Geeeehhh, haven't you sold the damn things yet?

OT - Selling My Equities

121,902 Views |

675 Replies |

Last: 5 yr ago by rkt88edmo

Ccl up 22% today. Sold some.

Bring back It’s It’s to Haas Pavillion!

Strong mkt today so far. Should it close at these levels or higher, it would be encouraging, especially on a Friday...

Sig test...

oskidunker said:

Why do you think xom is a good play in the short term?

Similar reasons as poster I was responding to. Up 23%, which is less than the gain I would have continued to see if I kept my stake in ZM, but I'm not upset. Fortunately I had some cash to buy equities during the market's free fall and have a larger portfolio now than I did on 2/23.

The Robinhood effect: How retail investors are beating the pros at their own game - Axios

https://www.axios.com/robinhood-effect-young-investors-c4acb5e8-ecc3-4d0d-a193-d125fdf075e4.html?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosam&stream=top

https://www.axios.com/robinhood-effect-young-investors-c4acb5e8-ecc3-4d0d-a193-d125fdf075e4.html?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosam&stream=top

Cancel my subscription to the Resurrection

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

I lost some money when the market crashed but made it back and more on BTG, Zoom, Peloton, and Inovio. Inovio should get P1 data by July 1 and FDA approval for either P2/P3 or straight to P3. However, the stock has been on a terror, and I am not sure how much more it will run. That is the only stock I am still in outside of my 401K.

I missed the boom on the retail stocks because I was afraid of them. I suppose if you pick the right hotel, cruise line, airline etc... and plan to hold for a long time, you cannot go wrong.

I missed the boom on the retail stocks because I was afraid of them. I suppose if you pick the right hotel, cruise line, airline etc... and plan to hold for a long time, you cannot go wrong.

bearister said:

The Robinhood effect: How retail investors are beating the pros at their own game - Axios

https://www.axios.com/robinhood-effect-young-investors-c4acb5e8-ecc3-4d0d-a193-d125fdf075e4.html?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosam&stream=top

Sports bettors may be a driving force behind the stock market surge - Axios

https://www.axios.com/sports-betting-stock-market-surge-0e945773-d676-4f0a-a6a0-a0f92611b10b.html?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiossports&stream=top

Cancel my subscription to the Resurrection

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Tesla or Bitcoin?

I feel like this is a great time to sit on the sidelines for awhile, then come back in when stock prices are more aligned with how the economy looks like it will be doing. Right now, there seems to be a huge disconnect.

In the midst of earnings season, including AAPL this Thu. With Sep and Oct not far-off, two months that have historically seen the most losses, I'm not going long at this point. Then the Nov elections, winter and the virus, plenty of uncertainty, which markets generally don't like...

Sent an email to my pop a few weeks back to look for AAPL to face resistance at 400, not just because it's 400, but because that level represents a 161.8% Fibonacci retracement / extension (pre-pandemic high ->pandemic low -> 400).

Sent an email to my pop a few weeks back to look for AAPL to face resistance at 400, not just because it's 400, but because that level represents a 161.8% Fibonacci retracement / extension (pre-pandemic high ->pandemic low -> 400).

Sig test...

It's been very interesting since mid-March. I'm with you about starting to leave the field for now. Too much turmoil in the country and it's not slowing down. If anything it looks to be increasing.

My pension balance looked strong today. Some people react to the impending Mad Maxing of America by getting armed up. My reaction is to bail 100% from equities, like I wanted to do in 2008 before the streets ran red with blood, BUT I didn't.

Your thoughts?

Your thoughts?

Inflation is coming. Bonds will be bad...good dividend stocks out there...90 times earnings for certain .stocks seems steepbearister said:

My pension balance looked strong today. Some people react to the impending Mad Maxing of America by getting armed up. My reaction is to bail 100% from equities, like I wanted to do in 2008 before the streets ran red with blood, BUT I didn't.

Your thoughts?

Buy gold...and silver!

Strykur said:

Buy gold...and silver!

I'm buying guns and lots of them!

ever try shoot'n holes in the climate? spoiler warning: nobody wins

Probabilities with Gold vs stocks never in favor of gold in excess of 65%. We invested in Gold and silver but never put more than 15% exposure in portfolios due to volatility.Strykur said:

Buy gold...and silver!

I'm pulling back some to redeploy either back into the market the same way it came out, or RE after a downward correction, but mostly just letting that ish ride.

what are the different options to buy gold and silver?Goobear said:Probabilities with Gold vs stocks never in favor of gold in excess of 65%. We invested in Gold and silver but never put more than 15% exposure in portfolios due to volatility.Strykur said:

Buy gold...and silver!

Slv, gdx, gld. These are symbols of etf or trusts you can buy.

Look at the charts, you can see the volatility. Be careful. Do your research.

Look at the charts, you can see the volatility. Be careful. Do your research.

Thanks Goo

Goobear said:

Slv, gdx, gld. These are symbols of etf or trusts you can buy.

Look at the charts, you can see the volatility. Be careful. Do your research.

The best Gold ETF is IAU (lowest mgt fee option and performs as well or better than GLD).

You want to hold Gold or Commodity ETFs in retirement accts if possible to avoid being issued a K1 during tax season.

You want to hold Gold or Commodity ETFs in retirement accts if possible to avoid being issued a K1 during tax season.

The best commodities option is the newly created VCMDX with its low .2% mgt fee and better performance vs DBC and it's high .85% mgt fee

Good stuff BearRaidNation for those of interest. I prefer a heavy bag go pre 1964 dimes for exhange if ever needed and Kruggerands/American Eagles.BearRaidNation said:

The best Gold ETF is IAU (lowest mgt fee option and performs as well or better than GLD).

You want to hold Gold or Commodity ETFs in retirement accts if possible to avoid being issued a K1 during tax season.

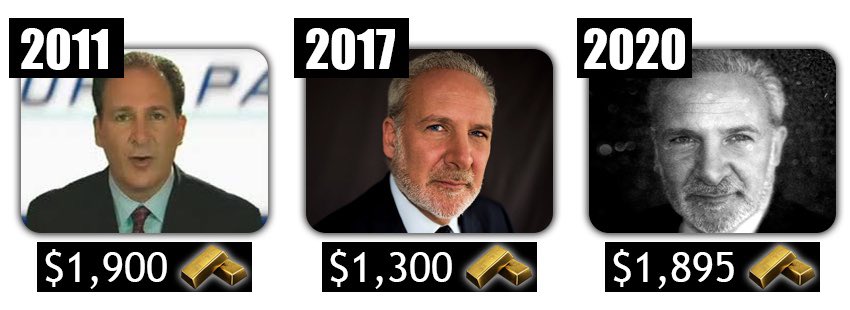

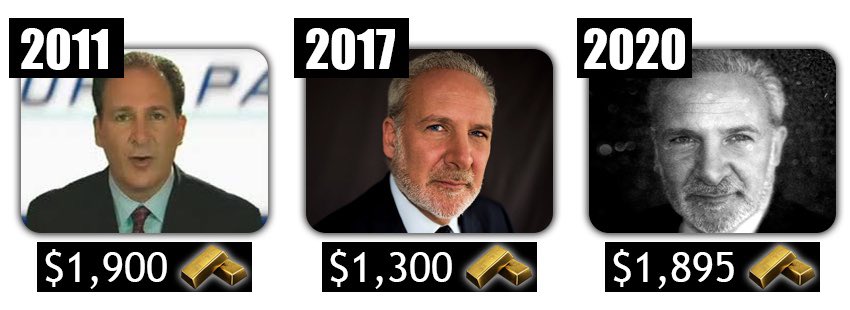

I know Peter Schiff is a Cal grad but didn't know he lurked on the boards here:

Serious question: Why buy gold when it's near its all-time high?

Your question if excellent. Certainly don't buy if you are a value investor. But there is a question that if you have it should you hold? I am not using it as an investment vehicle for gain as much as a safety valve for pain. Bot it in the eighties. Hold.Big C said:

Serious question: Why buy gold when it's near its all-time high?

The reason to buy gold is to hedge equities. US Treasuries are now trash - so they are out as a good hedge. I'd personally suggest a 80% SP500 and 20% IAU allocation today. It's both return enhancing and significantly reduces your standard deviation. If you do a back portfolio analysis it beats the SP500 with less volatility

I think a better solution to the problem you suggest is using a Tactical Bond program where you rotate between (or you advisor does) High Yield Corporate Bonds, 10 year Treasury equivalents, and Money Market Funds when sell signals prevail. I have experienced a 6.64% yield on same for the last 10 years with only one quarter down over 4% in that time interval.BearRaidNation said:

The reason to buy gold is to hedge equities. US Treasuries are now trash - so they are out as a good hedge. I'd personally suggest a 80% SP500 and 20% IAU allocation today. It's both return enhancing and significantly reduces your standard deviation. If you do a back portfolio analysis it beats the SP500 with less volatility

To add, that is the non equity part on portfolio, for safety.

Cal89 said:

Haven't logged-in for some time, but for those who chart the markets, the Naz made a double-top in what has been a V recovery... Not uncommon to see a rejection or reversal with this formation.

I took some off the table today, enough the pay-off the mortgage! A goal before retirement, so super excited. And, since it's after June 1st, estimated IRS payments not due until until Sep.

Hope all are well, in the markets and otherwise.

Still net long in all of my accounts, currently at a 65/35 balance (35% cash). I had a gold ETF in one of my retirement accounts, and recently cashed-out. It did quite well over the years, finally... However, I predominantly hedge with options via periodic put buys, like on the QQQ. I most often finance those with the selling of out-of-the-money covered calls. Has worked really well for me.

I quote myself above because due to some exciting, unexpected events I'll be retiring. In Aug my employer announced a desire to reduce costs by $1B. As if often the case, headcount is the means to do so. I was offered an early retirement package, and after much number-crunching, I took it. Previously, I had not planned to retire until about this time in 2021, at the earliest, more ideally 2-3 years out. The package, plus having paid-off the mortgage a few months back, the status of investments accounts, including profits secured, has me feeling pretty confident in my decision. We have two little ones in grade school, and with a wife who has never been employed in the States, the decision was by no means easy. I created 529 and Coverdell accounts for them literally the day each was born. I had the paperwork done prior to birth (their genders and names were known)...

I learned something a few years back that to this day I find very few know about. Not one colleague I know who also received the early retirement option from my employer was aware of the "55 Rule" with respect to some employer retirement offerings, like the 401(k). Typically, retirement accounts cannot have penalty-free distributions prior to the age of 59.5 years. The "55 Rule" is a notable exception. When I accepted the early retirement offer I was 53, yet it will apply to my situation because the rule is applicable for those who retire in the year in which they will turn 55 years of age. I am now 54 (b-day two weeks back), and my last day is 04 Jan 2021.

A couple colleagues were so dang happy I brought this to their attention. Figured I'd share here in case it might benefit others, now or later...

Hope everyone is well. Eager to see some Cal football!

Sig test...

If you had a 3 year old and had $25,000 to put into a Vanguard investment college fund, would you do it now or wait a few months? If now, what would be the composition?

Congrats s Cal89!

Are you going to "semi-retire" or go cold turkey? I hear that a lot of people in your situation end up getting offers from your employer to consult once they realize the retired people aren't so easy to replace which might be a nice backstop if equities don't perform so well.

Are you going to "semi-retire" or go cold turkey? I hear that a lot of people in your situation end up getting offers from your employer to consult once they realize the retired people aren't so easy to replace which might be a nice backstop if equities don't perform so well.

With 15 or so years to reach college age, I'd front-load it sooner as opposed to later. I find most would agree.oski003 said:

If you had a 3 year old and had $25,000 to put into a Vanguard investment college fund, would you do it now or wait a few months? If now, what would be the composition?

I don't like providing investment advise, even to family and friends, and I don't know Vanguard's offerings, but I'd be inclined to invest a healthy portion into whatever they have that emulates the S&P 500 or the like.

Sig test...

Featured Stories

See All

No. 6 Cal Moves Into First On Day 4 Of ACC Championships

by Cal Athletics

Cal Basketball's NCAA Tourney Chances and Resume

by Jim McGill

The Cultural Shift - Winter Workouts

by Bear Insider