Collab with @grandoldmemes pic.twitter.com/f3miqnXhdC

— Dumbass Photoshop (@DumbassPhotoshp) July 30, 2022

I was told this is Putin's price hike. It all depends on Putin.

Collab with @grandoldmemes pic.twitter.com/f3miqnXhdC

— Dumbass Photoshop (@DumbassPhotoshp) July 30, 2022

sycasey said:1. This Hopkins study seems to be about COVID mortality, not inflation.MinotStateBeav said:Have you been to the grocery store at all? Do you notice a lot of goods missing or really expensive? Well when you can't produce enough goods for the overprinted amount of money...you have inflation.sycasey said:MinotStateBeav said:Lockdown policies were set by state and local...but the federal government was urging them to do so under Biden..see the difference? Johns Hopkins came out with study that said lockdowns did more harm than good. I know you like to play dumb in order to defend the insane policies of this admin, but please...stop already."HUrr durr how does lockdown drive inflation..hurrr durrrrrrrrrrrrrr"sycasey said:MinotStateBeav said:Being Pro-lockdown f'd us. This administration was tooting that horn for the entire first yearcbbass1 said:Agree 100%!tequila4kapp said:Come on. Policy impacts how people act. People and companies do not exist in a vacuum.cbbass1 said:That's clearly NOT what I'm saying.tequila4kapp said:

So the oil companies conspired to screw the entire nation with historic gas prices starting Jan 7, 2020? They didn't do it to Clinton or Obama but there was something about Joe that set them off?

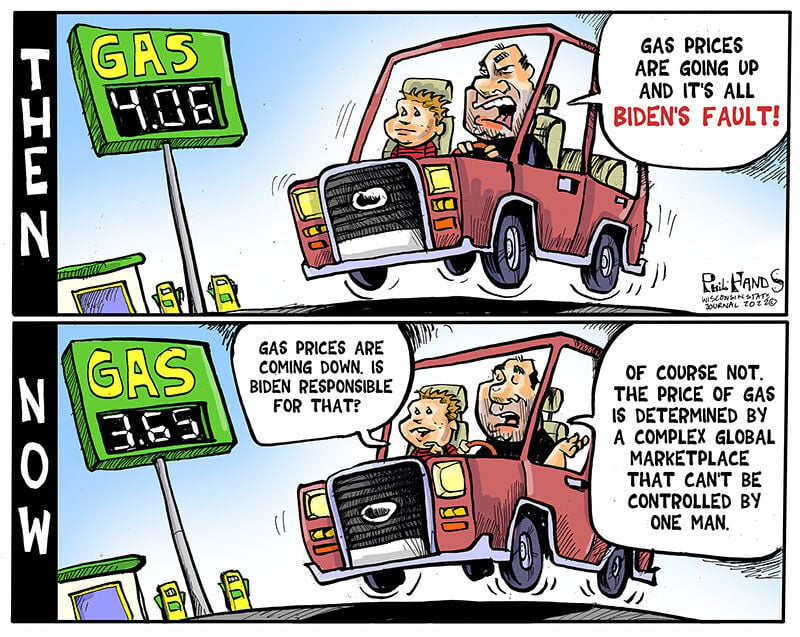

What I am saying is that oil companies, and oil companies alone, are responsible for the prices they charge for their product.

NOT the President, and NOT the President's political party.

So if you can be as specific as possible, what Democratic Party or Biden admin policies are contributing directly to higher gasoline prices in the U.S.?

Okay, I've been going through this thread and this is really a doozy.

1. There's no way the US had more lockdowns during the Biden administration than during Trump. It's not Trump's fault that Covid initially hit us on his watch, but that is what happened.

2. Lockdown policies in the US were mostly set at the state and local level, not by the federal government.

3. Is there some way lockdown policies in the US were harsher than other large countries around the world? They definitely weren't harsher than the large East Asian economies (China, Japan, Korea). Why aren't they to blame? Oil is a global market, right?

4. How would "lockdowns" drive inflation anyway? If a country is locked down there should be LESS demand for gas, right? If anything it would be the opposite: opening up the economy drives inflation.

I'm still trying to wrap my mind around how anyone makes this claim.

Did the Johns Hopkins study say that lockdowns caused inflation? Can you link me to your source?

I'm not playing dumb. I understand that there can be harms from lockdowns. I don't understand why they would cause INFLATION. If anything it's coming OUT of lockdown that might drive inflation: a sudden spike in demand when suppliers aren't ready for it, so the prices go up. When everyone is staying home all the time then demand should be low.

Example: Imagine the only good in the economy is corn and corn costs $1 a pound, and imagine you and all others earn $100 a month. Each month you buy 100 lbs of corn exchanging $1 for 1 lb of corn; so the real value of $1 is 1 lb of corn. Now suppose the government simply prints more dollar bills and gives you (and imagine everyone else) an additional hundred dollars. If you want to eat more than 100 lbs of corn a month, now you can do so but presumably, since others like you also want to do the same, the demand for corn in the economy would go up and very likely its price as well. Now you would have to give up, say $1.50 for each lb of corn. This, roughly speaking, is inflation, and it is eroding the real value of your dollars -- you are getting less corn for every dollar that you used to.

edit: Hopkins study is included in here. https://brownstone.org/articles/lockdowns-did-not-save-lives-concludes-meta-analysis/

2. This discussion was originally about the causes of oil/gasoline inflation, not corn. It seems pretty likely to me that demand for oil would be way down during a lockdown, but much higher once you're out of lockdown.

3. This still looks to me like it's coming OUT of lockdown (which has people going out and spending more money) that would actually drive inflation, not STAYING in lockdown. My reason for thinking so? The government basically "printed money" during the Trump administration (direct payments to citizens) and the initial phase of the pandemic too, and this did not cause inflation. Why not? Because a lot of places were still locked down; people stayed home in the time before vaccines were available. The round of stimulus payments under Biden coincided with the vaccines rolling out and places starting to open up. That seems like the key scenario that would create inflation: more natural demand for products and more money injected into the system, but the supply chain hasn't had time to rev itself up to meet that demand yet.

I'm fine if people want to criticize Biden for actions that may have driven the current inflationary problems. There probably is stuff to criticize. But your original point about "lockdowns = inflation" was dumb.

OdontoBear66 said:You have proven nothing wrong that I have written. You continue wishing to make excuses for the current administration in your reference to refineries as "the" cause. I choose to believe that the implied progressive policy intent of the Biden administration has been to move to complete green energy too quickly and away from fossil fuels much too rapidly such that the reduced output has been responsible for increased pricing.DiabloWags said:OdontoBear66 said:

The big problem is that gas prices jumped tremendously from January of 2021 to present, first with policies of the Biden administration posturing for complete elimination of fossil fuels and America's energy independence to favor a scorched earth (love the verbiage) move to alt energy. Then it became exaggerated by Russia's invasion of Ukraine---How much just that or that coupled with Biden's advisors shutting the nozzle on fossil fuels we can debate forever. Now those prices have come down a bit in the last month, so if we give him blame for one, give him credit for the recent drop.

You literally sound like a pundit on FAUX NEWS repeating the same thing over and over again as if it is true, when I have presented data here that has repeatedly proven you wrong.

Over 1.2 million barrels per day of processing capacity at Gulf Coast REFINERIES went off-line for MAINTENANCE in early 2021. That's why gas prices were heading up well before the Russian invasion of Ukraine.

That's a Fact that you just refuse to accept.

Your knowledge base when it comes to the energy markets is extremely poor.

From the start none of my information was from Fox News as I find there bias one way is similar to the other networks bias in the opposite. My info from the start came from the US Energy Information (eia) charts.

Let me repeat:

Jan 2021 $2.42

Jun 2022 $5.032

Jul 2022 $4.668.......This demonstrating the last month drop per dajo.

But the remainder of the data confirms the monstrous rise in gas prices as felt by all consumers. With three months left till November I suggest perception will win out unless there is a monstrous change. You can get causal with whomever, but I suggest the man at the gas pump is not looking at blaming refineries. My concern is the fact of the matter (Biden policy intent) and the result (doubled plus gas prices) together with proximity to election.

Along with your fellow libs, your personal attacks are laughable. Always attack the messenger when not liking the message. Additionally you put one in a position of arguing against alt energy when I agree with it, but until it can satisfy our energy needs other sources must be used. Fossil fuels, nuclear. Then as alt comes up to realistic speed bring it on.

Meantime what I don't accept is your rational to society's perception. There has been expression by Biden's Transportation Secretary that high gas prices will help the electric automobile industry. Intent?

Might I suggest your taking look at XLE CVX XOM OXY in this era of inflation. Some health care and utilities might be good at this time too.

OdontoBear66 said:You have proven nothing wrong that I have written. You continue wishing to make excuses for the current administration in your reference to refineries as "the" cause. I choose to believe that the implied progressive policy intent of the Biden administration has been to move to complete green energy tooDiabloWags said:OdontoBear66 said:

The big problem is that gas prices jumped tremendously from January of 2021 to present, first with policies of the Biden administration posturing for complete elimination of fossil fuels and America's energy independence to favor a scorched earth (love the verbiage) move to alt energy. Then it became exaggerated by Russia's invasion of Ukraine---How much just that or that coupled with Biden's advisors shutting the nozzle on fossil fuels we can debate forever. Now those prices have come down a bit in the last month, so if we give him blame for one, give him credit for the recent drop.

You literally sound like a pundit on FAUX NEWS repeating the same thing over and over again as if it is true, when I have presented data here that has repeatedly proven you wrong.

Over 1.2 million barrels per day of processing capacity at Gulf Coast REFINERIES went off-line for MAINTENANCE in early 2021. That's why gas prices were heading up well before the Russian invasion of Ukraine.

That's a Fact that you just refuse to accept.

Your knowledge base when it comes to the energy markets is extremely poor.

Along with your fellow libs, your personal attacks are laughable. Always attack the messenger when not liking the message.

dajo9 said:

It is silly to think Biden's views on green energy would have a real, immediate impact on gas prices. That is just politics talking.

DiabloWags said:dajo9 said:

It is silly to think Biden's views on green energy would have a real, immediate impact on gas prices. That is just politics talking.

True.

It's the kind of silliness that would appeal to a gullible teenager.

Never mind that this country is producing 11.6 MILLION BARRELS PER DAY OF CRUDE OIL.

Same as when Trump was in office.

I've repeatedly provided links to the FACTS, but OdontoBear conveniently ignores them.

U.S. Field Production of Crude Oil (Thousand Barrels per Day) (eia.gov)

Weekly U.S. Percent Utilization of Refinery Operable Capacity (Percent) (eia.gov)

DiabloWags said:

Like I've said on previous occasions, OT makes me feel as though my Cal degree from the Haas Business School is worthless.

To think that the President of the United States has control over REFINERY MAINTENANCE is about as ridiculous as it gets.

Kind of goes both ways, does it not? When the price was going up, Biden took no accountability, but as soon as it started going down, his administration took full credit.Unit2Sucks said:DiabloWags said:dajo9 said:

It is silly to think Biden's views on green energy would have a real, immediate impact on gas prices. That is just politics talking.

True.

It's the kind of silliness that would appeal to a gullible teenager.

Never mind that this country is producing 11.6 MILLION BARRELS PER DAY OF CRUDE OIL.

Same as when Trump was in office.

I've repeatedly provided links to the FACTS, but OdontoBear conveniently ignores them.

U.S. Field Production of Crude Oil (Thousand Barrels per Day) (eia.gov)

Weekly U.S. Percent Utilization of Refinery Operable Capacity (Percent) (eia.gov)

Shorter version.

Not sure it would have made sense for Biden to release from the strategic oil reserve before there was a gas affordability crisis. I don't think it's inconsistent to acknowledge that the crisis was largely created by external factors but that Biden's actions had an impact on the reduction in prices of late. You are free to argue that Biden played a role in the crisis and that his actions had a small or no impact, I think that's fair game as well.calbear93 said:Kind of goes both ways, does it not? When the price was going up, Biden took no accountability, but as soon as it started going down, his administration took full credit.Unit2Sucks said:DiabloWags said:dajo9 said:

It is silly to think Biden's views on green energy would have a real, immediate impact on gas prices. That is just politics talking.

True.

It's the kind of silliness that would appeal to a gullible teenager.

Never mind that this country is producing 11.6 MILLION BARRELS PER DAY OF CRUDE OIL.

Same as when Trump was in office.

I've repeatedly provided links to the FACTS, but OdontoBear conveniently ignores them.

U.S. Field Production of Crude Oil (Thousand Barrels per Day) (eia.gov)

Weekly U.S. Percent Utilization of Refinery Operable Capacity (Percent) (eia.gov)

Shorter version.

Just the way it goes in politics.

I think the Fed, existing regulation, refinery limitations, anti-competitive OPEC behaviors, built up demand from an extraordinary comparison point as a result of shutdowns, and war in Ukraine had more to do with both the up and the down. It is not the reserves but the decrease in expectation of the future economy that is more responsible for the decrease.Unit2Sucks said:Not sure it would have made sense for Biden to release from the strategic oil reserve before there was a gas affordability crisis. I don't think it's inconsistent to acknowledge that the crisis was largely created by external factors but that Biden's actions had an impact on the reduction in prices of late. You are free to argue that Biden played a role in the crisis and that his actions had a small or no impact, I think that's fair game as well.calbear93 said:Kind of goes both ways, does it not? When the price was going up, Biden took no accountability, but as soon as it started going down, his administration took full credit.Unit2Sucks said:DiabloWags said:dajo9 said:

It is silly to think Biden's views on green energy would have a real, immediate impact on gas prices. That is just politics talking.

True.

It's the kind of silliness that would appeal to a gullible teenager.

Never mind that this country is producing 11.6 MILLION BARRELS PER DAY OF CRUDE OIL.

Same as when Trump was in office.

I've repeatedly provided links to the FACTS, but OdontoBear conveniently ignores them.

U.S. Field Production of Crude Oil (Thousand Barrels per Day) (eia.gov)

Weekly U.S. Percent Utilization of Refinery Operable Capacity (Percent) (eia.gov)

Shorter version.

Just the way it goes in politics.

https://t.co/ctpA1t7iSo pic.twitter.com/D6eefmURNO

— Matt Darling 🌐🏗️ (@besttrousers) August 6, 2022

under $5 at CostcoDiabloWags said:

Gas Prices now down $1.10 from the prak.

Paid $5.49 for Chevron Premium in Walnut Xreek this week.

concordtom said:under $5 at CostcoDiabloWags said:

Gas Prices now down $1.10 from the prak.

Paid $5.49 for Chevron Premium in Walnut Xreek this week.

4.99 concord

4.79 crow canyon

DiabloWags said:

FYI: Refining capacity data shows that it peaked at 95% in late June. It was 91% last week. This is the lowest level since May.

Refiner's like Marathon will be conducting $400 million in Maintenance in the coming months. Phillips 66 has also scheduled maintenance in the second half. And then of course, there is the upcoming Hurricane Season that causes refiners to go "off-line".

On another note, Americans purchased 8%

Who's spiking the football?calbear93 said:

I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

DiabloWags said:Who's spiking the football?calbear93 said:

I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

Can you be specific?

By the way, I dont think that it's a mystery what the FED's response to +528,000 NFP jobs will be.

They will continue to increase rates in an aggressive front-loaded manner.

Talk of recession and a monetary policy pivot is very premature.

Hence the +6% increase in the yield on Friday in the 10 year.

The consensus forecast for July CPI is 8.7%

calbear93 said:DiabloWags said:Who's spiking the football?calbear93 said:

I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

Can you be specific?

By the way, I dont think that it's a mystery what the FED's response to +528,000 NFP jobs will be.

They will continue to increase rates in an aggressive front-loaded manner.

Talk of recession and a monetary policy pivot is very premature.

Hence the +6% increase in the yield on Friday in the 10 year.

The consensus forecast for July CPI is 8.7%

Umm… Biden. He's spiking the football a bit, is he not?

https://time.com/6204141/biden-jobs-report-july-economy/

DiabloWags said:concordtom said:under $5 at CostcoDiabloWags said:

Gas Prices now down $1.10 from the prak.

Paid $5.49 for Chevron Premium in Walnut Xreek this week.

4.99 concord

4.79 crow canyon

You're mistaken.

PREMIUM (as I mentioned in my post) is also at $5.49 at Costco. The prices you posted are for regular.

No worries.concordtom said:

Okay. My bad.

Missed that.

But I'll still take 20 cents more for using the Costco card.

calbear93 said:DiabloWags said:

FYI: Refining capacity data shows that it peaked at 95% in late June. It was 91% last week. This is the lowest level since May.

Refiner's like Marathon will be conducting $400 million in Maintenance in the coming months. Phillips 66 has also scheduled maintenance in the second half. And then of course, there is the upcoming Hurricane Season that causes refiners to go "off-line".

On another note, Americans purchased 8%

I am assuming there will be a recession in 2023. Oil prices will go down even more as summer ends, global economy cools even further and global demand goes down. Also assuming that the global shortage in natural gas will hurt the poor quite a bit this winter. How is it that the government, especially the WH, with so many resources, is so divorced from what leaders in the private sector are predicting and preparing? There is a reason investors are focused on companies who will weather downturn better (resilient with greater recurring revenue, participation in industries in secular trends indifferent to macroeconomic conditions, cutting costs and reducing headcount - there are already heavy discussion in many c-suites on pros and cons of cutting hours, furloughing or terminations - not everyone is in leisure and food service industries that are hiring). I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

DiabloWags said:calbear93 said:DiabloWags said:Who's spiking the football?calbear93 said:

I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

Can you be specific?

By the way, I dont think that it's a mystery what the FED's response to +528,000 NFP jobs will be.

They will continue to increase rates in an aggressive front-loaded manner.

Talk of recession and a monetary policy pivot is very premature.

Hence the +6% increase in the yield on Friday in the 10 year.

The consensus forecast for July CPI is 8.7%

Umm… Biden. He's spiking the football a bit, is he not?

https://time.com/6204141/biden-jobs-report-july-economy/

Politically, he has every right to "spike" the football.

Trump would have done the exact same thing, especially with mid-terms coming up.

As far as a Recession is concerned, that's still up to the FED in my book.

And as I have posted in the past, the last two quarters of GDP were highly impacted by the surge in inventories from Q4 of last year.

calbear93 said:DiabloWags said:

FYI: Refining capacity data shows that it peaked at 95% in late June. It was 91% last week. This is the lowest level since May.

Refiner's like Marathon will be conducting $400 million in Maintenance in the coming months. Phillips 66 has also scheduled maintenance in the second half. And then of course, there is the upcoming Hurricane Season that causes refiners to go "off-line".

On another note, Americans purchased 8%

I am assuming there will be a recession in 2023. Oil prices will go down even more as summer ends, global economy cools even further and global demand goes down. Also assuming that the global shortage in natural gas will hurt the poor quite a bit this winter. How is it that the government, especially the WH, with so many resources, is so divorced from what leaders in the private sector are predicting and preparing? There is a reason investors are focused on companies who will weather downturn better (resilient with greater recurring revenue, participation in industries in secular trends indifferent to macroeconomic conditions, cutting costs and reducing headcount - there are already heavy discussion in many c-suites on pros and cons of cutting hours, furloughing or terminations - not everyone is in leisure and food service industries that are hiring). I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

calbear93 said:DiabloWags said:Who's spiking the football?calbear93 said:

I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

Can you be specific?

By the way, I dont think that it's a mystery what the FED's response to +528,000 NFP jobs will be.

They will continue to increase rates in an aggressive front-loaded manner.

Talk of recession and a monetary policy pivot is very premature.

Hence the +6% increase in the yield on Friday in the 10 year.

The consensus forecast for July CPI is 8.7%

Umm… Biden. He's spiking the football a bit, is he not?

https://time.com/6204141/biden-jobs-report-july-economy/

concordtom said:calbear93 said:DiabloWags said:

FYI: Refining capacity data shows that it peaked at 95% in late June. It was 91% last week. This is the lowest level since May.

Refiner's like Marathon will be conducting $400 million in Maintenance in the coming months. Phillips 66 has also scheduled maintenance in the second half. And then of course, there is the upcoming Hurricane Season that causes refiners to go "off-line".

On another note, Americans purchased 8%

I am assuming there will be a recession in 2023. Oil prices will go down even more as summer ends, global economy cools even further and global demand goes down. Also assuming that the global shortage in natural gas will hurt the poor quite a bit this winter. How is it that the government, especially the WH, with so many resources, is so divorced from what leaders in the private sector are predicting and preparing? There is a reason investors are focused on companies who will weather downturn better (resilient with greater recurring revenue, participation in industries in secular trends indifferent to macroeconomic conditions, cutting costs and reducing headcount - there are already heavy discussion in many c-suites on pros and cons of cutting hours, furloughing or terminations - not everyone is in leisure and food service industries that are hiring). I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

What would you want the WH to do?

calbear93 said:concordtom said:calbear93 said:DiabloWags said:

FYI: Refining capacity data shows that it peaked at 95% in late June. It was 91% last week. This is the lowest level since May.

Refiner's like Marathon will be conducting $400 million in Maintenance in the coming months. Phillips 66 has also scheduled maintenance in the second half. And then of course, there is the upcoming Hurricane Season that causes refiners to go "off-line".

On another note, Americans purchased 8%

I am assuming there will be a recession in 2023. Oil prices will go down even more as summer ends, global economy cools even further and global demand goes down. Also assuming that the global shortage in natural gas will hurt the poor quite a bit this winter. How is it that the government, especially the WH, with so many resources, is so divorced from what leaders in the private sector are predicting and preparing? There is a reason investors are focused on companies who will weather downturn better (resilient with greater recurring revenue, participation in industries in secular trends indifferent to macroeconomic conditions, cutting costs and reducing headcount - there are already heavy discussion in many c-suites on pros and cons of cutting hours, furloughing or terminations - not everyone is in leisure and food service industries that are hiring). I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

What would you want the WH to do?

Be an actual leader, and say that they still have a lot of work to do to invest in expediting what it can expedite on supply chain, that the interest rate will have to go up and macroeconomic conditions still need to chill a bit more because they need to still fight inflation but that they will do everything in their power to make this as painless as possible. Credibility matters, and I don't want to default into thinking that the President is just another talking head.

Both sides are doing that. No, raising personal income taxes on consumers is not increasing inflation (just the opposite) and no increasing taxes on suppliers is not fighting inflation (just the opposite when you increase the expenses of suppliers).

calbear93 said:DiabloWags said:calbear93 said:

Umm… Biden. He's spiking the football a bit, is he not?

https://time.com/6204141/biden-jobs-report-july-economy/

Politically, he has every right to "spike" the football.

Trump would have done the exact same thing, especially with mid-terms coming up.

As far as a Recession is concerned, that's still up to the FED in my book.

And as I have posted in the past, the last two quarters of GDP were highly impacted by the surge in inventories from Q4 of last year.

That's my point. And that is why I limited my take to those in government and the press. It is too early to spike the football since I have been hearing from industry leaders that they are planning as if recession is a certainty and pricing power to pass on cost is going away. As such, they will have to reduce costs to protect some of the margin, which has a chain reaction. Not sure if the government leaders are ignoring all that or they would rather mislead the public for political win.

And Trump should not be the bar or the role model. The fact that I voted for Biden and Clinton over him despite my conservative leanings should tell you what I think of Trump.

dajo9 said:calbear93 said:DiabloWags said:

FYI: Refining capacity data shows that it peaked at 95% in late June. It was 91% last week. This is the lowest level since May.

Refiner's like Marathon will be conducting $400 million in Maintenance in the coming months. Phillips 66 has also scheduled maintenance in the second half. And then of course, there is the upcoming Hurricane Season that causes refiners to go "off-line".

On another note, Americans purchased 8%

I am assuming there will be a recession in 2023. Oil prices will go down even more as summer ends, global economy cools even further and global demand goes down. Also assuming that the global shortage in natural gas will hurt the poor quite a bit this winter. How is it that the government, especially the WH, with so many resources, is so divorced from what leaders in the private sector are predicting and preparing? There is a reason investors are focused on companies who will weather downturn better (resilient with greater recurring revenue, participation in industries in secular trends indifferent to macroeconomic conditions, cutting costs and reducing headcount - there are already heavy discussion in many c-suites on pros and cons of cutting hours, furloughing or terminations - not everyone is in leisure and food service industries that are hiring). I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

A week ago you were saying we already were in recession. What happened?

DiabloWags said:calbear93 said:DiabloWags said:calbear93 said:

Umm… Biden. He's spiking the football a bit, is he not?

https://time.com/6204141/biden-jobs-report-july-economy/

Politically, he has every right to "spike" the football.

Trump would have done the exact same thing, especially with mid-terms coming up.

As far as a Recession is concerned, that's still up to the FED in my book.

And as I have posted in the past, the last two quarters of GDP were highly impacted by the surge in inventories from Q4 of last year.

That's my point. And that is why I limited my take to those in government and the press. It is too early to spike the football since I have been hearing from industry leaders that they are planning as if recession is a certainty and pricing power to pass on cost is going away. As such, they will have to reduce costs to protect some of the margin, which has a chain reaction. Not sure if the government leaders are ignoring all that or they would rather mislead the public for political win.

And Trump should not be the bar or the role model. The fact that I voted for Biden and Clinton over him despite my conservative leanings should tell you what I think of Trump.

I think that there is a difference between a Corporate Earnings Recession which is what you have described (which will eventually lead to some kind of decrease in capital investment and potential layoffs) as opposed to an economic contraction that sends the unemployment rate back up in dramatic fashion.

Thus far, the capital spending has not gone away.

In fact, it's done the opposite.

In fact, it has remained strong and such expenditures are growing faster than stock repurchases for the first time since Q1 of 2021. If CEO's were truly battening down the hatches, they would not be spending like this.

https://www.wsj.com/articles/companies-from-google-to-pepsi-are-boosting-capital-spending-11659584015?st=ldi57bgfidcna23&reflink=desktopwebshare_permalink

calbear93 said:dajo9 said:calbear93 said:DiabloWags said:

FYI: Refining capacity data shows that it peaked at 95% in late June. It was 91% last week. This is the lowest level since May.

Refiner's like Marathon will be conducting $400 million in Maintenance in the coming months. Phillips 66 has also scheduled maintenance in the second half. And then of course, there is the upcoming Hurricane Season that causes refiners to go "off-line".

On another note, Americans purchased 8%

I am assuming there will be a recession in 2023. Oil prices will go down even more as summer ends, global economy cools even further and global demand goes down. Also assuming that the global shortage in natural gas will hurt the poor quite a bit this winter. How is it that the government, especially the WH, with so many resources, is so divorced from what leaders in the private sector are predicting and preparing? There is a reason investors are focused on companies who will weather downturn better (resilient with greater recurring revenue, participation in industries in secular trends indifferent to macroeconomic conditions, cutting costs and reducing headcount - there are already heavy discussion in many c-suites on pros and cons of cutting hours, furloughing or terminations - not everyone is in leisure and food service industries that are hiring). I don't expect a very damaging or long recession but why are so many folks spiking the football as if this is the first time they are following economic trends? Shouldn't our government and our press be more curious about what companies and consumers are predicting, what may be a self-fulfilling prophesy by the private sector and what the FED will do in response to a strong jobs report?

A week ago you were saying we already were in recession. What happened?

I think I explained why it is a recession under the standard rule of thumb but I know all this is confusing for you since you wrote so confidently that this inflation is transitory, massive government giveaway and increasing money supply do not create inflation, and that best time to invest in long-term treasury was right when people were predicting that yield was going to go up. You are the same expert who called the top of the market in 2017 and bragged that he rotated to long term bonds and deflected that he made money by investing in bonds. Wow, making money when every asset class was going up but missing out on the biggest bull market for equity and losing out on exponential gains in high growth I mentioned then is some brilliant save. So, let's talk about your brilliant record vs mine on even what we posted here. What do I know? I wrote about inflation concerns here in early 2021, wrote that monetary policies were creating the wealth disparity and was called a monetarist when people like you were focused on tax rate as the cause of wealth disparity, and wrote that I was rotating out of high growth stocks to cyclicals like energy in early 2021. But you are the IT consultant proudly owning an MBA. Only in your mind and some of the total amateurs' minds are you in any way knowledgeable about any of this. I will give props to folks I disagree with on politics (e.g. Unit2) for having actual knowledge and intelligence on financial markets and private industry. You are just a poser who is an expert only at deflection.

concordtom said:

Wow, 7 stars in less that 16 minutes?? That's gotta be a new OT record!