2020 Election - Catch-all Thread

391,877 Views |

2434 Replies |

Last: 5 yr ago by Unit2Sucks

That malnourished snowflake is a dime a dozen in the BA. Why can't libtards let other people, even other liberals, speak???

What a horrible idea. Not the 2% wealth tax, but to use those funds to cancel out student loan debt. This is the kind of condescending moral hazards that will only escalate the rise in costs of college education, and it subsidizes stupidity and recklessness. Make student loans bankruptable if you want to. Most people with student loans under $50k can afford to pay them back in 10 years even if making $30k gross income. There's no reason anybody with a loan balance that low to be forgiven automatically.B.A. Bearacus said:

EW on a slow, steady roll. Communicating very effectively.

There are some number at the far tail of the student loan debacle (just listen to Dave Ramsey's callers) where they are so stupidly buried in 6 figure debt and they're not doctors or lawyers ("I'm $200k in student loan debt getting a masters to be a clinician working for a non-profit making $50k/yr!"), many of them barely making minimum wage and accruing more interest per year than their yearly take home pay. They are not ever paying that back unless they figure out how to substantially raise their income.

I know a family with a 150k household income, six figure student loan debt, which they could pay off being aggressive in 5-7 years (30k/yr towards principle), but instead wanted have 3 kids, go on vacations, eat out, bought a house too big, and live like upper middle class because they "deserve it". In their own words they will be "paying the loan off their whole life unless the government saves us". They took out unsubsidized loans so they wouldn't have to work while going to school. I do not want this behavior rewarded.

This "we should help people go to whatever school you want" is the mantra that helped get us here. Sorry, if you're majoring in sociology, you need to go to a state public university, or you won't have access to subsidized, fed guaranteed student loans. Nope.

I know it doesn't matter, it will never pass, probably not even if Dems control all 3 branches.

I mostly agree with GB4L on this. Forgiving existing student loans won't fix the system. The problem is schools are currently incentivized improperly to raise tuition because title IV funds are easy to get. Schools should be much more careful with their investments (eg not wasting money on things that don't improve education) to ensure they remain affordable relative to the outcomes their students are expected to achieve.

My biggest problem with the donation culture at US schools is how much money goes toward unnecessary capital improvements that just end up raising the cost of attendance. I don't need my kids to attend a country club but that's what seems to be the trend. This is just as true at private primary schools as it is in colleges.

So if loan forgiveness would be a giveaway to existing debtors and won't help reduce college costs going forward, what can be done? I think title IV should be much tighter and should prevent schools from wasting money - basically treating them more as a utility. The Obama administration tried to do some of this with private for profit colleges (which was a disaster for that industry but actually would have gone a long way to helping with the really problematic situations) but of course those are being unwound because Trump and DeVos like to enable frauds like Trump University.

My biggest problem with the donation culture at US schools is how much money goes toward unnecessary capital improvements that just end up raising the cost of attendance. I don't need my kids to attend a country club but that's what seems to be the trend. This is just as true at private primary schools as it is in colleges.

So if loan forgiveness would be a giveaway to existing debtors and won't help reduce college costs going forward, what can be done? I think title IV should be much tighter and should prevent schools from wasting money - basically treating them more as a utility. The Obama administration tried to do some of this with private for profit colleges (which was a disaster for that industry but actually would have gone a long way to helping with the really problematic situations) but of course those are being unwound because Trump and DeVos like to enable frauds like Trump University.

Best explanation for why tRump was elected POTUS and why he may win again.

Cancel my subscription to the Resurrection

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

bearister said:

Best explanation for why tRump was elected POTUS and why he may win again.

Because your average American is ill-informed and/or willfully ignorant. And some of them actually bother to vote despite their ignorance. It's what makes them such easy marks for millionaire old white dudes to convince them that MOWDs have blue collar middle Americans' best interests in mind.

"There are three kinds of lies: lies, damned lies, and statistics." -- (maybe) Benjamin Disraeli, popularized by Mark Twain

Perhaps tRump will not have the backing of the military if he refuses to leave if not re-elected in 2020:

"The Pentagon has told the White House to stop politicizing the military, amid a furor over a Trump administration order to have the Navy ship named for the late U.S. Sen. John McCain hidden from view during President Donald Trump's recent visit to Japan." Lolita Baldor, Associated Press

"The Pentagon has told the White House to stop politicizing the military, amid a furor over a Trump administration order to have the Navy ship named for the late U.S. Sen. John McCain hidden from view during President Donald Trump's recent visit to Japan." Lolita Baldor, Associated Press

Cancel my subscription to the Resurrection

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

This move by someone in the Trump orbit tells us everything we need to know about the individual that was elected to the Presidency with the help of Russia.bearister said:

Perhaps tRump will not have the backing of the military if he refuses to leave if not re-elected in 2020:

"The Pentagon has told the White House to stop politicizing the military, amid a furor over a Trump administration order to have the Navy ship named for the late U.S. Sen. John McCain hidden from view during President Donald Trump's recent visit to Japan." Lolita Baldor, Associated Press

Opinion | The Coming G.O.P. Apocalypse - The New York Times

https://www.nytimes.com/2019/06/03/opinion/republicans-generation-gap.html

https://www.nytimes.com/2019/06/03/opinion/republicans-generation-gap.html

Cancel my subscription to the Resurrection

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Caption this photo:

Yang doesn't play identity politics (outright criticizes liberals for employing it), doesn't play the "Trump is the anti-christ" narrative ("if you watch cable news and listen to liberal rhetoric, you'd think Trump won because of Russia and racism and Facebook, but it's because the swing states that he won lost thousands of manufacturing jobs, and he was the only one who acknowledged their plight"), is non-ideological, "pragmatic", empirical, non-partisan....

...No wonder he has no chance of winning the Left.

...No wonder he has no chance of winning the Left.

Trump is the biggest identity politician America has seen since George Wallace.

He won because of racism and Russian and FBI actions that directly harmed Hillary's campaign - and because even when the American people voted for Hillary, the Electoral College denied the American people their choice.

He won because of racism and Russian and FBI actions that directly harmed Hillary's campaign - and because even when the American people voted for Hillary, the Electoral College denied the American people their choice.

And tRump is going to win again. Mom and pop in the flyovers have forced pragmatic Democrats to back Biden, a dunce, because he is the only Democrat that they relate to. The Progressive Dems, CNN and MSNBC are doing everything in their power to take Biden out, and they will succeed. Any other Democratic candidate will have no chance to secure the sacred votes in the flyovers. The only things that will take tRump out at this point are his diet, lack of sleep, lack of exercise and whatever Dr. Feelgood meth based "vitamin" concoction they shoot the old bugger up with to keep him going.

Cancel my subscription to the Resurrection

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

Send my credentials to the House of Detention

“I love Cal deeply. What are the directions to The Portal from Sproul Plaza?”

dajo9 said:

Trump is the biggest identity politician America has seen since George Wallace.

I hope fat shaming Trump makes you feel better.

GBear4Life said:

Yang doesn't play identity politics (outright criticizes liberals for employing it), doesn't play the "Trump is the anti-christ" narrative ("if you watch cable news and listen to liberal rhetoric, you'd think Trump won because of Russia and racism and Facebook, but it's because the swing states that he won lost thousands of manufacturing jobs, and he was the only one who acknowledged their plight"), is non-ideological, "pragmatic", empirical, non-partisan....

...No wonder he has no chance of winning the Left.

Yang has some good ideas but it's clear you haven't learned anything from the Trump failed experiment at having a political outsider and bomb thrower to run the country. Maybe the fact that Yang isn't a "low IQ" baby boomer will help but I wouldn't bet this country's future on it. We need stability to recover from the Trumpocalypse.

By the way, as soon as Yang hit the general election we would be living in this world:

The idea that whites without an education are clamoring for Biden and that will make a difference in 2020 doesn't compute. Trump got 400,000 more votes total than Romney in Michigan, Pennsylvania and Wisconsin- not a huge difference. ( In fact Trump received a lesser % of the national vote than Romney). But Republicans always win the white vote. Clinton was the last Democrat to barely win the white vote in a three party race in 1996.

The Democrats lost because Democrats didn't show up or went another way. Hillary got almost 700,000 less votes than Obama in those three states. Those Democrats were young people and minorities. If they showed up that was more than enough to elect her.

47% of eligible voters didn't vote or voted for a third party in 2016. If you want to win the margin is here not white males without a college degree the so called Biden silver bullet. Most of those votes are already lost.

Now if you think Biden can't possibly be as bad a candidate as Clinton you might shrug this off and vote for him. But on the other hand if he's a better Presidential candidate than Hillary, this would be the first time. Biden is spending all his time running against Biden.

The Democrats lost because Democrats didn't show up or went another way. Hillary got almost 700,000 less votes than Obama in those three states. Those Democrats were young people and minorities. If they showed up that was more than enough to elect her.

47% of eligible voters didn't vote or voted for a third party in 2016. If you want to win the margin is here not white males without a college degree the so called Biden silver bullet. Most of those votes are already lost.

Now if you think Biden can't possibly be as bad a candidate as Clinton you might shrug this off and vote for him. But on the other hand if he's a better Presidential candidate than Hillary, this would be the first time. Biden is spending all his time running against Biden.

The proposal is interesting in that it would suddenly produce an immediate windfall of cash.B.A. Bearacus said:

EW on a slow, steady roll. Communicating very effectively.

HOWEVER!

It's a completely immature thought which hasn't even begun to be vetted and had holes poked in it. For instance,

-how many families does this affect?

-how many of those families' wealth is tied up in company stock which cannot be sold for various reasons?

-how many individuals would relocate to a foreign country? You laugh at the concept? Don't. This is an ANNUAL 2% tax. Not one-time. After just 10 years, the US government has taken 20% of your net worth and likely screwed up your ownership structure.

So many more questions.

The concept needs some major work, rather than just holding up 2 fingers and saying "2 cents". I get pissed off every time I hear her simplify it as that.

Having said that, i am for closing the wealth gap.

You're a ****.GBear4Life said:

That malnourished snowflake is a dime a dozen in the BA. Why can't libtards let other people, even other liberals, speak???

I agree.Unit2Sucks said:

I mostly agree with GB4L on this. Forgiving existing student loans won't fix the system. The problem is schools are currently incentivized improperly to raise tuition because title IV funds are easy to get. Schools should be much more careful with their investments (eg not wasting money on things that don't improve education) to ensure they remain affordable relative to the outcomes their students are expected to achieve.

My biggest problem with the donation culture at US schools is how much money goes toward unnecessary capital improvements that just end up raising the cost of attendance. I don't need my kids to attend a country club but that's what seems to be the trend. This is just as true at private primary schools as it is in colleges.

So if loan forgiveness would be a giveaway to existing debtors and won't help reduce college costs going forward, what can be done? I think title IV should be much tighter and should prevent schools from wasting money - basically treating them more as a utility. The Obama administration tried to do some of this with private for profit colleges (which was a disaster for that industry but actually would have gone a long way to helping with the really problematic situations) but of course those are being unwound because Trump and DeVos like to enable frauds like Trump University.

Closing the wealth gap is one thing.

Writing checks to cover (and incentivize bad behavior, bad economic choices) is another.

Warren is pandering to the masses here. This is just like covering folks who took on a mortgage without thinking it thru properly, ten years ago.

GBear4Life said:

Yang doesn't play identity politics (outright criticizes liberals for employing it), doesn't play the "Trump is the anti-christ" narrative ("if you watch cable news and listen to liberal rhetoric, you'd think Trump won because of Russia and racism and Facebook, but it's because the swing states that he won lost thousands of manufacturing jobs, and he was the only one who acknowledged their plight"), is non-ideological, "pragmatic", empirical, non-partisan....

...No wonder he has no chance of winning the Left.

Yang has no chance of winning on either the Right or the Left because he's a guy no one has heard of before now and has no political experience. (Trump had no experience either but he was a well-known celebrity.)

Think of it like an investment fund expense ratio. If you're worth that much, your money is probably making significantly more than that on average every year. If it isn't you need a new investment advisor. These people won't be losing wealth; they just won't be accumulating it quite so fastconcordtom said:The proposal is interesting in that it would suddenly produce an immediate windfall of cash.B.A. Bearacus said:

EW on a slow, steady roll. Communicating very effectively.

HOWEVER!

It's a completely immature thought which hasn't even begun to be vetted and had holes poked in it. For instance,

-how many families does this affect?

-how many of those families' wealth is tied up in company stock which cannot be sold for various reasons?

-how many individuals would relocate to a foreign country? You laugh at the concept? Don't. This is an ANNUAL 2% tax. Not one-time. After just 10 years, the US government has taken 20% of your net worth and likely screwed up your ownership structure.

So many more questions.

The concept needs some major work, rather than just holding up 2 fingers and saying "2 cents". I get pissed off every time I hear her simplify it as that.

Having said that, i am for closing the wealth gap.

Not all holdings are as simple as receiving 5% and yielding 2% year over year.BearsWiin said:Think of it like an investment fund expense ratio. If you're worth that much, your money is probably making significantly more than that on average every year. If it isn't you need a new investment advisor. These people won't be losing wealth; they just won't be accumulating it quite so fastconcordtom said:The proposal is interesting in that it would suddenly produce an immediate windfall of cash.B.A. Bearacus said:

EW on a slow, steady roll. Communicating very effectively.

HOWEVER!

It's a completely immature thought which hasn't even begun to be vetted and had holes poked in it. For instance,

-how many families does this affect?

-how many of those families' wealth is tied up in company stock which cannot be sold for various reasons?

-how many individuals would relocate to a foreign country? You laugh at the concept? Don't. This is an ANNUAL 2% tax. Not one-time. After just 10 years, the US government has taken 20% of your net worth and likely screwed up your ownership structure.

So many more questions.

The concept needs some major work, rather than just holding up 2 fingers and saying "2 cents". I get pissed off every time I hear her simplify it as that.

Having said that, i am for closing the wealth gap.

Why I said it needs to be detailed in much greater extent.

For instance, let's say Bezos is 99% invested in AMZN. Is he supposed to sell 2% of his holdings every year?

Eventually, he loses control.

Why should that happen whence he's already paying income taxes the whole time.

I'd just like to see it spelled out in MUCH greater detail than simply, "2 cents".

Jeff Bezos will land on his feet somehow

concordtom said:Not all holdings are as simple as receiving 5% and yielding 2% year over year.BearsWiin said:Think of it like an investment fund expense ratio. If you're worth that much, your money is probably making significantly more than that on average every year. If it isn't you need a new investment advisor. These people won't be losing wealth; they just won't be accumulating it quite so fastconcordtom said:The proposal is interesting in that it would suddenly produce an immediate windfall of cash.B.A. Bearacus said:

EW on a slow, steady roll. Communicating very effectively.

HOWEVER!

It's a completely immature thought which hasn't even begun to be vetted and had holes poked in it. For instance,

-how many families does this affect?

-how many of those families' wealth is tied up in company stock which cannot be sold for various reasons?

-how many individuals would relocate to a foreign country? You laugh at the concept? Don't. This is an ANNUAL 2% tax. Not one-time. After just 10 years, the US government has taken 20% of your net worth and likely screwed up your ownership structure.

So many more questions.

The concept needs some major work, rather than just holding up 2 fingers and saying "2 cents". I get pissed off every time I hear her simplify it as that.

Having said that, i am for closing the wealth gap.

Why I said it needs to be detailed in much greater extent.

For instance, let's say Bezos is 99% invested in AMZN. Is he supposed to sell 2% of his holdings every year?

Eventually, he loses control.

Why should that happen whence he's already paying income taxes the whole time.

I'd just like to see it spelled out in MUCH greater detail than simply, "2 cents".

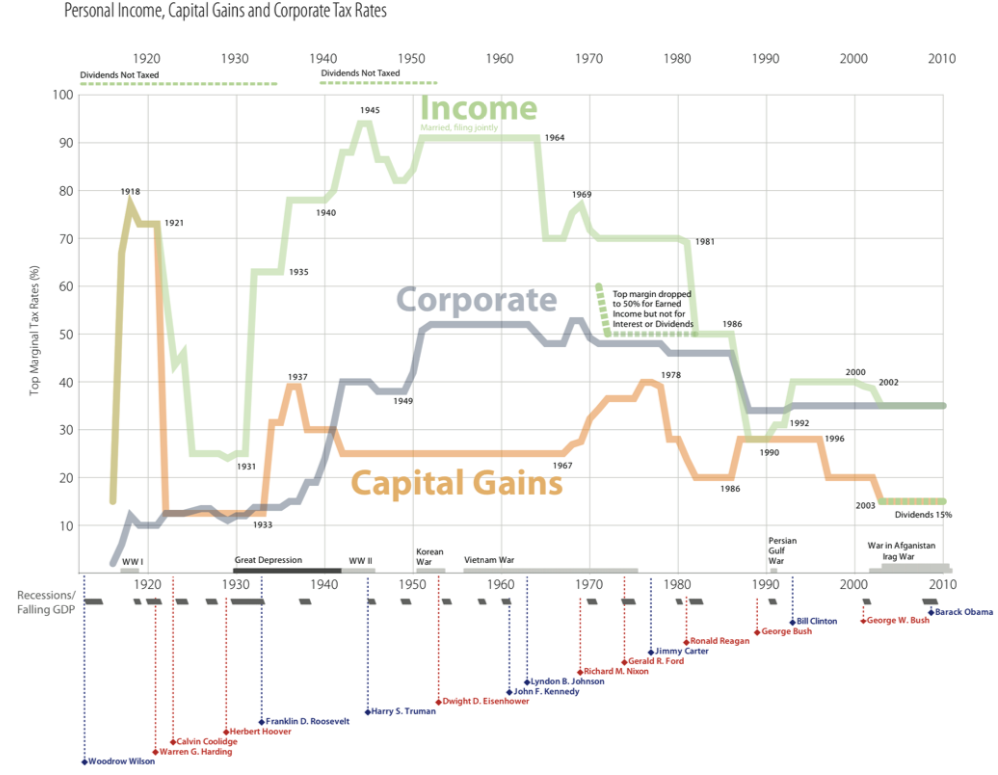

Capital gains and dividend taxes are too low so thus far Bezos has been undertaxed

Don't be ridiculous, Yang wouldn't have a chance to win the Dem nomination if he was a popular celebrity.

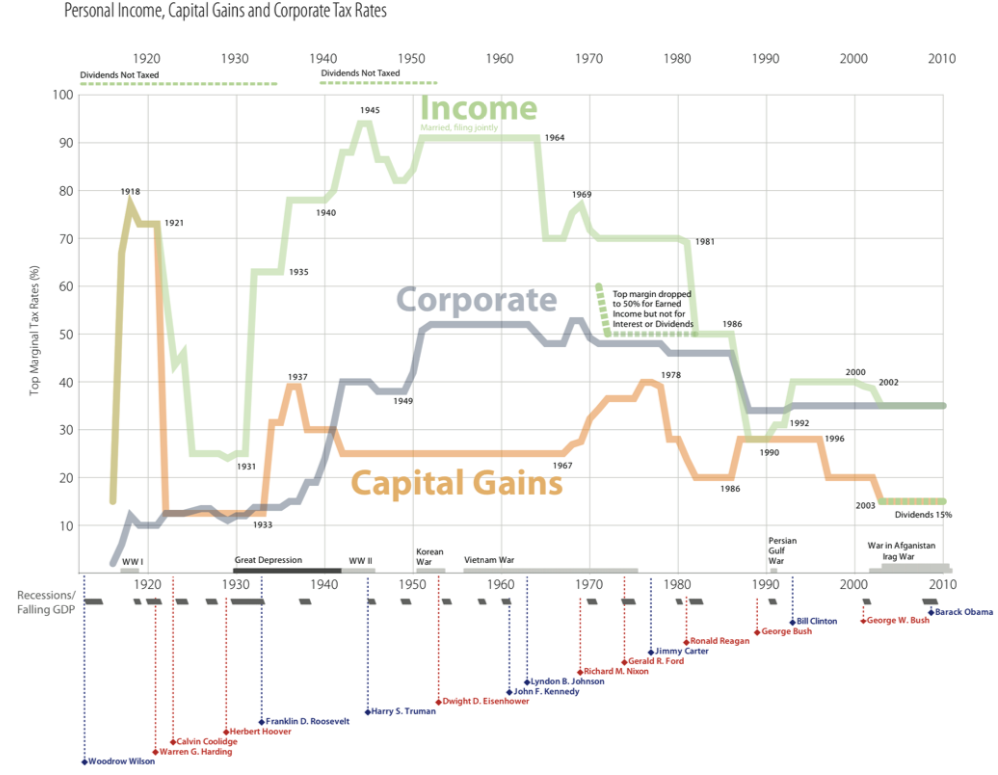

I believe capital gains and dividends over 200k should be taxed as ordinary income.dajo9 said:concordtom said:Not all holdings are as simple as receiving 5% and yielding 2% year over year.BearsWiin said:Think of it like an investment fund expense ratio. If you're worth that much, your money is probably making significantly more than that on average every year. If it isn't you need a new investment advisor. These people won't be losing wealth; they just won't be accumulating it quite so fastconcordtom said:The proposal is interesting in that it would suddenly produce an immediate windfall of cash.B.A. Bearacus said:

EW on a slow, steady roll. Communicating very effectively.

HOWEVER!

It's a completely immature thought which hasn't even begun to be vetted and had holes poked in it. For instance,

-how many families does this affect?

-how many of those families' wealth is tied up in company stock which cannot be sold for various reasons?

-how many individuals would relocate to a foreign country? You laugh at the concept? Don't. This is an ANNUAL 2% tax. Not one-time. After just 10 years, the US government has taken 20% of your net worth and likely screwed up your ownership structure.

So many more questions.

The concept needs some major work, rather than just holding up 2 fingers and saying "2 cents". I get pissed off every time I hear her simplify it as that.

Having said that, i am for closing the wealth gap.

Why I said it needs to be detailed in much greater extent.

For instance, let's say Bezos is 99% invested in AMZN. Is he supposed to sell 2% of his holdings every year?

Eventually, he loses control.

Why should that happen whence he's already paying income taxes the whole time.

I'd just like to see it spelled out in MUCH greater detail than simply, "2 cents".

Capital gains and dividend taxes are too low so thus far Bezos has been undertaxed

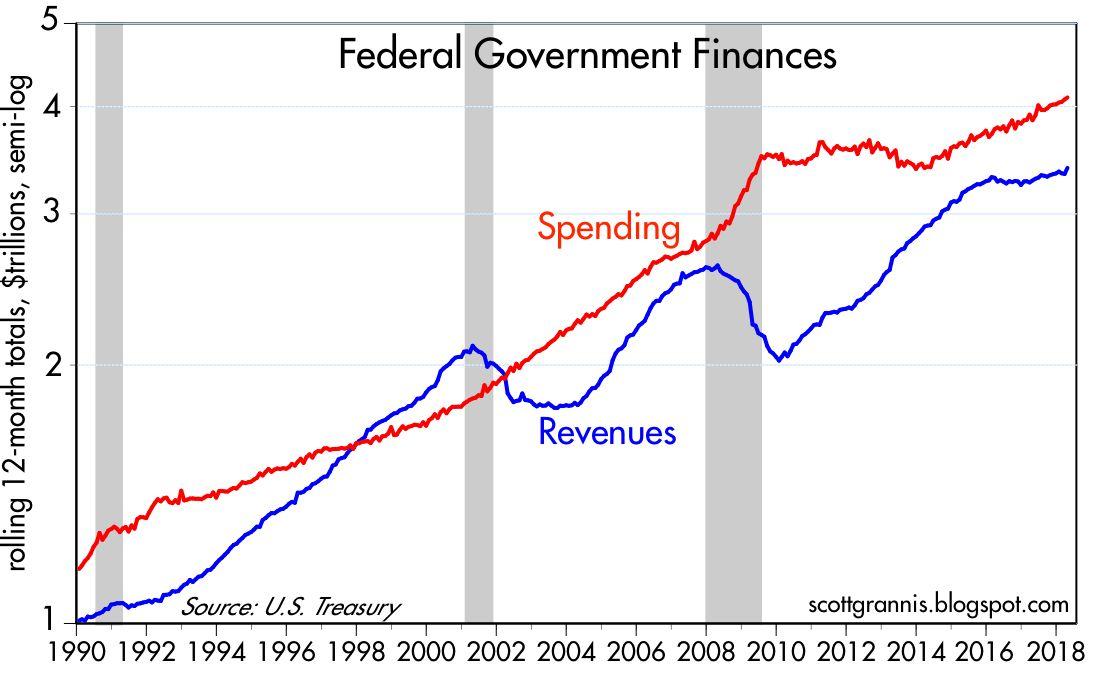

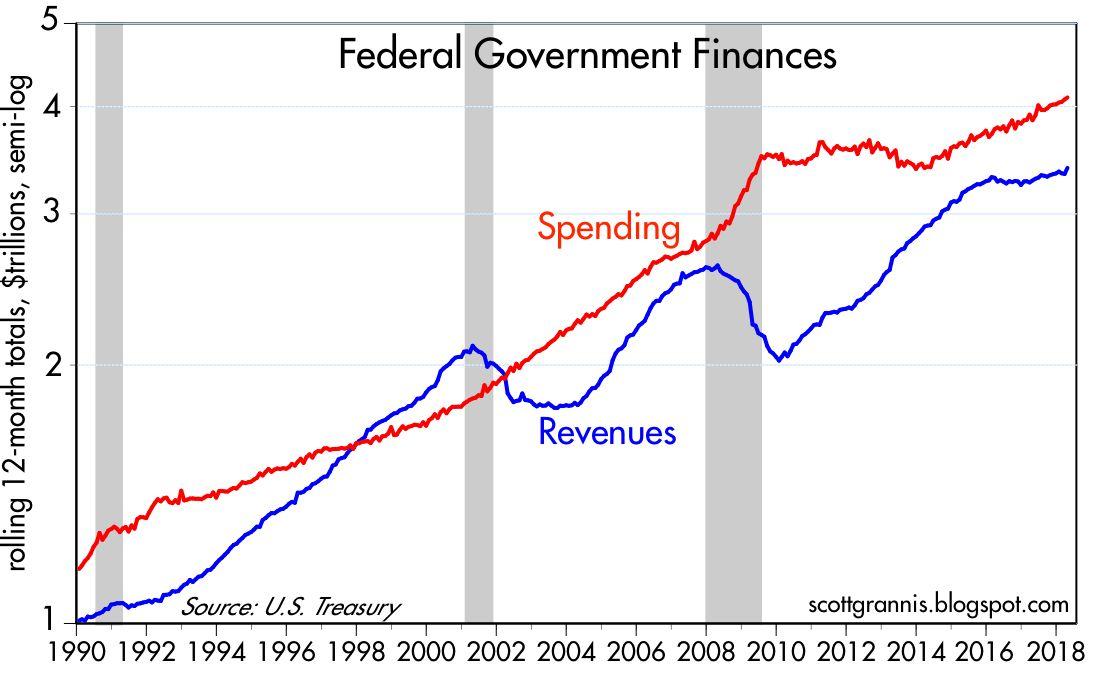

issue number 1: we need the blue and red lines to meet.

Issue number 2: we need both lines to be flatter, and lower. Less government, not as steep a growth rate (expansion of govt, or inflation since this is in dollars, not %)

Issue number 2: we need both lines to be flatter, and lower. Less government, not as steep a growth rate (expansion of govt, or inflation since this is in dollars, not %)

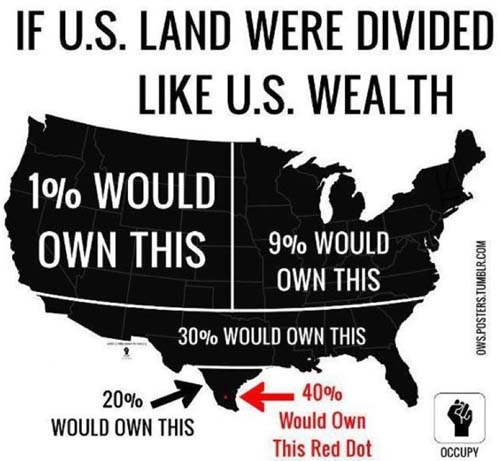

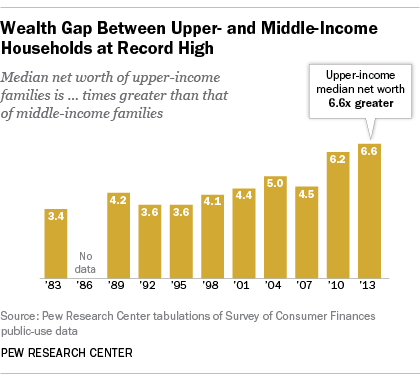

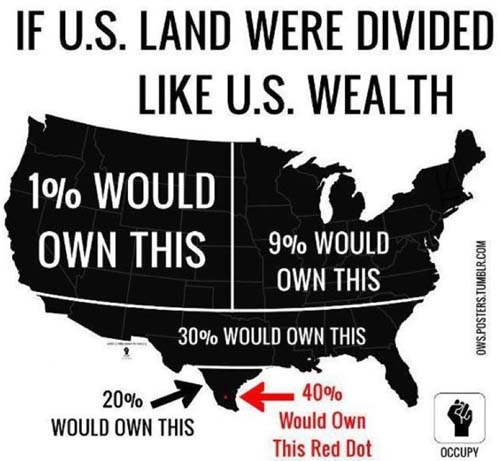

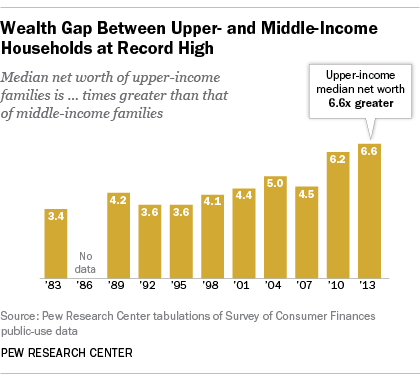

Issue number 3: wealth inequality.

I learned long ago that the best societies exist when there is a Large Middle Class.

That used to be the case for the US, but less so today. Lots of ways to graphically show that.

https://static.guim.co.uk/ni/1415721490539/Wealth_line-chart.svg

I learned long ago that the best societies exist when there is a Large Middle Class.

That used to be the case for the US, but less so today. Lots of ways to graphically show that.

https://static.guim.co.uk/ni/1415721490539/Wealth_line-chart.svg

Issue number 4: growth rate of economy.

GDP = C + G + I - trade deficit

C = consumer spending

G = govt spending

I = business investment (spending)

Trade deficit = exports - imports, could be a "+", but hasn't been in this country since forever.

If you suddenly decrease G to meet Issue 1, balance budget, you kill GDP = recession.

Trump knows this and expanded GDP thru deficit. (Cut taxes = increased C and I, with G remaining constant, I'm assuming)

Politicians need to submit a plan for tackling these issues. But they can't and won't because it's complicated, they don't want to confuse voters, and/or they don't even know themselves what is feasible. Instead, Warren holds up 2 fingers and says that will solve everything. Incomplete analysis.

GDP = C + G + I - trade deficit

C = consumer spending

G = govt spending

I = business investment (spending)

Trade deficit = exports - imports, could be a "+", but hasn't been in this country since forever.

If you suddenly decrease G to meet Issue 1, balance budget, you kill GDP = recession.

Trump knows this and expanded GDP thru deficit. (Cut taxes = increased C and I, with G remaining constant, I'm assuming)

Politicians need to submit a plan for tackling these issues. But they can't and won't because it's complicated, they don't want to confuse voters, and/or they don't even know themselves what is feasible. Instead, Warren holds up 2 fingers and says that will solve everything. Incomplete analysis.

Issue 5: tax justice

What levels are fair, for

Income

Dividends

Corporate

Cap gains

And now this new proposed Wealth Tax rate.

What levels are fair, for

Income

Dividends

Corporate

Cap gains

And now this new proposed Wealth Tax rate.

She doesn't say that, but you do youconcordtom said:

Issue number 4: growth rate of economy.

GDP = C + G + I - trade deficit

C = consumer spending

G = govt spending

I = business investment (spending)

Trade deficit = exports - imports, could be a "+", but hasn't been in this country since forever.

If you suddenly decrease G to meet Issue 1, balance budget, you kill GDP = recession.

Trump knows this and expanded GDP thru deficit. (Cut taxes = increased C and I, with G remaining constant, I'm assuming)

Politicians need to submit a plan for tackling these issues. But they can't and won't because it's complicated, they don't want to confuse voters, and/or they don't even know themselves what is feasible. Instead, Warren holds up 2 fingers and says that will solve everything. Incomplete analysis.

She is not addressing the bigger picture, just presenting a perceived panacea.

That in essence is as far as she goes. So far.

That in essence is as far as she goes. So far.

kelly09 said:I believe capital gains and dividends over 200k should be taxed as ordinary income.dajo9 said:concordtom said:Not all holdings are as simple as receiving 5% and yielding 2% year over year.BearsWiin said:Think of it like an investment fund expense ratio. If you're worth that much, your money is probably making significantly more than that on average every year. If it isn't you need a new investment advisor. These people won't be losing wealth; they just won't be accumulating it quite so fastconcordtom said:The proposal is interesting in that it would suddenly produce an immediate windfall of cash.B.A. Bearacus said:

EW on a slow, steady roll. Communicating very effectively.

HOWEVER!

It's a completely immature thought which hasn't even begun to be vetted and had holes poked in it. For instance,

-how many families does this affect?

-how many of those families' wealth is tied up in company stock which cannot be sold for various reasons?

-how many individuals would relocate to a foreign country? You laugh at the concept? Don't. This is an ANNUAL 2% tax. Not one-time. After just 10 years, the US government has taken 20% of your net worth and likely screwed up your ownership structure.

So many more questions.

The concept needs some major work, rather than just holding up 2 fingers and saying "2 cents". I get pissed off every time I hear her simplify it as that.

Having said that, i am for closing the wealth gap.

Why I said it needs to be detailed in much greater extent.

For instance, let's say Bezos is 99% invested in AMZN. Is he supposed to sell 2% of his holdings every year?

Eventually, he loses control.

Why should that happen whence he's already paying income taxes the whole time.

I'd just like to see it spelled out in MUCH greater detail than simply, "2 cents".

Capital gains and dividend taxes are too low so thus far Bezos has been undertaxed

I think it should start at $1. Why any difference at all.

Featured Stories

See All

Bears High Target SG Quincy Wadley Nearing a Decision

by Jim McGill

Bears Add Fast Rising Westlake WR/Safety Niles Davis

by Jim McGill

Paws Analysis: Big Game Fallout, New Era Begins, and SMU Up Next

by Mike Pawlawski

Ultimate Insider Podcast E120: Big Game Breakdown, SMU Preview

by Mike Pawlawski