edwinbear said:I think being a cash flow investor is great. If real estate is your preferred method of generating that cash flow, there's nothing wrong with that. The following is how I'd address your concerns, however.dajo9 said:Thank you for sharing the Fidelity explainer - I read it with an open mind. Unfortunately, I have read similar things in the past and bitcoin still comes up short in my view. You may have a different opinion on bitcoin's utility and that is fine. But here are my concerns:edwinbear said:That should not have been the takeaway, and if that's how it came across that was unintended. But to try and answer this question as succinctly as possible, one should save in bitcoin for the same reasons that people save in real estate or gold. The properties that historically made real estate/gold attractive places to store wealth are just better with bitcoin.dajo9 said:edwinbear said:Tried to answer this for you back in 2017. If you're still asking this question after you've had 7 years to maybe do some basic research on your own, I don't believe you're asking this in good faith.dajo9 said:edwinbear said:

If you haven't studied bitcoin enough to the point that you no longer see it as "investing" in bitcoin but rather "saving" in bitcoin, then you have no business opining publicly about it. If you still conflate "bitcoin" with the rest of "crypto," then again you haven't studied it enough and have no business opining publicly about it.

Just my 2 satoshis.

Why should I save in bitcoin?

https://bearinsider.com/forums/2/topics/74219/replies/1420628

If I'm wrong and you ARE asking this in good faith, I am more than happy to have that conversation. But I'm not going down this road again just so you can "dunk" on me with ill-informed bitcoin takes.

My takeaway from that is you are saying we should save in bitcoin because we will be transacting in bitcoin. It's been 7 years and bitcoin transactions are still extremely rare.

Is there another reason I should save in bitcoin or are you making the same prediction from 7 years ago that still hasn't come to pass?

I get it though, I'm just some random guy on the internet, so my own personal decade-long interest/study in bitcoin probably holds no weight with you.

I have to imagine you see Fidelity as more legitimate though.

https://institutional.fidelity.com/app/proxy/content?literatureURL=/9903921.PDF

They have a great explanation of why bitcoin matters in one of their reports, if you are genuine in wanting to learn.

- I invest in real estate. I use it to generate cash. I do not invest in gold. It does not generate cash. I am not looking for a store of wealth. I am looking to generate wealth. The economy is hopefully growing and if I stand pat, I'm going to fall behind. Through its existence, bitcoin has been a terrible store of wealth as it is highly volatile.

- As a currency, bitcoin is inferior because it's supply is limited. That will ultimately lead to destructive deflation if the economy wants to grow faster than bitcoin supply. Expansive supply is a feature of fiat currencies, not a bug. Flexibility is key because deflationary crashes are the worst form of economic disruption.

- As a means of transaction, bitcoin is inferior because the banks / governments that process USD transactions help make me more confident that the process is legitimate and I'm not dealing with a bad actor. The small fee and amount of time is a small price to pay. I do not want to be involved in a currency that most benefits tax cheats, gangsters, and thieves. If I were in an oppressive country I might feel differently. In that case, the problem isn't the currency - it is the oppressive government.

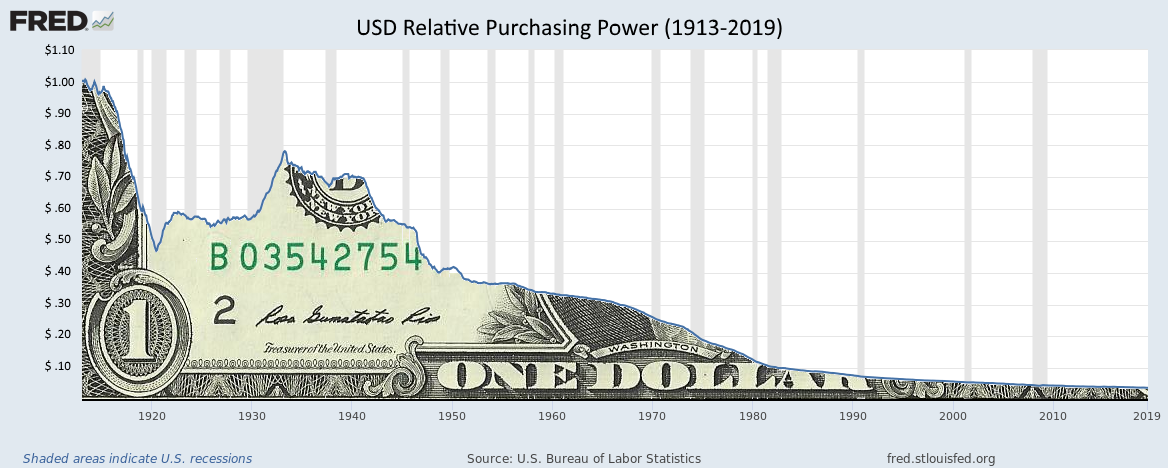

Real Estate: I think the inability the preserve purchasing power through saving dollars compels people to seek out alternatives for safeguarding their wealth. Real estate has become a favored option, which financialized it as an asset class valued well beyond its utility value. If housing is a basic human need, is this a good or bad thing? That's a separate debate, but I do see it as problematic that people are pushed towards owning multiple properties (and/or stocks, etc.) simply because they lack viable means to save in currency. In other words, our money is broken. We should be able to save in money itself and not be forced into becoming investors on top of our 9 to 5 just to try and maintain its purchasing power. I think bitcoin does present itself as a direct savings mechanism, and offers a potential solution to this issue. Other reasons I believe bitcoin is superior to real estate include:Volatility: Bitcoin's inherent volatility during its monetization process is to be expected, as it operates uniquely compared to other assets. Traditional assets adjust their supply based on demand shiftsfor instance, increased demand for gold/housing leads to more mining/developments. Bitcoin stands out as its supply remains fixed, unaffected by demand changes, leading to a vertical supply curve. This setup makes its price especially sensitive to demand fluctuations, manifesting as volatility. The assumption that Bitcoin's price will continually rise hinges on the expectation of growing demand over time. As Bitcoin matures, gaining market cap and global liquidity, its volatility is will decrease, a trend supported by various studies. Nominally, bitcoin's price in USD will trend up "forever." Trending obviously implies volatility, no one seriously believes it happens in a straight line. But a volatile increase in purchasing power over time vs a stable but guaranteed loss of purchasing power over time wins in my opinion. With a finite asset priced in an infinite currency, it's not hard to see how all this plays out over the years, in my opinion.

- Finite vs. Scalable Scarcity: Bitcoin's fixed supply contrasts sharply with real estate, which can become less scarce as demand increases, thanks to new developments and rezoning efforts.

- No Maintenance or Hidden Costs: Bitcoin stands out for its lack of ongoing expensesno maintenance, no tenants, and no fluctuating property taxes. It's not just low-maintenance; it's maintenance-free.

- Asset Security: Unlike real estate, which can be physically seized, Bitcoin offers a level of security against confiscation.

- Lower Risk Factors: Real estate investment carries multiple risks, including leverage, tenant reliability, government policy changes, environmental factors, and reliance on insurance payouts. Bitcoin sidesteps these concerns.

- Unmatched Portability and Liquidity: Real estate is immovable and often difficult to sell quickly. In contrast, Bitcoin can be easily moved and sold globally 24/7, offering superior liquidity and portability.

Inflation/Deflation: The debate around inflation and deflation transcends our shared economics education at Cal, where the prevailing wisdom suggests that some inflation is beneficial and deflationary currencies are problematic. However, this perspective is more theoretical than factual. Despite being educated in these principles, I've grown to question them, particularly noting the absence of Austrian economics in our curriculum, which was dominated by Keynesian theories. This omission raises questions about the breadth of economic theories presented to us, especially since Austrian economics offers a viewpoint where inflation isn't deemed necessary, and deflation can be positive. If I put on a tinfoil hat, I might speculate that the mainstream focus on the necessity of inflation serves to justify governmental monetary expansion and currency debasement. While we may hold differing views on the necessity of inflation, I recommend a book that challenged my own understanding and could provide you with an intriguing perspective if you have the free time:

https://www.amazon.com/Price-Tomorrow-Deflation-Abundant-Future/dp/1999257405

Transactions: Totally disagree here. Trusting in Bitcoin really just means you're putting your faith in math, and honestly, I'd take that any day over trusting Uncle Sam. Going through banks and governments for transactions feels like an endless obstacle course. They're all about collecting your info, putting up barriers, and moving at a snail's pace. Bitcoin, though? It's direct, no middleman to hike up fees or slap down restrictions. Plus, it's totally neutral it's there if you want it, no biggie if you don't.

And calling Bitcoin a playground for the shady types? That's way off base. With its open ledger, only an idiot would pick it for anything dodgy. There are reasons why many criminals who used bitcoin believing it was anonymous and not just pseudonymous have been caught. It's like saying knives are evil because they can be used in stabbings, or cars are a menace because they can be getaway vehicles. Come on, that's not the point of these things.

Since 2017, we've seen some wild moves, like the US cancelling Russia's treasury assets and Canada locking down bank accounts over trucker rally protest support. It really makes you wonder how safe any country's assets are if they're not on the US's good side, or what it means for anyone backing peaceful protests that the government doesn't like. When the government holds the reins on currency from creating it to setting its value and deciding who can use it there's no separating it from its political strings. You mentioned if you lived in an oppressive country you might feel differently. Most of the world lives in an oppressive country. If you're from the financially privileged western world, it's harder to see bitcoin's use case. But those in countries regularly experiencing hyperinflation and/or oppressive regimes see it clearly.

If we're not lining up on this basic idea about money, I get why we're at odds. It seems you're cool with governments calling the shots on money, while I'm over here saying it should stay out of their grasp, kind of like keeping church and state apart. Except this is the separation of money an state. I'm all in on the idea that money should be government-neutral, and for me (and plenty of others), Bitcoin seems like our best shot at making that happen.

You and I have fundamental disagreements about the nature and role of government and economics. In my view, government when done right, is the only chance we have to not be completely dominated by wealthy, industrial interests. The last people I want in charge of our currency are private actors with the means to waste immense amounts of energy resources doing complex math equations to enrich themselves. The government power vacuum you dream of would be filled by such people to the detriment of the average person.