DiabloWags said:

A poster has made previous comments that the S&P could go down 50% and it would be no "biggie".

Just the other day, they posted that the S&P was simply back to March 2021 levels. No biggie.

But that's a terribly simplistic view of the equity market.

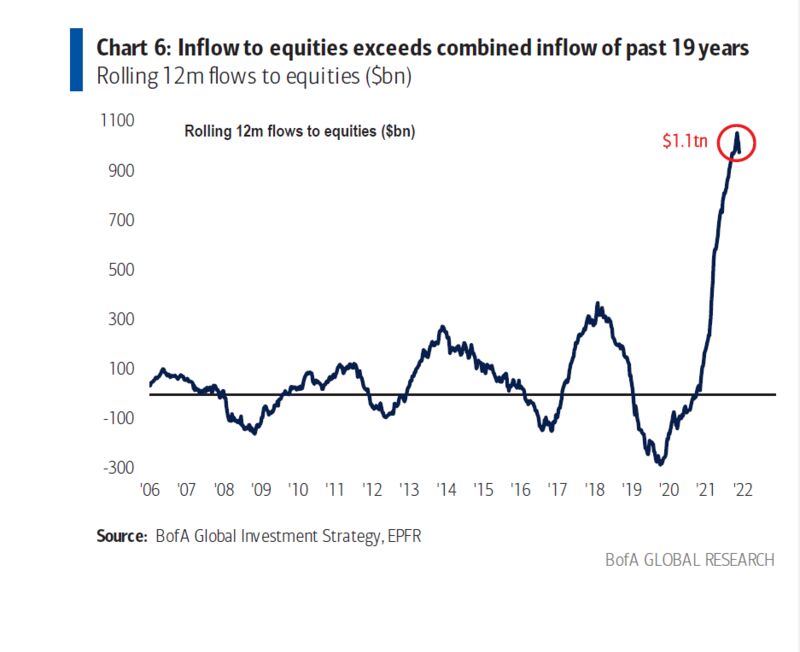

What he doesnt seem to have a clue about is that nearly $900 Billion came into exchange traded and long-only funds in 2021. As a result, the current decline will be having a generational impact.

I think he was speaking to the impact on his personal finances not on those of others. I too wouldn't be troubled by a massive drop in the market purely from a personal net worth perspective because I'm cash heavy, but there would be knock on effects that I do care about - primarily impact on my current and future business prospects.

I think dimitrig was really talking about proper personal finance practices. If you have money in the market it should be for long term investing. If you need liquidity over a shorter horizon then say 3-5 years, the equity market it's the the best vehicle. I don't think you would disagree with that sentiment. People who have short term liquidity issues impacted by a market downturn have taken on more risk than they should have, basically by definition.