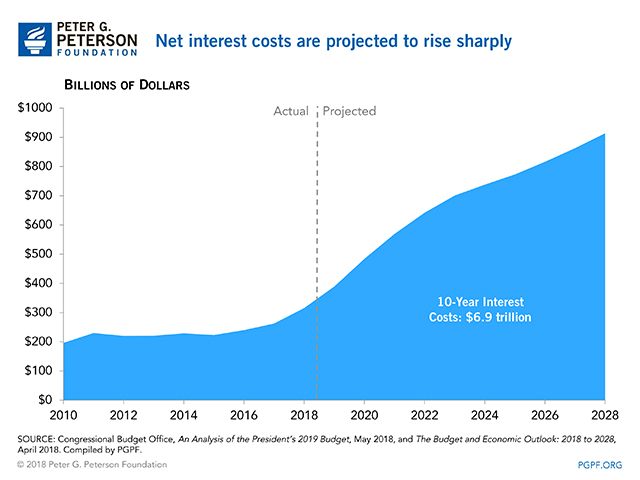

This is a few years old. But look at the Brown. 6.1%

Now look at historical interest rates. As you can see, we are STILL at historical lows.

So, what happens to the 6.1% of expenses when the (recycling and increasing) interest rate goes up?

Now look at historical interest rates. As you can see, we are STILL at historical lows.

So, what happens to the 6.1% of expenses when the (recycling and increasing) interest rate goes up?

Zero people are talking about this.

Instead, we are discussing INFRASTRUCTURE projects, which would no doubt increase the debt even further.

The US has no more budget hawks in DC. I fear we are doomed, particularly while we F around with such BS issues as Russia hacks, No Collusion, How many lies has he told, Abortion, stack the Supreme Court, Climate change, Fake News, Investigate the Investigators, Media bias wars....

https://www.crfb.org/blogs/interest-spending-course-quadruple

Interest Spending Is On Course to Quadruple

You think we can't fund various projects now?

The shtt is going to hit the fan.

But, I suppose you're right. 4.1% GDP growth, and the stock market is up..... so, who cares. Pass the buck, to our grandchildren.

Instead, we are discussing INFRASTRUCTURE projects, which would no doubt increase the debt even further.

The US has no more budget hawks in DC. I fear we are doomed, particularly while we F around with such BS issues as Russia hacks, No Collusion, How many lies has he told, Abortion, stack the Supreme Court, Climate change, Fake News, Investigate the Investigators, Media bias wars....

https://www.crfb.org/blogs/interest-spending-course-quadruple

Interest Spending Is On Course to Quadruple

You think we can't fund various projects now?

The shtt is going to hit the fan.

But, I suppose you're right. 4.1% GDP growth, and the stock market is up..... so, who cares. Pass the buck, to our grandchildren.

concordtom, we are in a battle for the soul of America. The powerbrokers that run the right want to resolve the debt issues that concern you by bankrupting the country and forcing severe curtailments to Social Security, Medicare, Medicaid, and all other forms of non-corporate welfare spending. Bankruptcy and extremely low taxes on the wealthy is the goal of the right. They appear to be winning.

If the Democrats get in control they will raise taxes on the wealthy and reduce the deficit just like they always have in my adult life. When the Republicans get in control they will do the opposite.

The battle will be won or lost, not on these issues, but on issues of race and abortion and other cultural markers.

Sad.

If the Democrats get in control they will raise taxes on the wealthy and reduce the deficit just like they always have in my adult life. When the Republicans get in control they will do the opposite.

The battle will be won or lost, not on these issues, but on issues of race and abortion and other cultural markers.

Sad.

I think the biggest reason interest rates will never really return to "normal" would be the impact on our economy from interest payments on the national debt.

I could be wrong, but that's been my position for the last 10 years. We are basically boxed in because of the size of the debt so there is some natural limit to interest rates.

I could be wrong, but that's been my position for the last 10 years. We are basically boxed in because of the size of the debt so there is some natural limit to interest rates.

Interest rates will rise not when the fed says so, but when folks stop buying US dollars and US debt.

When the regime breaks, it will collapse.

Playing a very dangerous game.

US hegemony is at stake.

The rise and fall of great nations.

Never mind Greece, Egypt, Rome or even the Ottoman Empire.

Think Spanish Armada 1500's

The sun never set on the British empire.

And the US' day in the sun will eventually end.

They are speeding it up.

When the regime breaks, it will collapse.

Playing a very dangerous game.

US hegemony is at stake.

The rise and fall of great nations.

Never mind Greece, Egypt, Rome or even the Ottoman Empire.

Think Spanish Armada 1500's

The sun never set on the British empire.

And the US' day in the sun will eventually end.

They are speeding it up.

Study: Trump Tax Cuts Failed to Help Anybody But the Wealthy - New York Magazine

https://apple.news/AK4WkCu7xRwiUhHT64Mu-kg

https://apple.news/AK4WkCu7xRwiUhHT64Mu-kg

Cancel my subscription to the Resurrection

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

bearister said:

Study: Trump Tax Cuts Failed to Help Anybody But the Wealthy - New York Magazine

https://apple.news/AK4WkCu7xRwiUhHT64Mu-kg

Define wealthy. I know quite a few people they helped that I dont consider wealthy.

oski003 said:bearister said:

Study: Trump Tax Cuts Failed to Help Anybody But the Wealthy - New York Magazine

https://apple.news/AK4WkCu7xRwiUhHT64Mu-kg

Define wealthy. I know quite a few people they helped that I dont consider wealthy.

You Know Who the Tax Cuts Helped? Rich People

https://www.nytimes.com/interactive/2018/08/12/opinion/editorials/trump-tax-cuts.html

"The idea that the tax cuts were going to line workers' pockets was always a mirage. Most people will enjoy only a modest and temporary tax cut families earning $25,000 or less will save on average just $60 on their federal tax this year, and those making between $48,600 and $86,100 will save $930, according to the Urban-Brookings Tax Policy Center. Families in the top 1 percent, on the other hand, will save an average of $51,140."

https://www.politifact.com/truth-o-meter/statements/2019/mar/05/sherrod-brown/do-70-benefits-trumps-tax-law-benefit-wealthiest-1/

https://www.google.com/amp/s/www.vox.com/platform/amp/policy-and-politics/2018/12/18/18146253/tax-cuts-and-jobs-act-stock-market-economy

https://www.google.com/amp/s/www.forbes.com/sites/teresaghilarducci/2019/04/09/five-good-reasons-it-doesnt-feel-like-the-trump-tax-cut-benefited-you/amp/

https://www.google.com/amp/s/www.nytimes.com/2019/04/14/business/economy/income-tax-cut.amp.html

https://www.bloomberg.com/graphics/2018-tax-plan-consequences/

Cancel my subscription to the Resurrection

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

bearister said:oski003 said:bearister said:

Study: Trump Tax Cuts Failed to Help Anybody But the Wealthy - New York Magazine

https://apple.news/AK4WkCu7xRwiUhHT64Mu-kg

Define wealthy. I know quite a few people they helped that I dont consider wealthy.

You Know Who the Tax Cuts Helped? Rich People

https://www.nytimes.com/interactive/2018/08/12/opinion/editorials/trump-tax-cuts.html

"The idea that the tax cuts were going to line workers' pockets was always a mirage. Most people will enjoy only a modest and temporary tax cut families earning $25,000 or less will save on average just $60 on their federal tax this year, and those making between $48,600 and $86,100 will save $930, according to the Urban-Brookings Tax Policy Center. Families in the top 1 percent, on the other hand, will save an average of $51,140."

https://www.politifact.com/truth-o-meter/statements/2019/mar/05/sherrod-brown/do-70-benefits-trumps-tax-law-benefit-wealthiest-1/

https://www.google.com/amp/s/www.vox.com/platform/amp/policy-and-politics/2018/12/18/18146253/tax-cuts-and-jobs-act-stock-market-economy

https://www.google.com/amp/s/www.forbes.com/sites/teresaghilarducci/2019/04/09/five-good-reasons-it-doesnt-feel-like-the-trump-tax-cut-benefited-you/amp/

https://www.google.com/amp/s/www.nytimes.com/2019/04/14/business/economy/income-tax-cut.amp.html

https://www.bloomberg.com/graphics/2018-tax-plan-consequences/

And those savings are temporary because the inflation index was changed. The only permanent parts of the tax law are the corporate tax cuts and the increase in personal tax rates across the board caused by the change in inflation indexing.

bearister said:oski003 said:bearister said:

Study: Trump Tax Cuts Failed to Help Anybody But the Wealthy - New York Magazine

https://apple.news/AK4WkCu7xRwiUhHT64Mu-kg

Define wealthy. I know quite a few people they helped that I dont consider wealthy.

You Know Who the Tax Cuts Helped? Rich People

https://www.nytimes.com/interactive/2018/08/12/opinion/editorials/trump-tax-cuts.html

"The idea that the tax cuts were going to line workers' pockets was always a mirage. Most people will enjoy only a modest and temporary tax cut families earning $25,000 or less will save on average just $60 on their federal tax this year, and those making between $48,600 and $86,100 will save $930, according to the Urban-Brookings Tax Policy Center. Families in the top 1 percent, on the other hand, will save an average of $51,140."

https://www.politifact.com/truth-o-meter/statements/2019/mar/05/sherrod-brown/do-70-benefits-trumps-tax-law-benefit-wealthiest-1/

https://www.google.com/amp/s/www.vox.com/platform/amp/policy-and-politics/2018/12/18/18146253/tax-cuts-and-jobs-act-stock-market-economy

https://www.google.com/amp/s/www.forbes.com/sites/teresaghilarducci/2019/04/09/five-good-reasons-it-doesnt-feel-like-the-trump-tax-cut-benefited-you/amp/

https://www.google.com/amp/s/www.nytimes.com/2019/04/14/business/economy/income-tax-cut.amp.html

https://www.bloomberg.com/graphics/2018-tax-plan-consequences/

People that pay more tax $ will save more $. Got it. Families in the top 1% make like $500,000-100,00,000+ per year. Of course families making 25k or less wont save that much because they hardly paid taxes prior to the cuts. Im not in the top 1%, and the tax cut saved me more than $1,000. It helped me.

This last year, the US government spent more than $1T than it took in. If our population is 333M, that equates to 3,000 per person.oski003 said:

People that pay more tax $ will save more $. Got it. Families in the top 1% make like $500,000-100,00,000+ per year. Of course families making 25k or less wont save that much because they hardly paid taxes prior to the cuts. Im not in the top 1%, and the tax cut saved me more than $1,000. It helped me.

How do you feel about the tax cuts and your $1,000 gain now?

concordtom said:This last year, the US government spent more than $1T than it took in. If our population is 333M, that equates to 3,000 per person.oski003 said:

People that pay more tax $ will save more $. Got it. Families in the top 1% make like $500,000-100,00,000+ per year. Of course families making 25k or less wont save that much because they hardly paid taxes prior to the cuts. Im not in the top 1%, and the tax cut saved me more than $1,000. It helped me.

How do you feel about the tax cuts and your $1,000 gain now?

That's not relevant to my point. i am simply addressing misleading claims that the tax cuts only helped the wealthy.

Willful ignorance should be met with capital punishment now that we're in authoritarian rule.

Fair enough.oski003 said:concordtom said:This last year, the US government spent more than $1T than it took in. If our population is 333M, that equates to 3,000 per person.oski003 said:

People that pay more tax $ will save more $. Got it. Families in the top 1% make like $500,000-100,00,000+ per year. Of course families making 25k or less wont save that much because they hardly paid taxes prior to the cuts. Im not in the top 1%, and the tax cut saved me more than $1,000. It helped me.

How do you feel about the tax cuts and your $1,000 gain now?

That's not relevant to my point. i am simply addressing misleading claims that the tax cuts only helped the wealthy.

Point taken.

But now, as a separate question, given what I pointed out, how do you feel about the tax cuts?

concordtom said:Fair enough.oski003 said:concordtom said:This last year, the US government spent more than $1T than it took in. If our population is 333M, that equates to 3,000 per person.oski003 said:

People that pay more tax $ will save more $. Got it. Families in the top 1% make like $500,000-100,00,000+ per year. Of course families making 25k or less wont save that much because they hardly paid taxes prior to the cuts. Im not in the top 1%, and the tax cut saved me more than $1,000. It helped me.

How do you feel about the tax cuts and your $1,000 gain now?

That's not relevant to my point. i am simply addressing misleading claims that the tax cuts only helped the wealthy.

Point taken.

But now, as a separate question, given what I pointed out, how do you feel about the tax cuts?

My experience has been positive. I and most other people I know have more money in their pockets, despite what the MSM writes. I am not foolish enough to believe 100% in trickle down economics. However, I see so much government waste and laziness. Until public enterprise can function like an actual business that cares about costs, the less money it has the better.

See concordtom - bankruptcy is the goal

Okay, so you like the cuts because you want govt to have less money.oski003 said:concordtom said:Fair enough.oski003 said:concordtom said:This last year, the US government spent more than $1T than it took in. If our population is 333M, that equates to 3,000 per person.oski003 said:

People that pay more tax $ will save more $. Got it. Families in the top 1% make like $500,000-100,00,000+ per year. Of course families making 25k or less wont save that much because they hardly paid taxes prior to the cuts. Im not in the top 1%, and the tax cut saved me more than $1,000. It helped me.

How do you feel about the tax cuts and your $1,000 gain now?

That's not relevant to my point. i am simply addressing misleading claims that the tax cuts only helped the wealthy.

Point taken.

But now, as a separate question, given what I pointed out, how do you feel about the tax cuts?

My experience has been positive. I and most other people I know have more money in their pockets, despite what the MSM writes. I am not foolish enough to believe 100% in trickle down economics. However, I see so much government waste and laziness. Until public enterprise can function like an actual business that cares about costs, the less money it has the better.

Do you care about a $1T annual debt?

If so, how would you balance the budget, "like an actual business"?

In other words, what expenditure areas would you cut?

And it looks like we'd have to cut $1T out of $4T (25%) in order to balance.

How would/should one do that without slowing the economy to such a drastic manner so as to immediately cause a severe recession. Like, what happens to unemployment if $1T were to suddenly happen?

concordtom said:Okay, so you like the cuts because you want govt to have less money.oski003 said:concordtom said:Fair enough.oski003 said:concordtom said:This last year, the US government spent more than $1T than it took in. If our population is 333M, that equates to 3,000 per person.oski003 said:

People that pay more tax $ will save more $. Got it. Families in the top 1% make like $500,000-100,00,000+ per year. Of course families making 25k or less wont save that much because they hardly paid taxes prior to the cuts. Im not in the top 1%, and the tax cut saved me more than $1,000. It helped me.

How do you feel about the tax cuts and your $1,000 gain now?

That's not relevant to my point. i am simply addressing misleading claims that the tax cuts only helped the wealthy.

Point taken.

But now, as a separate question, given what I pointed out, how do you feel about the tax cuts?

My experience has been positive. I and most other people I know have more money in their pockets, despite what the MSM writes. I am not foolish enough to believe 100% in trickle down economics. However, I see so much government waste and laziness. Until public enterprise can function like an actual business that cares about costs, the less money it has the better.

Do you care about a $1T annual debt?

If so, how would you balance the budget, "like an actual business"?

In other words, what expenditure areas would you cut?

And it looks like we'd have to cut $1T out of $4T (25%) in order to balance.

How would/should one do that without slowing the economy to such a drastic manner so as to immediately cause a severe recession. Like, what happens to unemployment if $1T were to suddenly happen?

if the tax cuts caused a huge recession, that would definitely make me not in favor of them.

I'm sorry.

I don't think you understood my post.

Could you please read it again, and answer it?

I'm not trying to grill you.

It's a very serious issue which requires a quite tricky solution.

I don't think you understood my post.

Could you please read it again, and answer it?

I'm not trying to grill you.

It's a very serious issue which requires a quite tricky solution.

concordtom said:

I'm sorry.

I don't think you understood my post.

Could you please read it again, and answer it?

I'm not trying to grill you.

It's a very serious issue which requires a quite tricky solution.

I simply challenged the lame assertions that the tax cuts only helped the wealthy. I do not know how to balance the federal budget. Perhaps we can tax remittances back to Mexico and other countries.

I understand.

It would be an extremely daunting task, and I would hardly know how to tackle it.

I told myself that I'd cut the military budget first. But then I see that the total military of $680 B is less than the $1T I seek to cut. So, it seems impossible.

But I ask you because it is equally a problem that people just stick their heads in the sand and focus solely on whether the tax cuts were "good" or "bad". Like, that's the wrong question in my mind, and thus the wrong answer.

I'm trying to get you to realize that it's foolish to think, "well, I got $1000, so I guess the tax cuts are good."

I'll ask that you stretch your mind to consider the future consequences of having a never ending and growing national debt.

Default would happen. Or hyperinflation.

Either would destroy the dollar's standing as The Premier Global Reserve Currency of wealth. That affords the US massive benefits, which your grandchildren would surely miss!

It's my opinion that politicians only focus on the immediate period so they get reelected and they roll the dice of the future. That is very bad news, a bad omen.

We will pay the price, making all the current squabbling over all other domestic problems meaningless.

Wealth buys solutions to those. Poverty adds new ones.

We need to take care (protect) the future economic standing of the US.

Nothing is promised or certain.

The rise and fall of great nations.

Seems like history will repeat itself.

Such a shame.

I ask that you see the bigger picture, and not just your myopic world.

It would be an extremely daunting task, and I would hardly know how to tackle it.

I told myself that I'd cut the military budget first. But then I see that the total military of $680 B is less than the $1T I seek to cut. So, it seems impossible.

But I ask you because it is equally a problem that people just stick their heads in the sand and focus solely on whether the tax cuts were "good" or "bad". Like, that's the wrong question in my mind, and thus the wrong answer.

I'm trying to get you to realize that it's foolish to think, "well, I got $1000, so I guess the tax cuts are good."

I'll ask that you stretch your mind to consider the future consequences of having a never ending and growing national debt.

Default would happen. Or hyperinflation.

Either would destroy the dollar's standing as The Premier Global Reserve Currency of wealth. That affords the US massive benefits, which your grandchildren would surely miss!

It's my opinion that politicians only focus on the immediate period so they get reelected and they roll the dice of the future. That is very bad news, a bad omen.

We will pay the price, making all the current squabbling over all other domestic problems meaningless.

Wealth buys solutions to those. Poverty adds new ones.

We need to take care (protect) the future economic standing of the US.

Nothing is promised or certain.

The rise and fall of great nations.

Seems like history will repeat itself.

Such a shame.

I ask that you see the bigger picture, and not just your myopic world.

Did you see that trump's main economic advisor Kevin Hassert is leaving the White House?

I don't know more than the headline, but this blows my mind. He was the chief proponent at the podium.

Trump is gonna leave a pile of crap for us all.

I don't know more than the headline, but this blows my mind. He was the chief proponent at the podium.

Trump is gonna leave a pile of crap for us all.

I don't know if oski003 is a Baby Boomer but he sure sounds like one

dajo9 said:

I don't know if oski003 is a Baby Boomer but he sure sounds like one

Bingo. Tom is asking a question about the future to a generation of people who have made it clear that long-term ends when they do.

Some GOP are fighting Trump on tariffs to Mexico. Nice to know there's a few with sense and understanding. The rest however have been cuckolded into believing up is down and down is up.

News reports are tariffs have had negative effects on the economy and if anything sends the U.S. economy into recession it will be tariffs, not banking fraud and/or unseen/unregulated chicanery. Nope, this time around it will be done with eyes wide open and tariffs.

This is how you shoot yourself in the foot with an automatic weapon and then stand up and spray the room with death.

The really sad and stupid part is Trump doesn't understand how tariffs work. I'm not against tariffs just that you have to negotiate, phase them in/out and plan. Just dropping them without thinking or planning is pure 4 y.o. crap on the floor behavior.

News reports are tariffs have had negative effects on the economy and if anything sends the U.S. economy into recession it will be tariffs, not banking fraud and/or unseen/unregulated chicanery. Nope, this time around it will be done with eyes wide open and tariffs.

This is how you shoot yourself in the foot with an automatic weapon and then stand up and spray the room with death.

The really sad and stupid part is Trump doesn't understand how tariffs work. I'm not against tariffs just that you have to negotiate, phase them in/out and plan. Just dropping them without thinking or planning is pure 4 y.o. crap on the floor behavior.

Unit2Sucks said:dajo9 said:

I don't know if oski003 is a Baby Boomer but he sure sounds like one

Bingo. Tom is asking a question about the future to a generation of people who have made it clear that long-term ends when they do.

https://www.msn.com/en-us/lifestyle/did-you-know/22-small-changes-you-can-make-to-be-more-environmentally-friendly-every-day/ss-AACoB1V?li=BBnb7Kz#image=5

Featured Stories

See All

Bears Drop 35-31 Heartbreaker in Sheraton Hawaii Bowl

by Jim McGill

Hawaii Bowl a Full Circle Moment for Rolovich and Chang

by Jim McGill

Bhonapha Named Running Backs Coach

by Cal Athletics

Bears Alone Atop ACC After 74-56 Win Over Columbia

by Jim McGill