Does anyone see a rebound soon? Netflix just got a 25% haircut on so-so earnings. Tesla is dropping. Peloton had a higher stock price before covid 19, when nobody had heard of them.

Thoughts?

Peloton looks shady afoski003 said:

NASDAQ is getting crushed.

Does anyone see a rebound soon? Netflix just got a 25% haircut on so-so earnings. Tesla is dropping. Peloton had a higher stock price before covid 19, when nobody had heard of them.

Thoughts?

MinotStateBeav said:

Peloton looks shady af

https://www.nbcnews.com/business/business-news/peloton-insiders-sold-nearly-500-million-stock-big-drop-rcna12741

MinotStateBeav said:Peloton looks shady afoski003 said:

NASDAQ is getting crushed.

Does anyone see a rebound soon? Netflix just got a 25% haircut on so-so earnings. Tesla is dropping. Peloton had a higher stock price before covid 19, when nobody had heard of them.

Thoughts?

https://www.nbcnews.com/business/business-news/peloton-insiders-sold-nearly-500-million-stock-big-drop-rcna12741

DiabloWags said:

Growth stocks have been nearly in a "free-fall" ever since the FED became much more hawkish on raising interest rates at their December meeting.

All this, on top of a massive ROTATION out of growth names and into what are known as "value" stocks (primarily cyclicals) who have earnings tied to economic growth. This ROTATION began nearly a year ago as the economy began to open back up. It's why the energy sector has been on fire and the medical diagnostics sector has gotten slaughtered. It's why people like a growth fund manager Cathie Wood and her ARK Invest ETF's are down nearly 60% over the last 12 months.

Growth stocks with little to no earnings, high price to sales multiples and high-cash burn have been under tremendous selling pressure, because when rates go higher their future cash flows decline when those expected cash flows are discounted back to today, given that a higher (discount) rate is used in order to calculate intrinsic value. The lower the discount rate, the higher the value attributed today to future cash flows of tomorrow - - - and vice versa.

The typical "60/40" balanced approach that most financial advisors recommend for their clients IRA's and investment portfolios is also at big RISK here, because not only is the 40% portion of the portfolio getting clobbered (equities) but also the bond portion (60%) given the anticipation of higher rates in an attempt to cool off inflation.

Throw in global tensions over Ukraine and the market is heading nowhere but down until it finds a support level that can offer a decent bounce.

You literally have the stock market facing 3 negatives..... higher rates due to a FED trying to fight inflation, slower economic growth, and global military tensions.

dajo9 said:

It's all just liquidity. If the Fed really gets going trying to raise rates, the 10 year yield is going to go into freefall.

DiabloWags said:dajo9 said:

It's all just liquidity. If the Fed really gets going trying to raise rates, the 10 year yield is going to go into freefall.

But you and your economic guru Elizabeth Warren will be happy... because a Recession will decrease the wealth "gap".

dajo9 said:DiabloWags said:dajo9 said:

It's all just liquidity. If the Fed really gets going trying to raise rates, the 10 year yield is going to go into freefall.

But you and your economic guru Elizabeth Warren will be happy... because a Recession will decrease the wealth "gap".

This is a BF2 level post

Besides inflation, the economy is doing exceedingly well. Record low unemployment, job gains, highest GDP growth in 40 years.

— Nicolas Falacci (@NickFalacci) January 22, 2022

But the average voter doesn’t hear this. They hear about major inflation nearly 24/7 on all the major news outlets.

2/

dajo9 said:Besides inflation, the economy is doing exceedingly well. Record low unemployment, job gains, highest GDP growth in 40 years.

— Nicolas Falacci (@NickFalacci) January 22, 2022

But the average voter doesn’t hear this. They hear about major inflation nearly 24/7 on all the major news outlets.

2/

oski003 said:dajo9 said:Besides inflation, the economy is doing exceedingly well. Record low unemployment, job gains, highest GDP growth in 40 years.

— Nicolas Falacci (@NickFalacci) January 22, 2022

But the average voter doesn’t hear this. They hear about major inflation nearly 24/7 on all the major news outlets.

2/

The people that want to work can get a job. The problem is that a record number of people don't want to work. Those people aren't counted in the employment numbers. This isn't necessarily the president's fault.

Last time the unemployment rate was at 4.2%, prime-working-age labor force participation was right around where it is now. Things look roughly the same in snapshot, except the current pace of improvement is much faster than last cycle. pic.twitter.com/GddDUmZZ2H

— Guy Berger (@EconBerger) January 7, 2022

dajo9 said:oski003 said:dajo9 said:Besides inflation, the economy is doing exceedingly well. Record low unemployment, job gains, highest GDP growth in 40 years.

— Nicolas Falacci (@NickFalacci) January 22, 2022

But the average voter doesn’t hear this. They hear about major inflation nearly 24/7 on all the major news outlets.

2/

The people that want to work can get a job. The problem is that a record number of people don't want to work. Those people aren't counted in the employment numbers. This isn't necessarily the president's fault.

What do you base your claim on that a record number of people don't want to work? Resignations for a better job is a good thing.Last time the unemployment rate was at 4.2%, prime-working-age labor force participation was right around where it is now. Things look roughly the same in snapshot, except the current pace of improvement is much faster than last cycle. pic.twitter.com/GddDUmZZ2H

— Guy Berger (@EconBerger) January 7, 2022

oski003 said:dajo9 said:oski003 said:dajo9 said:Besides inflation, the economy is doing exceedingly well. Record low unemployment, job gains, highest GDP growth in 40 years.

— Nicolas Falacci (@NickFalacci) January 22, 2022

But the average voter doesn’t hear this. They hear about major inflation nearly 24/7 on all the major news outlets.

2/

The people that want to work can get a job. The problem is that a record number of people don't want to work. Those people aren't counted in the employment numbers. This isn't necessarily the president's fault.

What do you base your claim on that a record number of people don't want to work? Resignations for a better job is a good thing.Last time the unemployment rate was at 4.2%, prime-working-age labor force participation was right around where it is now. Things look roughly the same in snapshot, except the current pace of improvement is much faster than last cycle. pic.twitter.com/GddDUmZZ2H

— Guy Berger (@EconBerger) January 7, 2022

Your tweets reference lower labor force participation rate. It is at levels from 50+ years ago when Americans typically only had one parent participate. Now, you have families with two parents working and many families with no parents participating in the labor force.

https://fred.stlouisfed.org/series/CIVPART

Cal_79 said:

Resignations for a better job is one thing. Resignations without having another job in hand is something else.

dimitrig said:Cal_79 said:

Resignations for a better job is one thing. Resignations without having another job in hand is something else.

Van life, baby!

People, especially young people, feel like they are owned by their possessions. They don't want to be married with two kids working to paying a mortgage and two car payments.

They save up some money at a gig job and then live a while before getting another gig job. If they have skills such as in the trades, writing, or tech-related they can do this indefinitely while seeing the world.

A lot of people under 40 don't want to live to work, but instead work to live European-style.

I know Baby Boomers don't get it, but that's okay. They don't have to.

People underestimate how large the impact on the labor participation rate is from retiring baby boomers. The pace of retirement accelerated during the pandemic. My mother in law was a nurse who might have worked a few more years but retired early in the pandemic. Before the pandemic something like 10k boomers were retiring per day, now I would imagine it's increased. That's 300k+ retirees per month.dajo9 said:oski003 said:dajo9 said:oski003 said:dajo9 said:Besides inflation, the economy is doing exceedingly well. Record low unemployment, job gains, highest GDP growth in 40 years.

— Nicolas Falacci (@NickFalacci) January 22, 2022

But the average voter doesn’t hear this. They hear about major inflation nearly 24/7 on all the major news outlets.

2/

The people that want to work can get a job. The problem is that a record number of people don't want to work. Those people aren't counted in the employment numbers. This isn't necessarily the president's fault.

What do you base your claim on that a record number of people don't want to work? Resignations for a better job is a good thing.Last time the unemployment rate was at 4.2%, prime-working-age labor force participation was right around where it is now. Things look roughly the same in snapshot, except the current pace of improvement is much faster than last cycle. pic.twitter.com/GddDUmZZ2H

— Guy Berger (@EconBerger) January 7, 2022

Your tweets reference lower labor force participation rate. It is at levels from 50+ years ago when Americans typically only had one parent participate. Now, you have families with two parents working and many families with no parents participating in the labor force.

https://fred.stlouisfed.org/series/CIVPART

The data shows Baby Boomers leaving the workforce (retiring). Prime age workforce participation is unchanged from a few years ago when the unemployment rate was at this level.

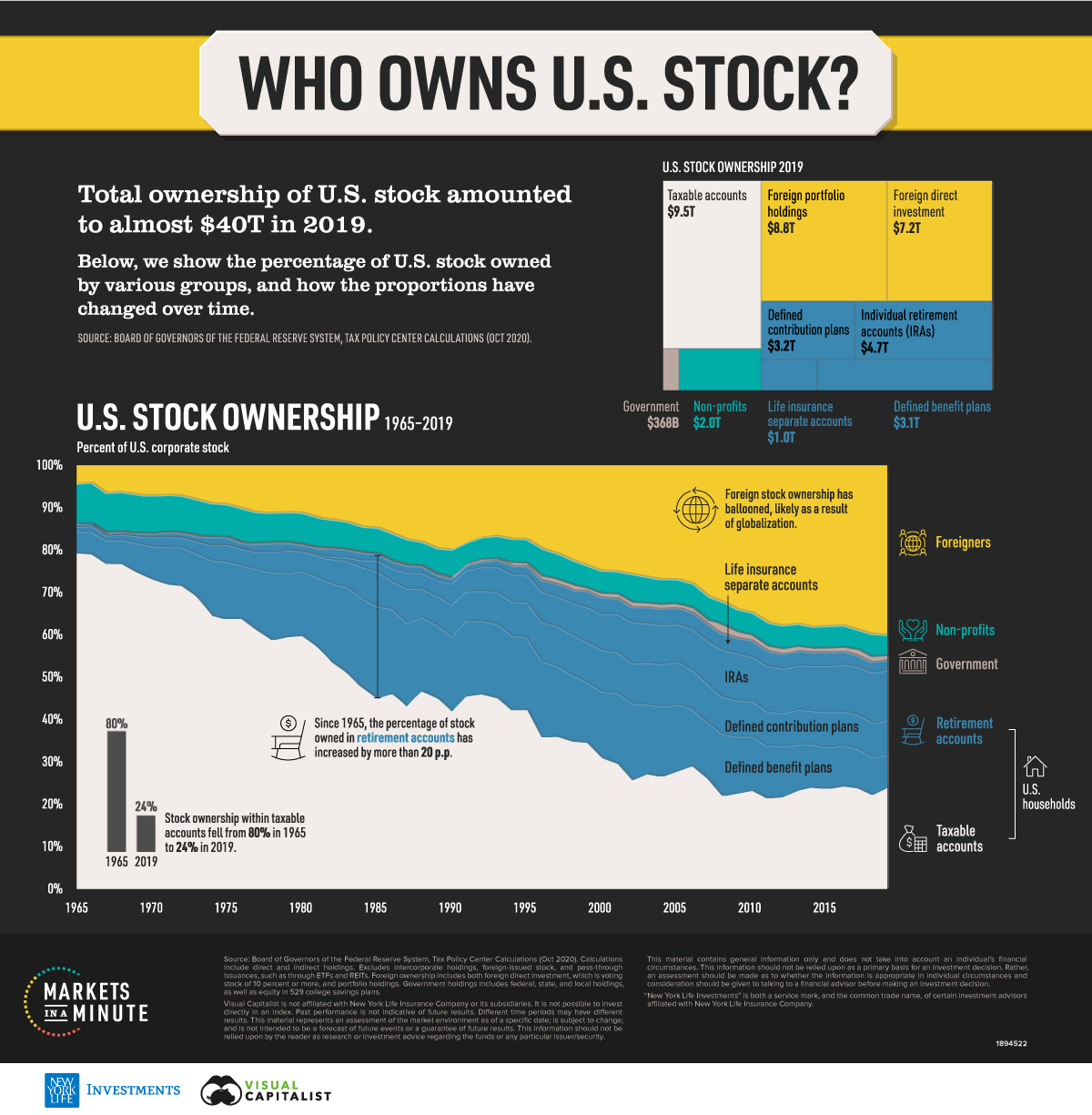

The richest 10% of Americans own 89% of stocks.

— Robert Reich (@RBReich) January 24, 2022

The bottom 90% own 11% of stocks.

Repeat after me:

The stock market is not the economy.

Trump wanted people to believe so when he could take credit for it doing well.DiabloWags said:

No one ever said that the stock market was the ECONOMY.

That's so dumb.

Do you ever think for yourself Bearister, or do you just follow the path of Going for Roses who uses "surrogates" like Tweets and Tik Tok to speak for himself?

Unit2Sucks said:Trump wanted people to believe so when he could take credit for it doing well.DiabloWags said:

No one ever said that the stock market was the ECONOMY.

That's so dumb.

Do you ever think for yourself Bearister, or do you just follow the path of Going for Roses who uses "surrogates" like Tweets and Tik Tok to speak for himself?

Reich's tweet is also misleading because it ignores foreign ownership. Roughly 40% of US public equities are owned by foreigners.

DiabloWags said:

No one ever said that the stock market is the ECONOMY.

That's so dumb.

Do you ever think for yourself Bearister, or do you just follow the path of Going for Roses who uses "surrogates" like Tweets and Tik Tok to speak for himself?

bearister said:

Whenever you get personal in response to an impersonal post, I know I've drawn blood. You guys are just too high strung.

DiabloWags said:bearister said:

Whenever you get personal in response to an impersonal post, I know I've drawn blood. You guys are just too high strung.

You live in a very twisted reality.

But your meme's and tweets are pretty comical.

But what would you expect from a history major?

The decline in liquidity being telegraphed by the Fed is bumping up against the market notion that the Fed has created over the years that it will not allow stock valuations to significantly come down. The liquidity traders are selling and the "buy the dip" traders are buying. My view is that liquidity tends to win but so far the Fed has not actually reduced liquidity - they have just said the will take away liquidity in the future.oski003 said:

Stick save today from the fed or head fake?