OdontoBear66 said:

DiabloWags said:

OdontoBear, I believe there will be a "V" bottom by GROWTH stocks when all is said and done given that their valuations have been slashed. But there will be a large part of the market that will underperform and face an "L" type recovery.

Very possibly true. DW and calbears93, if it is, my strategy works. I do not buy until either the "level" or "L" starts its climb up. Give me NVDA and AMD at 166 and 91 at some time in the future (not now as I tend not to buy in confirmed downtrends) and I am happy. Not today. And I agree with you on growth DW as the valuations are becoming more reasonable, but at the same time that will depend more on where interest rates go and how fast. Let me summarize like everyone else I try to use my limited market smarts to be like the House in Vegas....Would like to win 55%/lose 45% and life is good. Anything better of course is better.

I've said this a bunch of times before and I will say it again.... it depends on what equity sector you are looking at.

I'm not gonna pretend that I know what the P/S multiples are for NVDA or AMD. But I am fully aware of growth names that are already trading at 3.5 - 4.5x sales. At this point, it doesnt matter where interest rates go and how fast. There are sectors in the equity market that have ALREADY DISCOUNTED what everyone has been talking about for months. They have already been slaughtered, no matter if they had a solid Q1 and guided higher on full year revenue guidance. These will be the stocks that will eventually show relative strength well before the likes of the "talking heads" on CNBC declare that the S&P has finally bottomed.

I'm fairly data driven on specific companies.

But I "get" that conservative investors will probably want to see a reversal in trend of the major market averages before they do any buying. It's certainly a lower risk methodology that will still give you strong returns, without getting involved in a "catch a falling knife" scenario. Until we see a stock (or the market) rally on bad news, it's probably best to stay away if you are a passive index fund type investor.

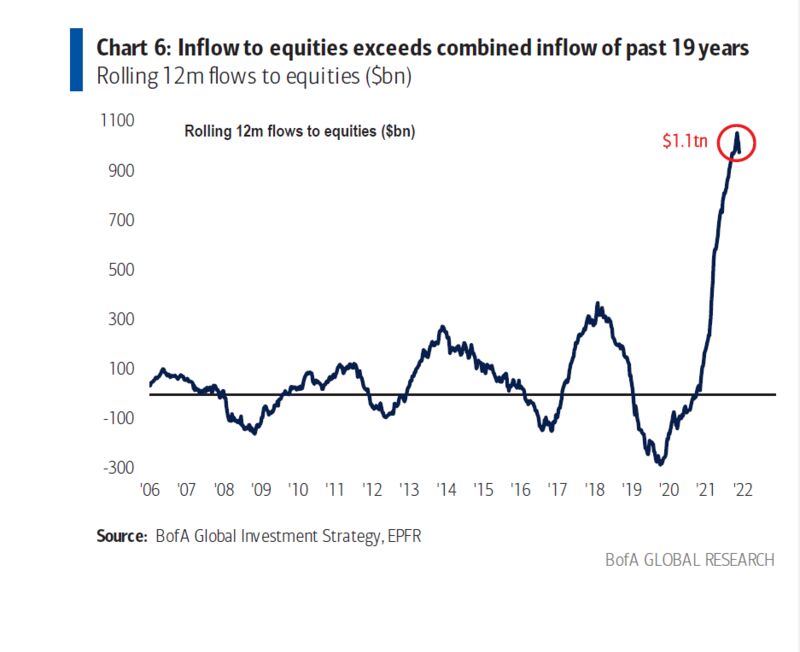

On a Macro basis, if you look at the average price declines and duration of the past 19 Bear Markets going back 140 years, you'll find that the average peak-to-trough decline has been 37% with an average duration of 289 days. That would say that the current bear market would end Oct. 19th. That's why people like Michael Hartnett are saying that 3600 is the

Bull case.But again, I would continue to suggest that it is a

market of stocks and not a stock market.There will be stocks and sectors that bottom way before the S&P does.

"Cults don't end well. They really don't."