concordtom said:

going4roses said:

People need to stop talking about a $15 minimum wage, and go back to democratizing power in a way that'll end with $40 an hour wages.

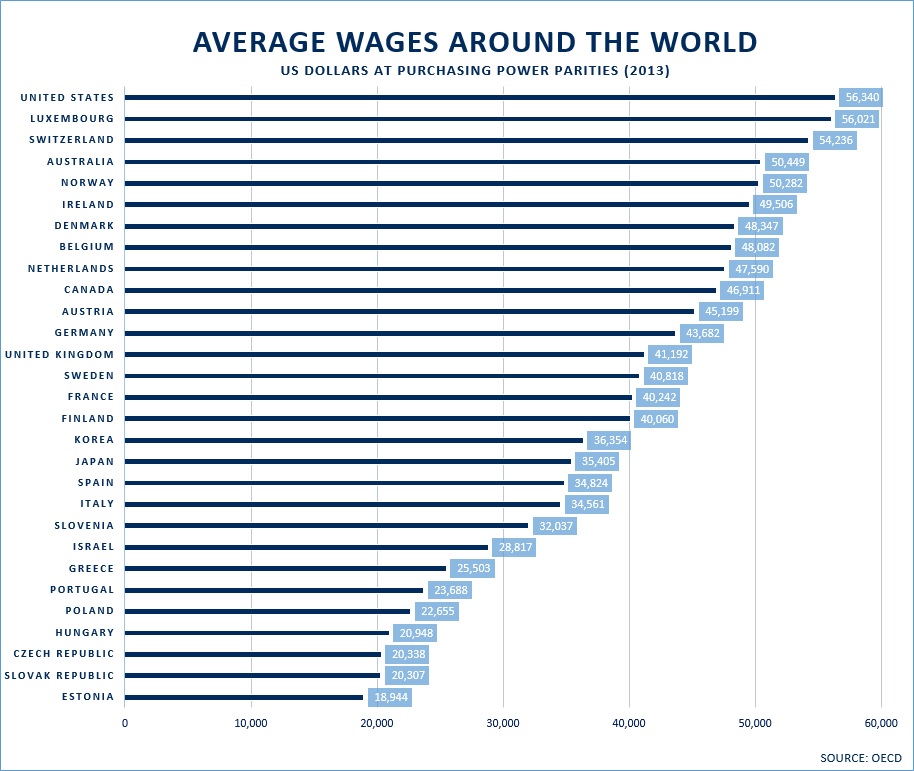

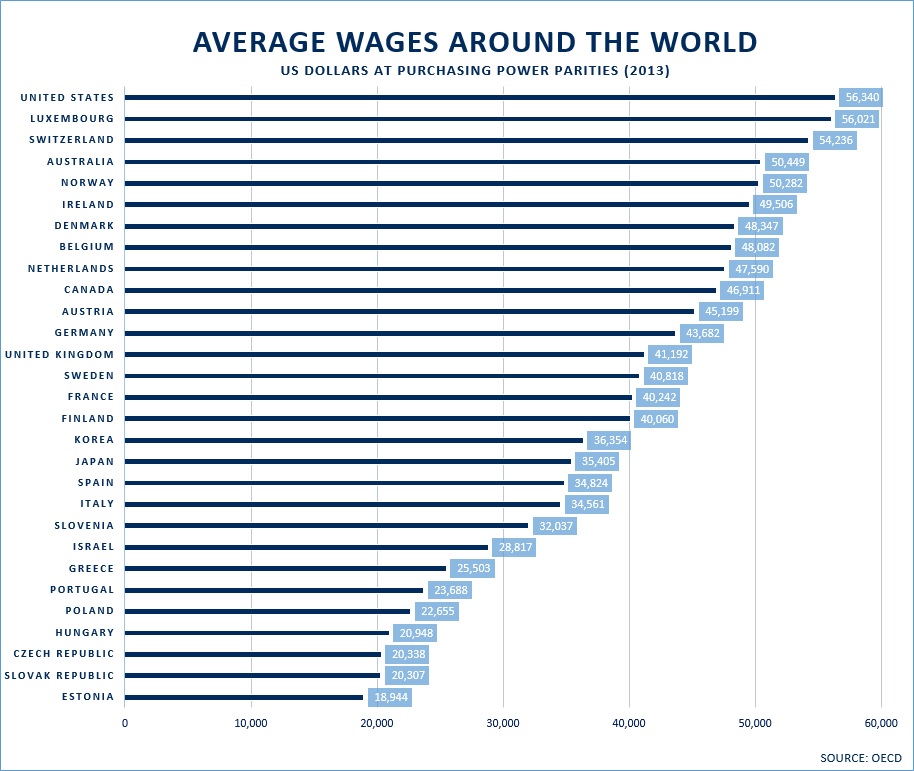

US wages are extremely high compared to rest of world.

Since we live in a world where most everything is transportable (investment capital, raw materials, finished goods), the US must compete with rest of world wages.

Your $40/hr proposal would only kill the US economy and send even more economic activity elsewhere.

For this reason, I'm against even a $15/hr minimum wage.

US wages need to go DOWN, not up.

This is how China is winning the game, long term.

Min wages are short-term gains, short-sighted.

Well, that's one opinion on the matter.

The only reason why US wages are "extremely high" is that the US Cost of Living is "extremely high".

Q: Where do people get the $$$ to purchase goods & services?

A: By selling their Labor. Most Consumer Spending comes from the Wages & Salaries of Workers.

When wages go down, and Worker/Customers have less $$$ & less time to spend it,

what do you think happens to the revenues of businesses??Again, this is like the farmer who decides to use less fertilizer so he can be more profitable. He

thinks that by spending less on fertilizer -- with everything else remaining the same -- that he'll be better off.

The problem is that using less fertilizer means lower crop yields, and less revenue. So he says to himself, "I have to cut my fertilizer usage

even more!"

In economics, this is a phenomenon known as the "Race to the Bottom," and we've been doing it for the last 40+ years. What on Earth convinced you that this was "good for the economy??" Good for

you, maybe, if you make your $$ from OPL (Other Peoples' Labor), but certainly NOT good for the economy!