DiabloWags said:

The University of California an early investor.

BlackRock launches three targeted ETFs for investors looking to diversify risks | Reuters

Quote:

The iShares Nasdaq Top 30 Stocks ETF (QTOP.O), opens new tab will let investors hold the 30 biggest non-financial stocks, including mega-cap tech. It has secured backing from the University of California's investing arm.

I don't find that to be very intellectually stimulating. It could be a better-than-"market"-return strategy, but I'm personally interested in a broader way of diverging from "the market".

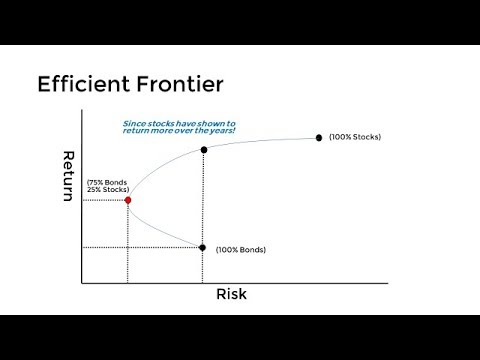

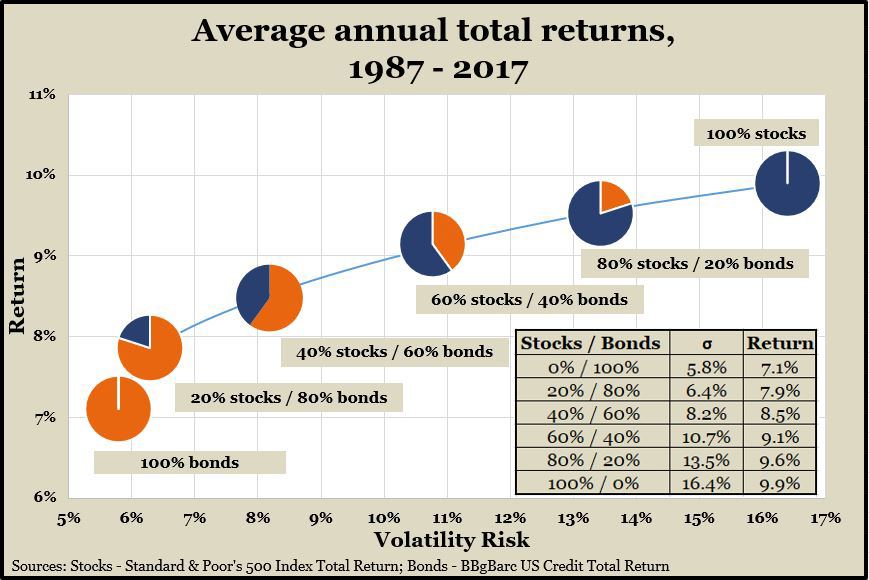

I'm on the investment advisory team for a nonprofit and have introduced to others the concept of how diversification among asset classes is the best way to maximize Return while minimizing Risk.

I first learned of the late Yale Endowment CIO David Swenson some 20 years ago.

And recently I picked up another book:

The common takeaway, for me, is that the world of assets we should be investing in is WAY beyond US stocks. It's also way beyond your typical asset allocation model (which varies by age or risk appetite of the asset holder) as offered by your local brokerage firm.

Swensen talked about real estate, timber as asset classes. So does Lo.

We must span the planet to consider grabbing a piece of the entire array of possibilities.